Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Swiftsure Ltd has carried forward a deferred tax liability of 170000, arising from differences between carrying amount and tax bases of the companys assets. On

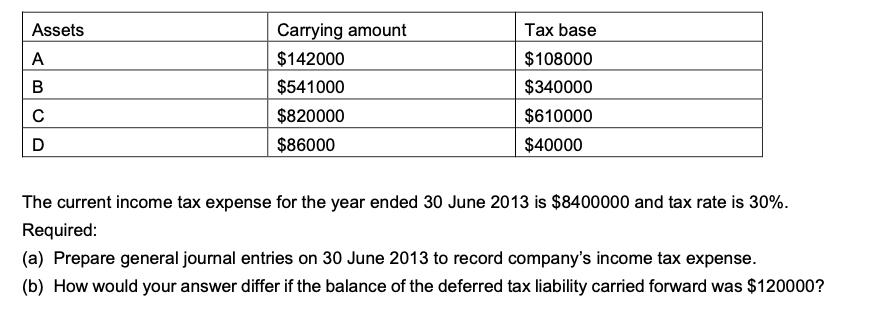

Swiftsure Ltd has carried forward a deferred tax liability of 170000, arising from differences between carrying amount and tax bases of the company’s assets. On 30 June 2013, the carrying amounts and tax bases of the company’s assets were as follows:

Assets Carrying amount Tax base A $142000 $108000 $541000 $340000 $820000 $610000 $86000 $40000 The current income tax expense for the year ended 30 June 2013 is $8400000 and tax rate is 30%. Required: (a) Prepare general journal entries on 30 June 2013 to record company's income tax expense. (b) How would your answer differ if the balance of the deferred tax liability carried forward was $120000?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Deferred Tax balances arises when there is temporary difference and temporary difference is differ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started