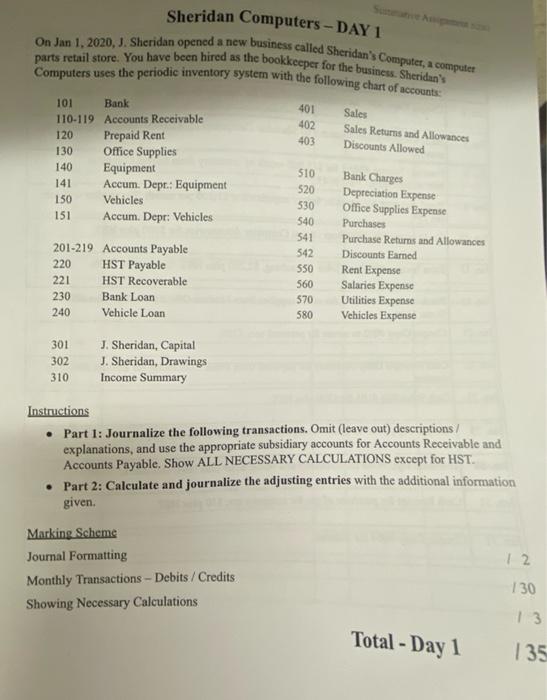

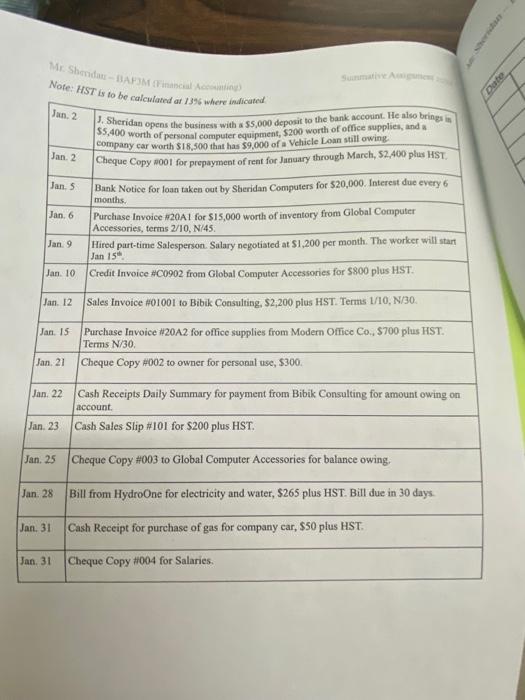

Sustman Sheridan Computers - DAY 1 On Jan 1, 2020, J. Sheridan opened a new business called Sheridan's Computer, a computer parts retail store. You have been hired as the bookkeeper for the business. Sheridan's Computers uses the periodic inventory system with the following chart of accounts: 101 Bank 401 Sales 110-119 Accounts Receivable 402 120 Prepaid Rent Sales Returns and Allowances Discounts Allowed 403 130 Office Supplies 140 Equipment 510 Bank Charges 141 Accum. Depr.: Equipment 520 Depreciation Expense 150 Vehicles 530 Office Supplies Expense 151 Accum. Depr: Vehicles 540 Purchases 541 Purchase Returns and Allowances 201-219 Accounts Payable 542 Discounts Earned 220 HST Payable 550 Rent Expense 221 HST Recoverable 560 Salaries Expense 230 Bank Loan 570 Utilities Expense 240 Vehicle Loan 580 Vehicles Expense 301 J. Sheridan, Capital 302 J. Sheridan, Drawings 310 Income Summary Instructions Part 1: Journalize the following transactions. Omit (leave out) descriptions/ explanations, and use the appropriate subsidiary accounts for Accounts Receivable and Accounts Payable. Show ALL NECESSARY CALCULATIONS except for HST. Part 2: Calculate and journalize the adjusting entries with the additional information given. Marking Scheme 12 Journal Formatting Monthly Transactions - Debits/Credits Showing Necessary Calculations Total - Day 1 130 13 135 Mr. Sheridan-BAF3M (Financial Accounting) Note: HST is to be calculated at 13% where indicated Jan. 2 Jan. 2 Jan. 5 Jan. 6 Jan. 9 Jan. 10 Jan. 12 Jan. 15 J. Sheridan opens the business with a $5,000 deposit to the bank account. He also brings is $5,400 company car worth $18,500 that has $9,000 of a Vehicle Loan still owing. Cheque Copy #001 for prepayment of rent for January through March, 52,400 plus HST. Bank Notice for loan taken out by Sheridan Computers for $20,000. Interest due every 6 months. Purchase Invoice #20A1 for $15,000 worth of inventory from Global Computer Accessories, terms 2/10, N/45. Hired part-time Salesperson. Salary negotiated at $1,200 per month. The worker will start Jan 15 Credit Invoice #C0902 from Global Computer Accessories for $800 plus HST. Sales Invoice #01001 to Bibik Consulting, $2,200 plus HST. Terms 1/10, N/30. Purchase Invoice #20A2 for office supplies from Modern Office Co., $700 plus HST. Terms N/30. Jan. 21 Cheque Copy #002 to owner for personal use, $300. Jan. 22 Cash Receipts Daily Summary for payment from Bibik Consulting for amount owing on account. Jan. 23 Cash Sales Slip # 101 for $200 plus HST. Jan. 25 Cheque Copy # 003 to Global Computer Accessories for balance owing. Jan. 28 Bill from HydroOne for electricity and water, $265 plus HST. Bill due in 30 days. Jan. 31 Cash Receipt for purchase of gas for company car, $50 plus HST. Jan. 31 Cheque Copy #004 for Salaries. Date Date