Question

Sweet Ayla Company currently has the capacity to manufacture 150,000 widgets a year. The widgets normally sell for $23.00 each. Sweet Ayla Company has the

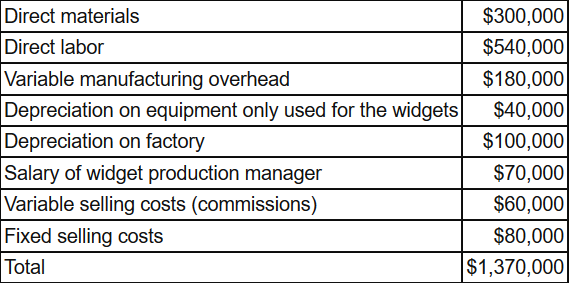

Sweet Ayla Company currently has the capacity to manufacture 150,000 widgets a year. The widgets normally sell for $23.00 each. Sweet Ayla Company has the following costs related to manufacturing and selling 120,000 widgets:

Now assume that at the end of the year. Sweet Ayla Company still has 2,000 units on the shelf. Sweet Ayla Company has redesigned the widget for next year's production, making the old units nearly obsolete. As a result, they are trying to liquidate the old widgets. Normal commissions will be paid. Which costs are relevant in determining the lowest amount that Sweet Ayla Company should accept for these 2,000 units? Choose whether each cost is relevant or not.

direct materials and direct labor

depreciation on the factory

depreciation on the machinery used only on the widgets

variable selling costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started