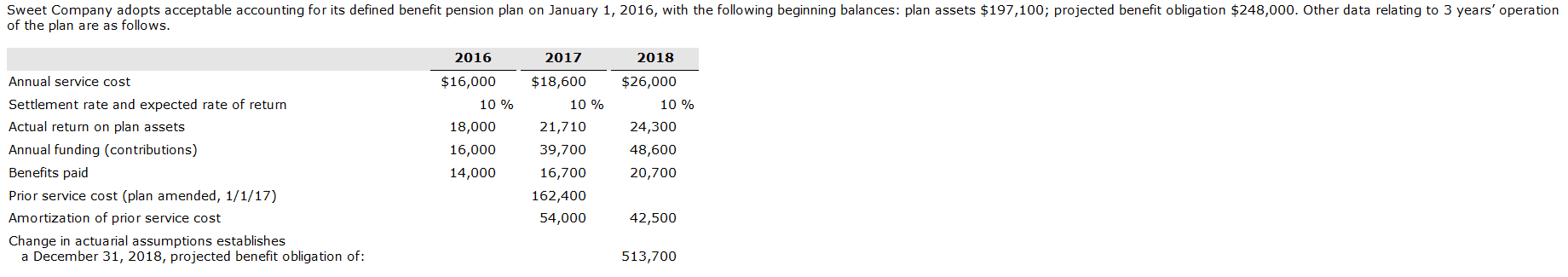

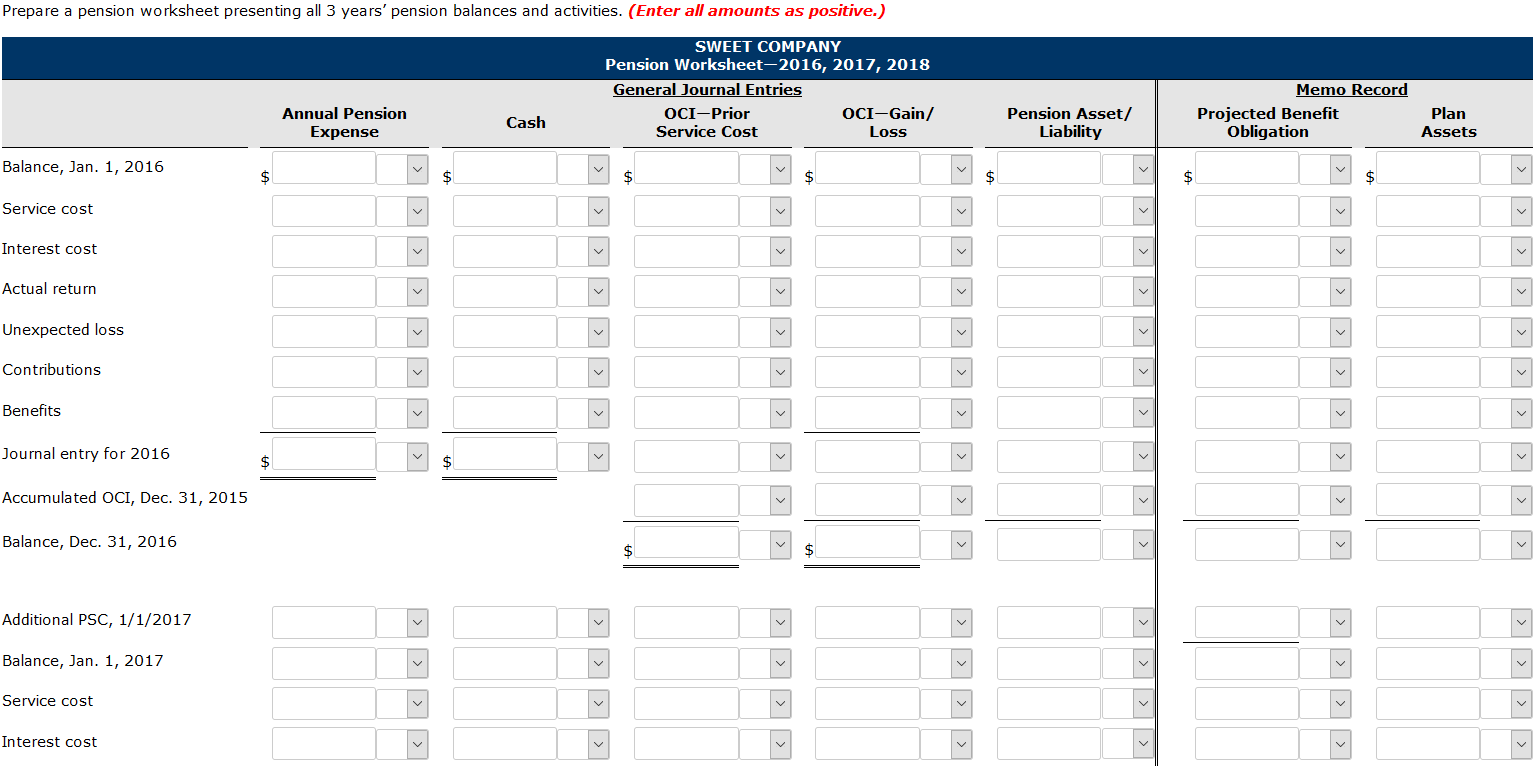

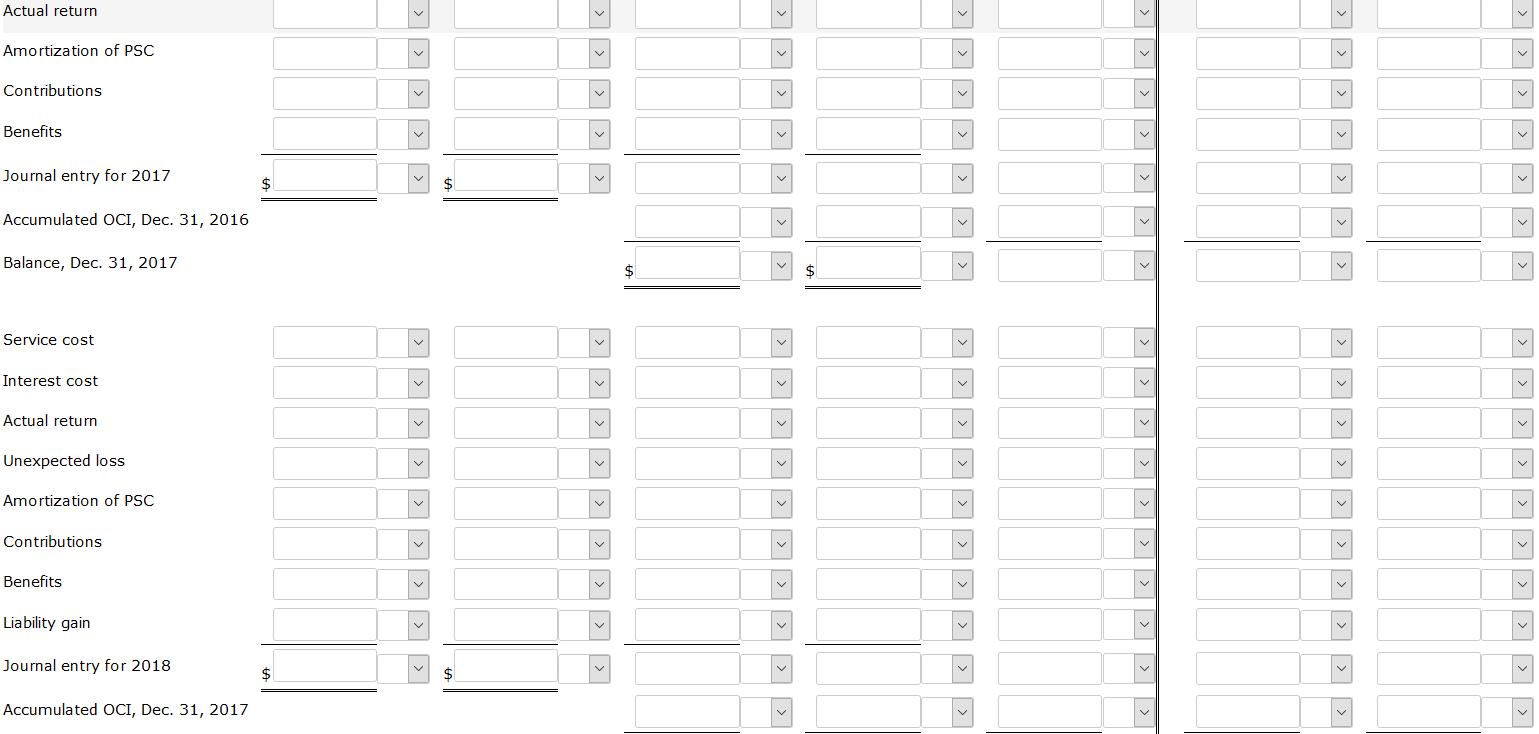

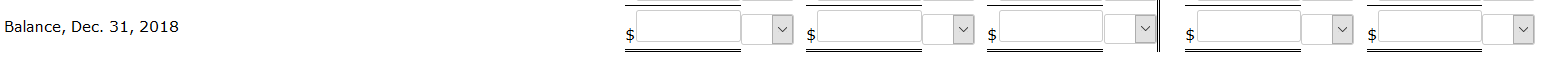

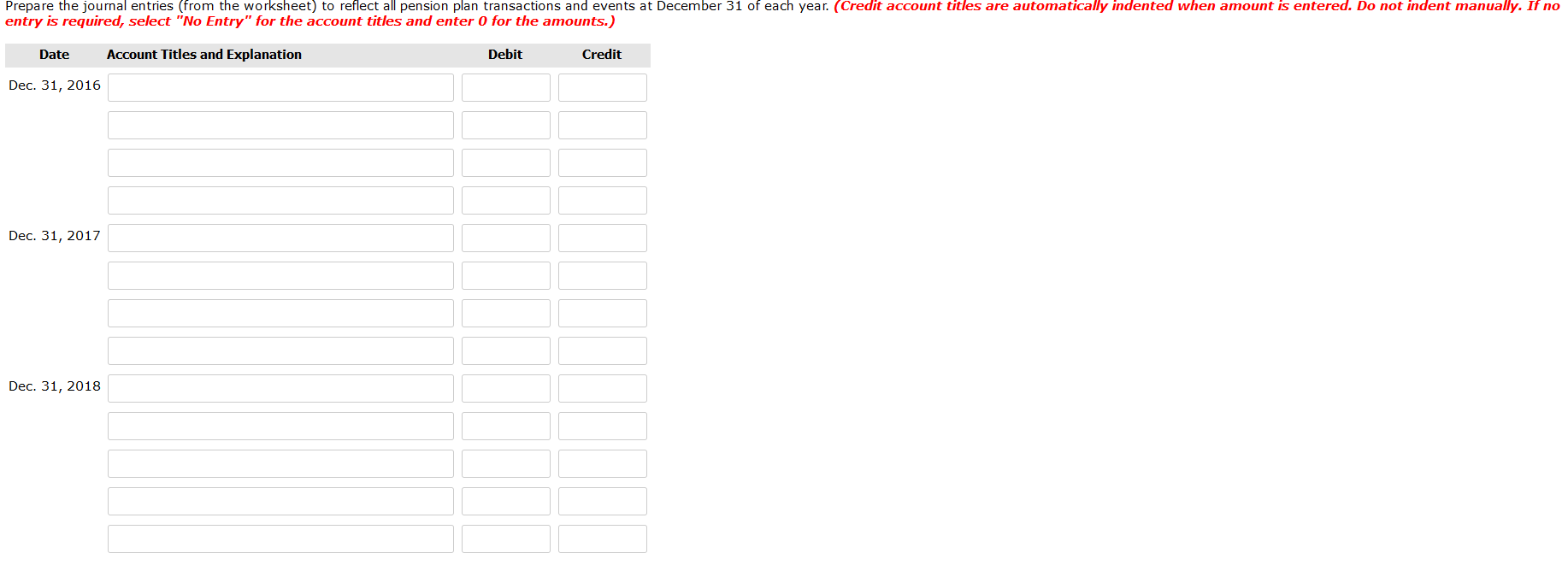

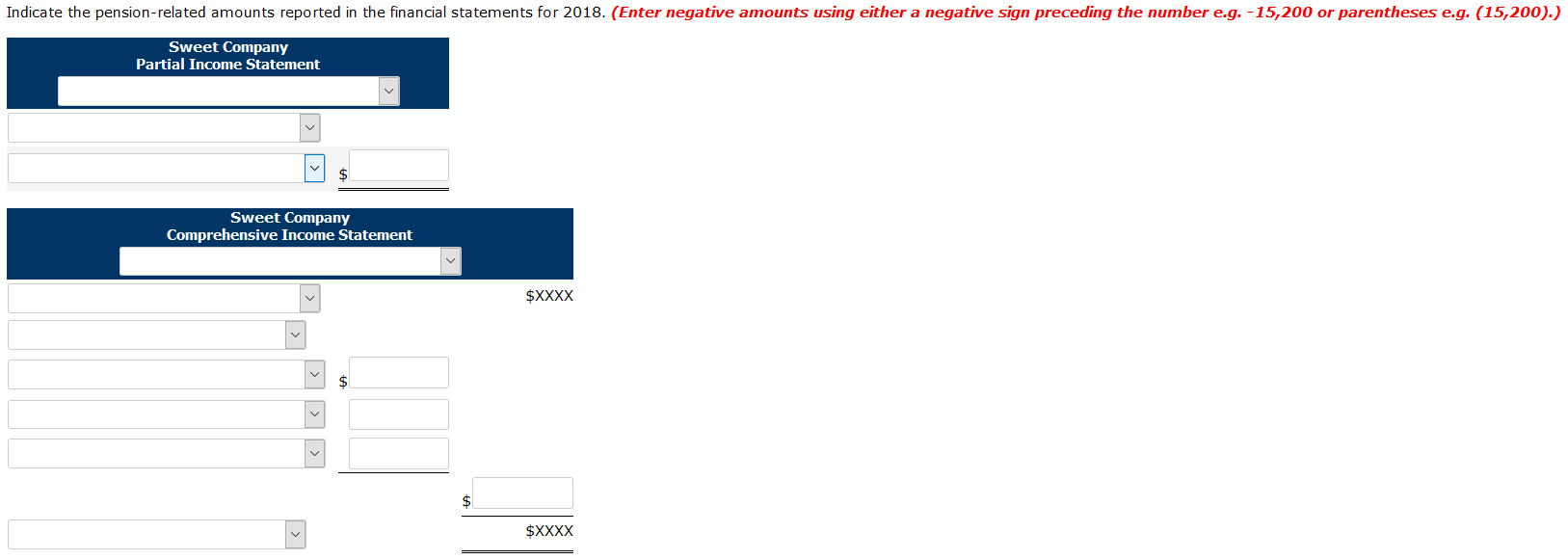

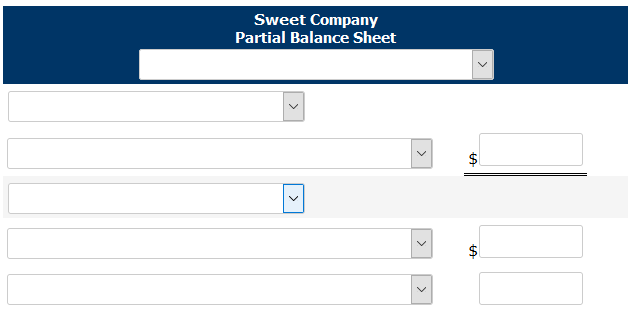

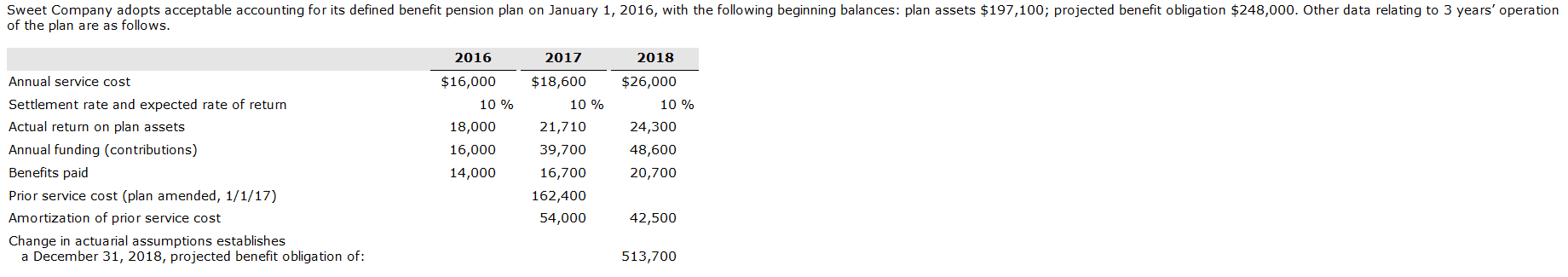

