Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susie is single and has 1 child, Grace, who is 22 and is a full time student. Grace resides with Susie and who pays all

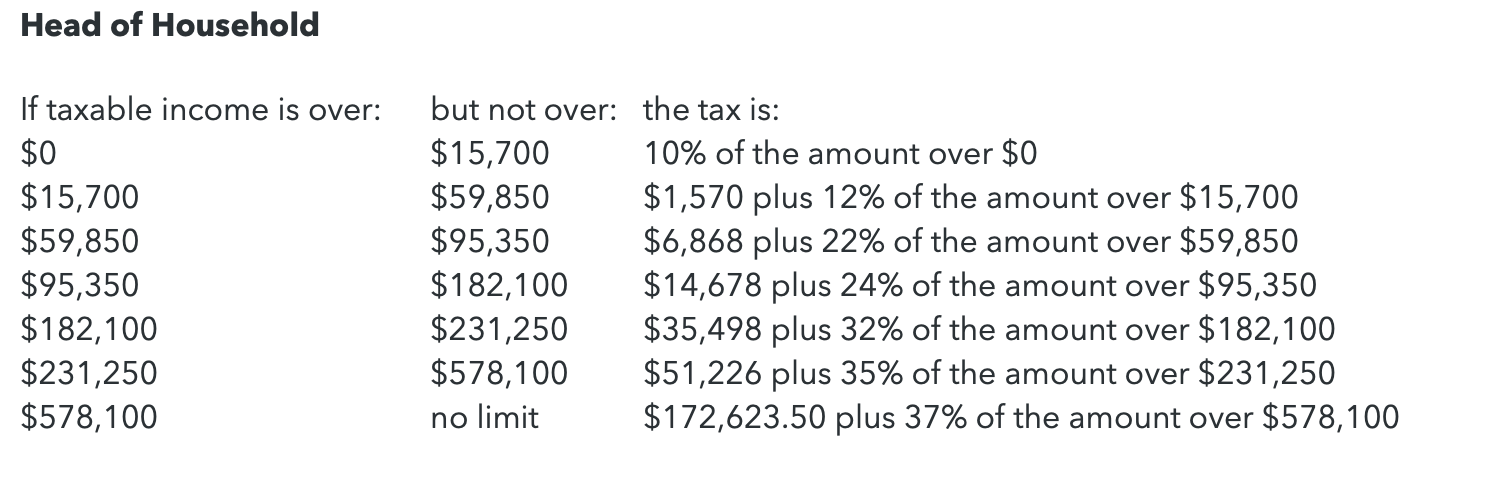

- Susie is single and has 1 child, Grace, who is 22 and is a full time student. Grace resides with Susie and who pays all her expenses since grace has no job or income. Susie has a salary of $89,000 and interest income of $251. She rents a condo for $2000 has a car payment of $467 a month and miscellaneous other personal expenses expenses total $900 a month. What is her tax liability (before any credits) using the 2023 schedule?

2. Which of the following can self-employed taxpayers NOT deducts as deductions for AGI?

The cost of the health insurance premiums paid by the self-employed

The employers portion of self-employment tax

Contributions to a SEP or other retirement programs from the self-employment

The income tax paid on the income earned by the self-employment

Head of Household \begin{tabular}{lll} If taxable income is over: & but not over: & the tax is: \\ $0 & $15,700 & 10% of the amount over $0 \\ $15,700 & $59,850 & $1,570 plus 12% of the amount over $15,700 \\ $59,850 & $95,350 & $6,868 plus 22% of the amount over $59,850 \\ $95,350 & $182,100 & $14,678 plus 24% of the amount over $95,350 \\ $182,100 & $231,250 & $35,498 plus 32% of the amount over $182,100 \\ $231,250 & $578,100 & $51,226 plus 35% of the amount over $231,250 \\ $578,100 & no limit & $172,623.50 plus 37% of the amount over $578,100 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started