Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Swee Rien Roofing Materials,inc., is considering two mutually exclusive projects, each with an initial investment of RM1,5000,000. The company's board of directors has set a

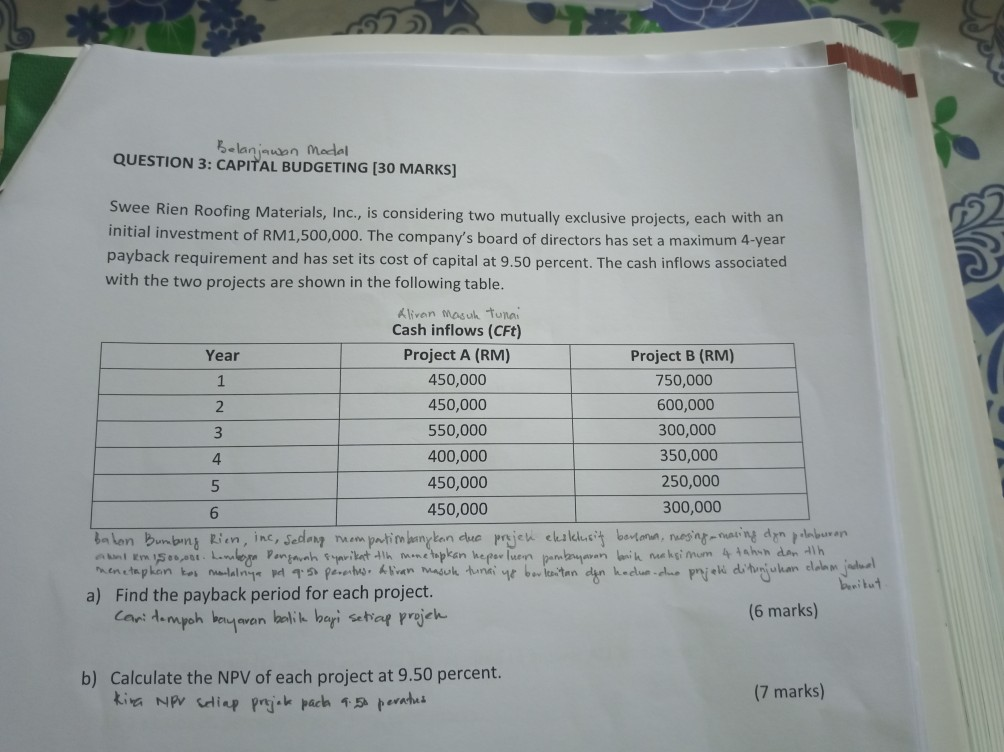

Swee Rien Roofing Materials,inc., is considering two mutually exclusive projects, each with an initial investment of RM1,5000,000. The company's board of directors has set a maximum 4-year payback requirement and has set it cost of capital at 9.5 percent. The cash inflows associated with the two projects are shown in the following table.

2-lanjauon madal QUESTION 3: CAPITAL BUDGETING [30 MARKS] Swee Rien Roofing Materials, Inc., is considering two mutually exclusive projects, each with an initial investment of RM1,500,000. The company's board of directors has set a maximum 4-year payback requirement and has set its cost of capital at 9.50 percent. The cash inflows associated with the two projects are shown in the following table. Alivan masuk tuna Cash inflows (CFt) Project A (RM) Project B (RM) Year 450,000 750,000 1 450,000 600,000 2 300,000 550,000 3 350,000 400,000 4 250,000 450,000 300,000 450,000 6 Ba Lon Bunbng Rien, inc, Sedan naem patimbanykan due prjew ekalelueit batann, nuesing-ating dyn pburan anl Em 15es,ar. Lne Pangaah yarikat lh mne topkan hepar luen payaran aih nehsimum 44ahsh dan lh PhEnetapkan tor nlalnye pd 4 peh an masuk tunai r bltan dyn kedlue-du piek ditniukan clalam jual a) Find the payback period for each project. Cani dempoh hayavan balik bayi setiaf prejeh itut (6 marks) b) Calculate the NPV of each project at 9.50 percent. tiva NPv diap prsi k pach 4 perahu (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started