General Journal Particulars P.R. Debit Credit Sustman Sheridan Computers - DAY 1 On Jan 1, 2020, J. Sheridan opened a new business called Sheridan's Computer, a computer parts retail store. You have been hired as the bookkeeper for the business. Sheridan's Computers uses the periodic inventory system with the following chart of accounts: 101 Bank 401 Sales 110-119 Accounts Receivable 402 120 Prepaid Rent Sales Returns and Allowances Discounts Allowed 403 130 Office Supplies 140 Equipment 510 Bank Charges 141 Accum. Depr.: Equipment 520 Depreciation Expense 150 Vehicles 530 Office Supplies Expense 151 Accum. Depr: Vehicles 540 Purchases 541 Purchase Returns and Allowances 201-219 Accounts Payable 542 Discounts Earned 220 HST Payable 550 Rent Expense 221 HST Recoverable 560 Salaries Expense 230 Bank Loan 570 Utilities Expense 240 Vehicle Loan 580 Vehicles Expense 301 J. Sheridan, Capital 302 J. Sheridan, Drawings 310 Income Summary Instructions Part 1: Journalize the following transactions. Omit (leave out) descriptions/ explanations, and use the appropriate subsidiary accounts for Accounts Receivable and Accounts Payable. Show ALL NECESSARY CALCULATIONS except for HST. Part 2: Calculate and journalize the adjusting entries with the additional information given. Marking Scheme 12 Journal Formatting Monthly Transactions - Debits/Credits Showing Necessary Calculations Total - Day 1 130 13 135 Mr. Sheridan-BAF3M (Financial Accounting) Note: HST is to be calculated at 13% where indicated Jan. 2 Jan. 2 Jan. 5 Jan. 6 Jan. 9 Jan. 10 Jan. 12 Jan. 15 J. Sheridan opens the business with a $5,000 deposit to the bank account. He also brings is $5,400 company car worth $18,500 that has $9,000 of a Vehicle Loan still owing. Cheque Copy #001 for prepayment of rent for January through March, 52,400 plus HST. Bank Notice for loan taken out by Sheridan Computers for $20,000. Interest due every 6 months. Purchase Invoice #20A1 for $15,000 worth of inventory from Global Computer Accessories, terms 2/10, N/45. Hired part-time Salesperson. Salary negotiated at $1,200 per month. The worker will start Jan 15 Credit Invoice #C0902 from Global Computer Accessories for $800 plus HST. Sales Invoice #01001 to Bibik Consulting, $2,200 plus HST. Terms 1/10, N/30. Purchase Invoice #20A2 for office supplies from Modern Office Co., $700 plus HST. Terms N/30. Jan. 21 Cheque Copy #002 to owner for personal use, $300. Jan. 22 Cash Receipts Daily Summary for payment from Bibik Consulting for amount owing on account. Jan. 23 Cash Sales Slip # 101 for $200 plus HST. Jan. 25 Cheque Copy # 003 to Global Computer Accessories for balance owing. Jan. 28 Bill from HydroOne for electricity and water, $265 plus HST. Bill due in 30 days. Jan. 31 Cash Receipt for purchase of gas for company car, $50 plus HST. Jan. 31 Cheque Copy #004 for Salaries. Date Date General Journal Particulars P.R. Debit Credit