Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susie has just graduated from East Central University and has just been offered a job as a teacher at Latta Public Schools. Her beginning salary

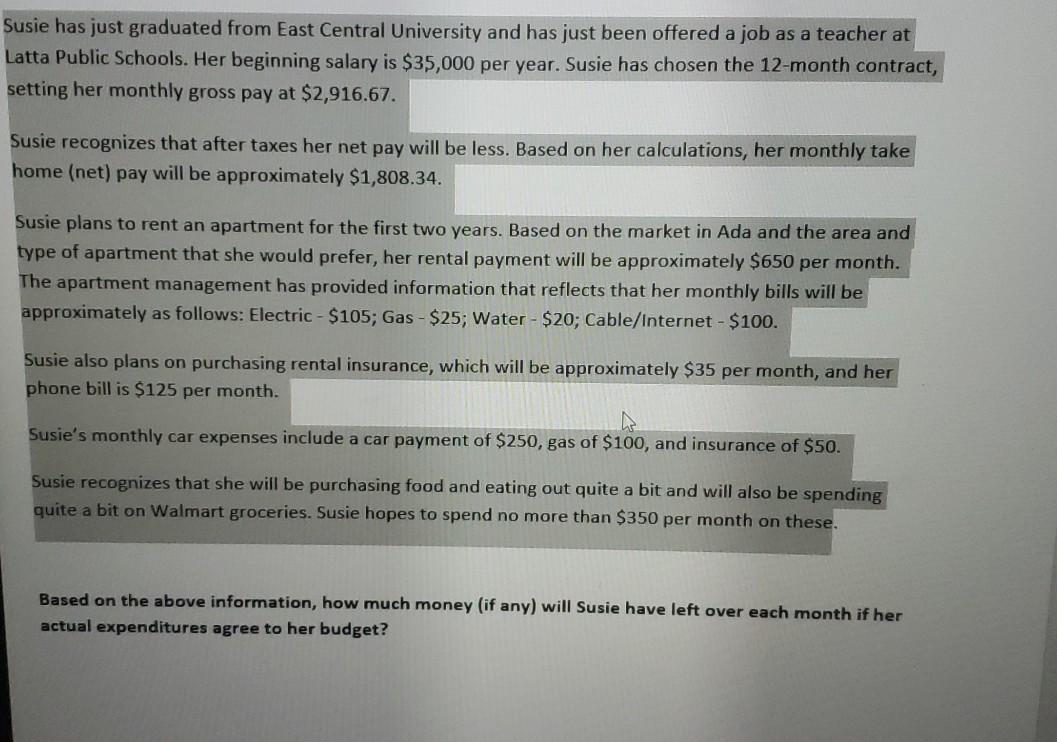

Susie has just graduated from East Central University and has just been offered a job as a teacher at Latta Public Schools. Her beginning salary is $35,000 per year. Susie has chosen the 12-month contract, setting her monthly gross pay at $2,916.67. Susie recognizes that after taxes her net pay will be less. Based on her calculations, her monthly take home (net) pay will be approximately $1,808.34. Susie plans to rent an apartment for the first two years. Based on the market in Ada and the area and type of apartment that she would prefer, her rental payment will be approximately $650 per month. The apartment management has provided information that reflects that her monthly bills will be approximately as follows: Electric - $105; Gas - $25; Water - $20; Cable/Internet - $100. Susie also plans on purchasing rental insurance, which will be approximately $35 per month, and her phone bill is $125 per month. Susie's monthly car expenses include a car payment of $250, gas of $100, and insurance of $50. Susie recognizes that she will be purchasing food and eating out quite a bit and will also be spending quite a bit on Walmart groceries. Susie hopes to spend no more than $350 per month on these. Based on the above information, how much money (if any) will Susie have left over each month if her actual expenditures agree to her budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started