Question

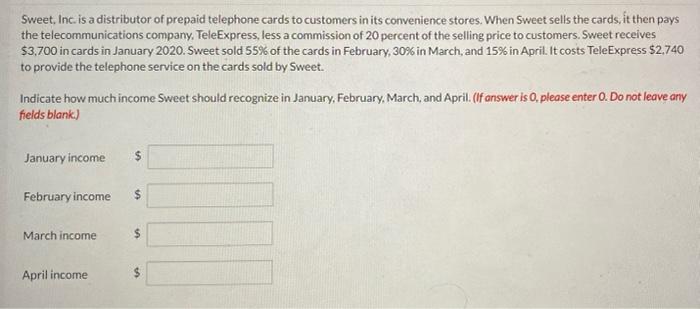

Sweet, Inc. is a distributor of prepaid telephone cards to customers in its convenience stores. When Sweet sells the cards, it then pays the

Sweet, Inc. is a distributor of prepaid telephone cards to customers in its convenience stores. When Sweet sells the cards, it then pays the telecommunications company, TeleExpress, less a commission of 20 percent of the selling price to customers. Sweet receives $3,700 in cards in January 2020. Sweet sold 55% of the cards in February, 30% in March, and 15% in April. It costs TeleExpress $2,740 to provide the telephone service on the cards sold by Sweet. Indicate how much income Sweet should recognize in January, February, March, and April. (If answer is 0, please enter O. Do not leave any fields blank.) January income February income March income April income 40 $

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Amount January Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: kieso, weygandt and warfield.

14th Edition

9780470587232, 470587288, 470587237, 978-0470587287

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App