Question

Sweetness Processing Company, a VAT-registered taxpayer, is a processor of refined sugar. In June 2021, the records of the company revealed the following: Sales

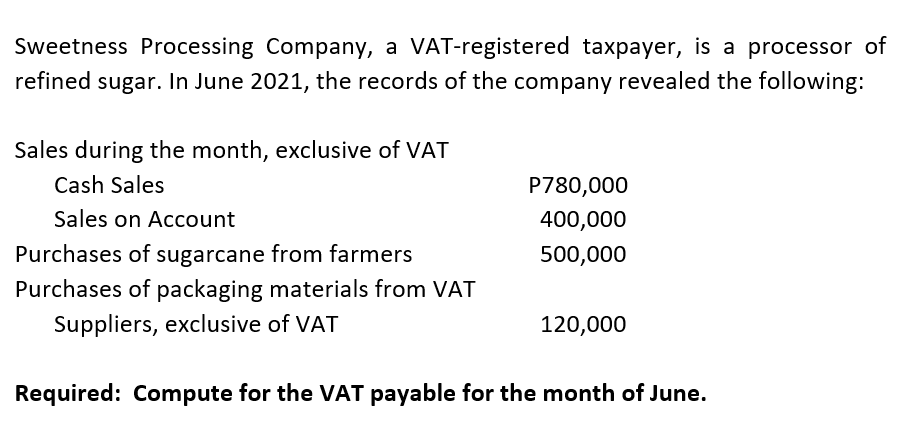

Sweetness Processing Company, a VAT-registered taxpayer, is a processor of refined sugar. In June 2021, the records of the company revealed the following: Sales during the month, exclusive of VAT Cash Sales Sales on Account Purchases of sugarcane from farmers Purchases of packaging materials from VAT Suppliers, exclusive of VAT P780,000 400,000 500,000 120,000 Required: Compute for the VAT payable for the month of June.

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer To compute the VAT payable for the month of June we need to determine the taxable sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Financial Accounting

Authors: Christopher D. Burnley

2nd Canadian Edition

1119406927, 978-1119406921

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App