Answered step by step

Verified Expert Solution

Question

1 Approved Answer

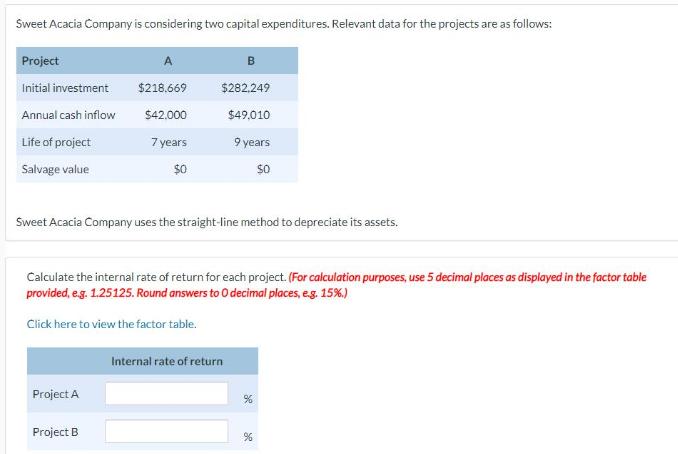

Sweet Acacia Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of

Sweet Acacia Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of project Salvage value $218.669 $42.000 Project A 7 years. $0 Sweet Acacia Company uses the straight-line method to depreciate its assets. Project B B $282.249 $49,010 9 years $0 Calculate the internal rate of return for each project. (For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25125. Round answers to O decimal places, e.g. 15%.) Click here to view the factor table. Internal rate of return % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the internal rate of return IRR for each project we can use the formula IRR CF1 1 r1 CF2 1 r2 CFn 1 rn Initial Investment where CF1 CF2 CFn are the annual cash inflows for each y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started