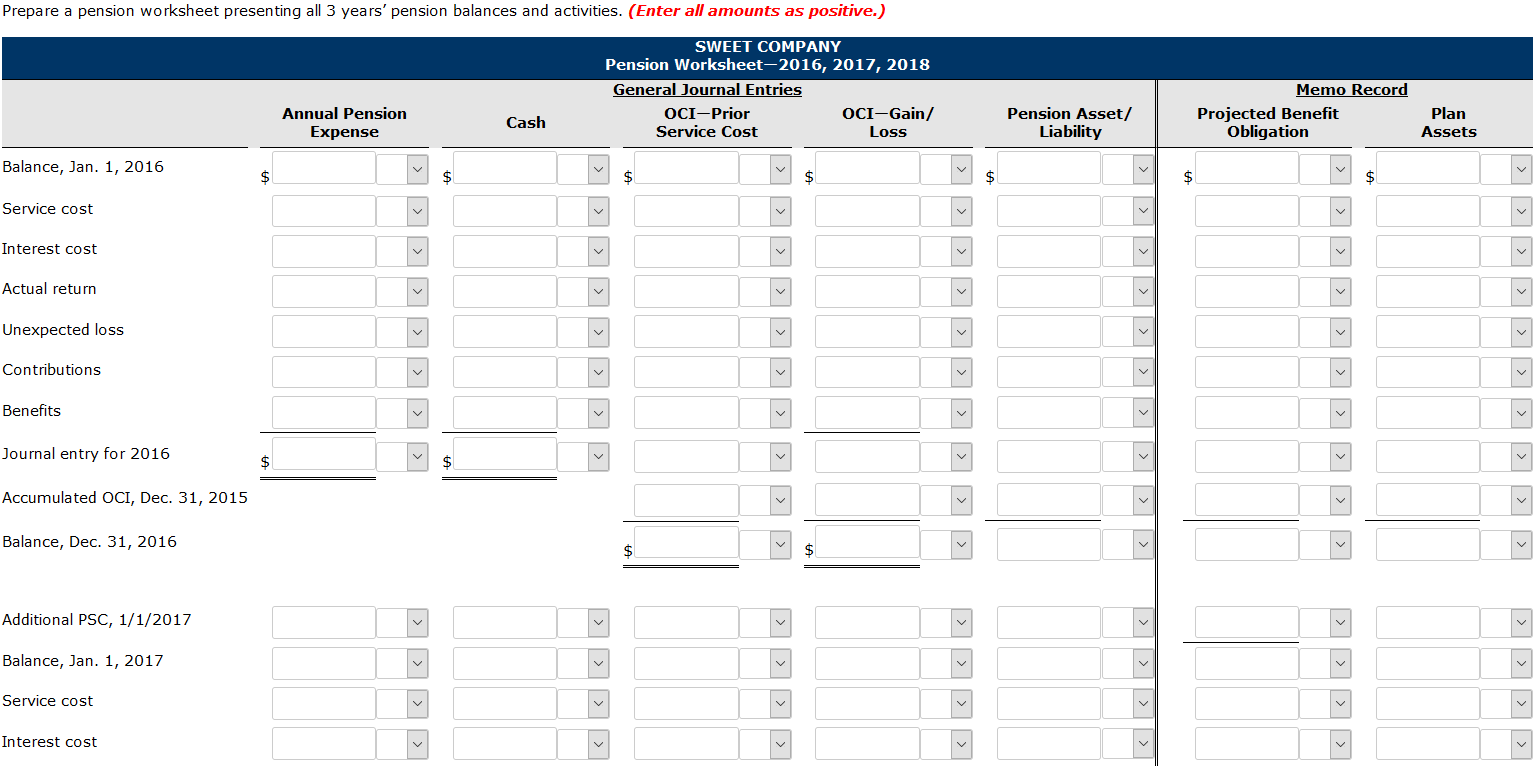

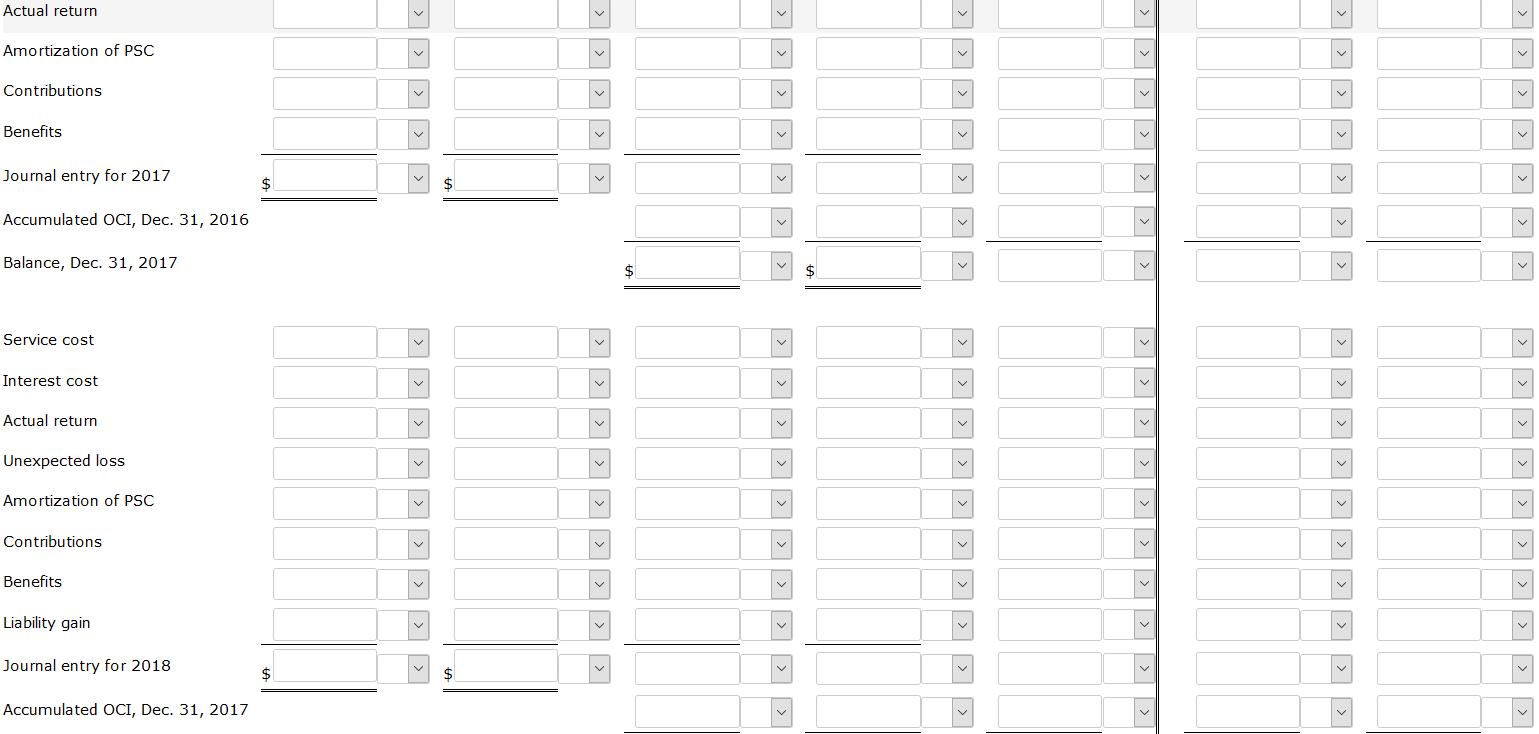

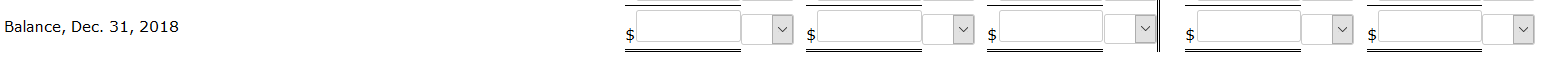

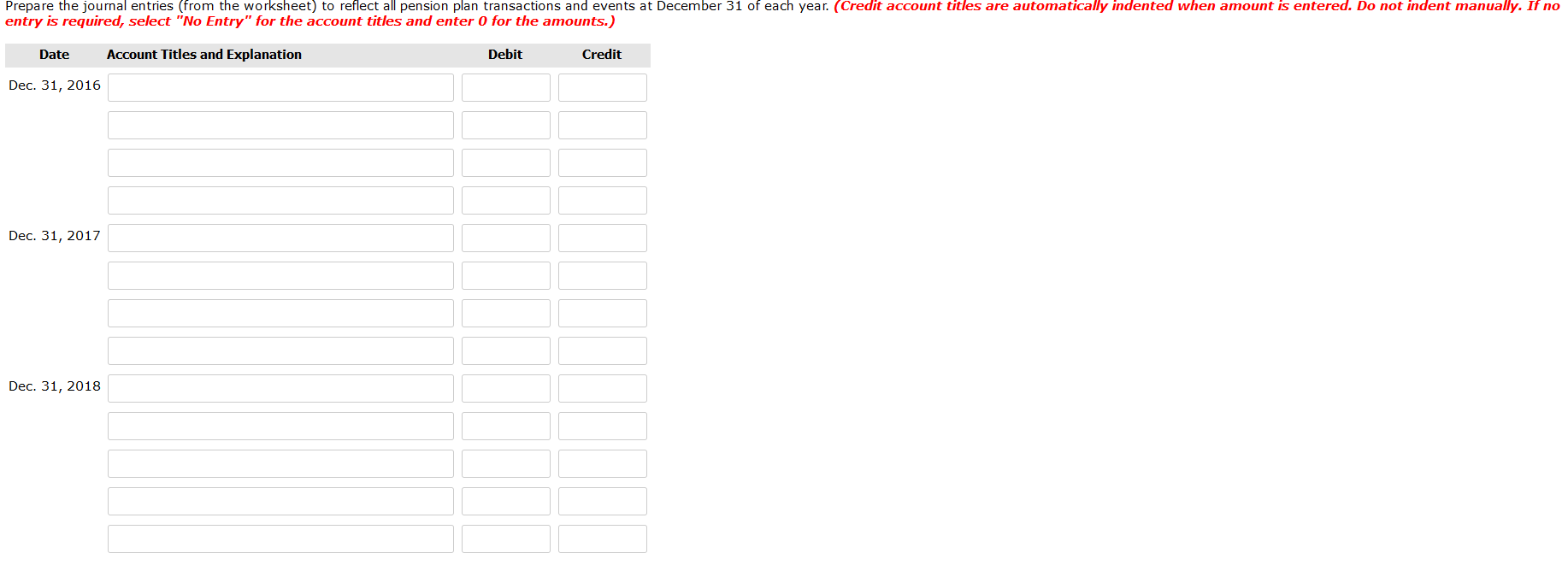

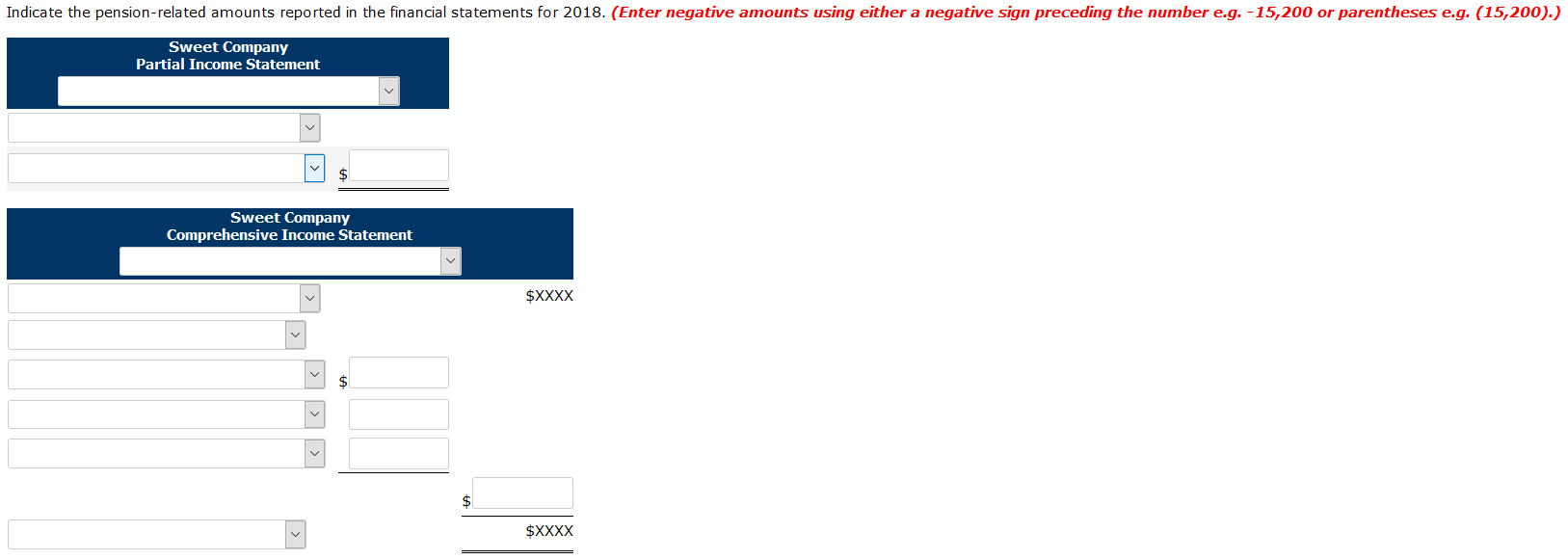

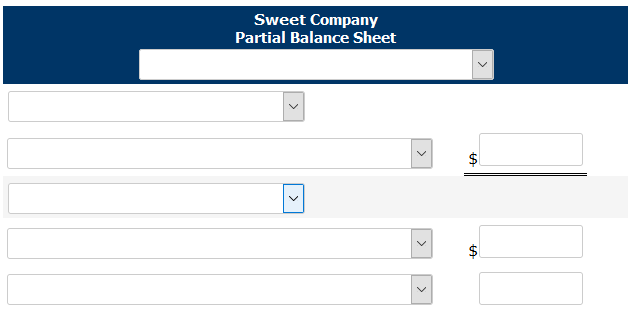

Sweet Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2016, with