Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sweden is a small open economy that adopts a flexible exchange rate, and the market perceives the American assets as the only safe assets.

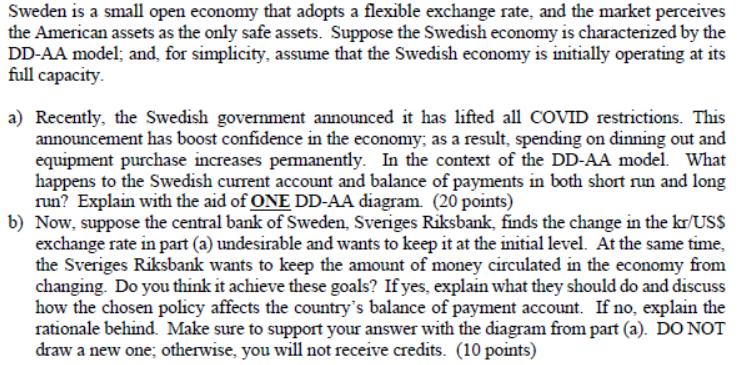

Sweden is a small open economy that adopts a flexible exchange rate, and the market perceives the American assets as the only safe assets. Suppose the Swedish economy is characterized by the DD-AA model; and, for simplicity, assume that the Swedish economy is initially operating at its full capacity. a) Recently, the Swedish government announced it has lifted all COVID restrictions. This announcement has boost confidence in the economy, as a result, spending on dinning out and equipment purchase increases permanently. In the context of the DD-AA model. What happens to the Swedish current account and balance of payments in both short run and long run? Explain with the aid of ONE DD-AA diagram. (20 points) b) Now, suppose the central bank of Sweden, Sveriges Riksbank, finds the change in the kr/USS exchange rate in part (a) undesirable and wants to keep it at the initial level. At the same time, the Sveriges Riksbank wants to keep the amount of money circulated in the economy from changing. Do you think it achieve these goals? If yes, explain what they should do and discuss how the chosen policy affects the country's balance of payment account. If no, explain the rationale behind. Make sure to support your answer with the diagram from part (a). DO NOT draw a new one; otherwise, you will not receive credits. (10 points)

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a If the Swedish government lifts all COVID restrictions and this boosts confidence in the ec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started