Answered step by step

Verified Expert Solution

Question

1 Approved Answer

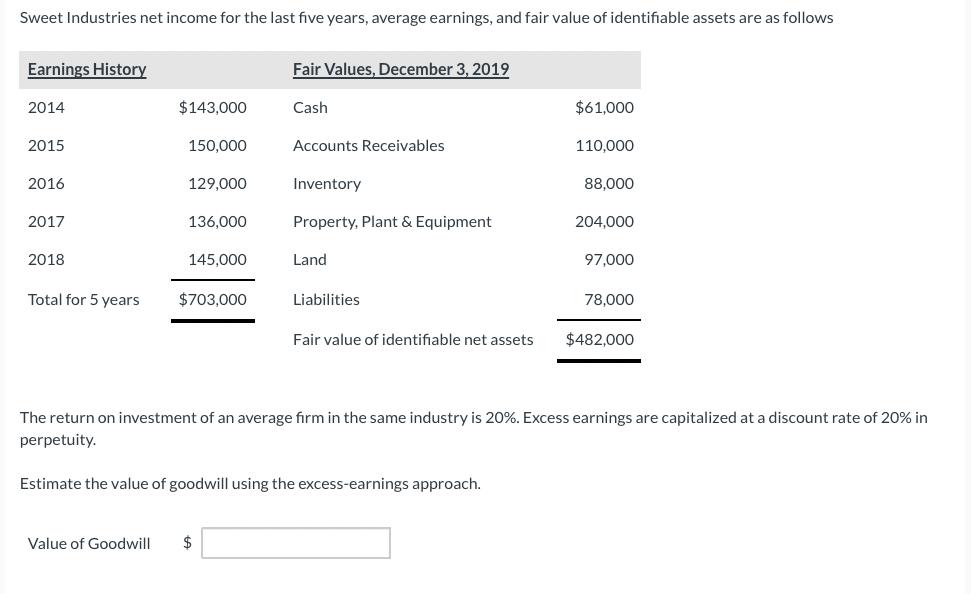

Sweet Industries net income for the last five years, average earnings, and fair value of identifiable assets are as follows Earnings History Fair Values,

Sweet Industries net income for the last five years, average earnings, and fair value of identifiable assets are as follows Earnings History Fair Values, December 3, 2019 2014 $143,000 Cash $61,000 2015 150,000 Accounts Receivables 110,000 2016 129,000 Inventory 88,000 2017 136,000 Property, Plant & Equipment 204,000 2018 145,000 Land 97,000 Total for 5 years $703,000 Liabilities 78.000 Fair value of identifiable net assets $482,000 The return on investment of an average firm in the same industry is 20%. Excess earnings are capitalized at a discount rate of 20% in perpetuity. Estimate the value of goodwill using the excess-earnings approach. Value of Goodwill $

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of excess earnings Particulars Av...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started