the following beginning balances: plan assets $197,100; projected benefit obligation $248,000. Other data relating to 3 years' operation of the plan are as follows. 2016 2017 2018 $26,000 10 % Annual service cost Settlement rate and expected rate of return Actual return on plan assets Annual funding (contributions) Benefits paid Prior service cost (plan amended, 1/1/17) Amortization of prior service cost Change in actuarial assumptions establishes a December 31, 2018, projected benefit obligation of: $16,000 10 % 18,000 16,000 14,000 $18,600 10 % 21,710 39,700 16,700 162,400 54,000 24,300 48,600 20,700 42,500 513,700 Prepare a pension worksheet presenting all 3 years' pension balances and activities. (Enter all amounts as positive.) SWEET COMPANY Pension Worksheet-2016, 2017, 2018 General Journal Entries OCI-Prior OCI-Gain/ Service Cost Loss Annual Pension Expense Memo Record Projected Benefit Obligation Pension Asset/ Liability Cash Plan Assets Balance, Jan. 1, 2016 $ $ $ $ $ Service cost Interest cost Actual return Unexpected loss Contributions Benefits Journal entry for 2016 $ $ Accumulated OCI, Dec. 31, 2015 Balance, Dec. 31, 2016 $ $ Additional PSC, 1/1/2017 Balance, Jan. 1, 2017 Service cost Interest cost Actual return Amortization of PSC Contributions Benefits Journal entry for 2017 $ Accumulated OCI, Dec. 31, 2016 Balance, Dec. 31, 2017 $ $ Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits Liability gain Journal entry for 2018 $ $ Accumulated OCI, Dec. 31, 2017 Balance, Dec. 31, 2018 $ $ Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 Indicate the pension-related amounts reported in the financial statements for 2018. (Enter negative amounts using either a negative sign preceding the number e.g. -15,200 or parentheses e.g. (15,200).) Sweet Company Partial Income Statement $ Sweet Company Comprehensive Income Statement $XXXX $ $ $XXXX Sweet Company Partial Balance Sheet $