Question

Sweet Entertainment and Candy Broadcasting are all-equity firms. The Sweet Entertainment is acquiring Candy Broadcasting for RM628,900 in cash. Currently, the market value for Sweet

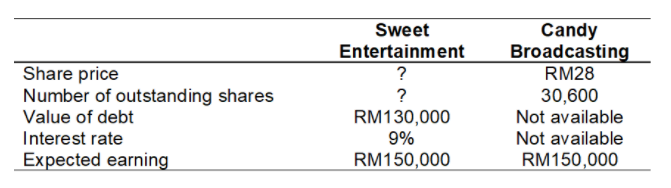

Sweet Entertainment and Candy Broadcasting are all-equity firms. The Sweet Entertainment is acquiring Candy Broadcasting for RM628,900 in cash. Currently, the market value for Sweet Shoppe is RM1,200,900. The information for both companies are as follows:

Based on the information, calculate:

i. Share price and number of outstanding shares for Sweet Entertainment if the number of shares to be exchange is 24,810 shares.

(4 marks)

ii. Share price and synergy created by this merger. Discuss whether both companies should merger or not.

(6 marks)

iii. Sweet Entertainment is an entertainment company while Candy Broadcasting is a commercial broadcast television network. Identify the type of merger and explain the rationale of the merge for both companies.

Share price Number of outstanding shares Value of debt Interest rate Expected earning Sweet Entertainment ? ? RM130,000 9% RM150,000 Candy Broadcasting RM28 30,600 Not available Not available RM150,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started