Answered step by step

Verified Expert Solution

Question

1 Approved Answer

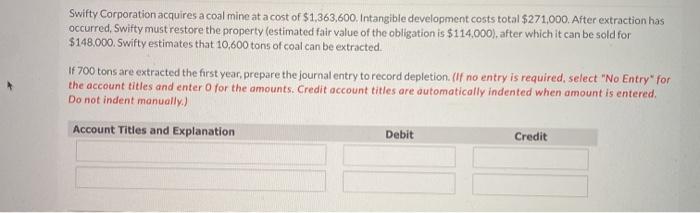

Swifty Corporation acquires a coal mine at a cost of $1,363,600. Intangible development costs total $271,000. After extraction has occurred, Swifty must restore the

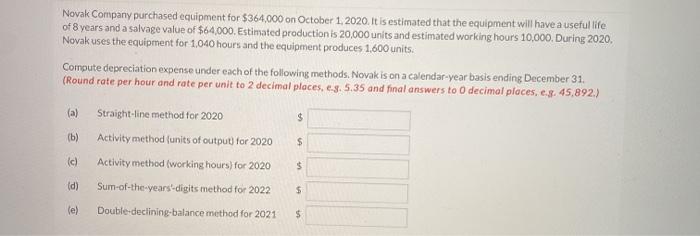

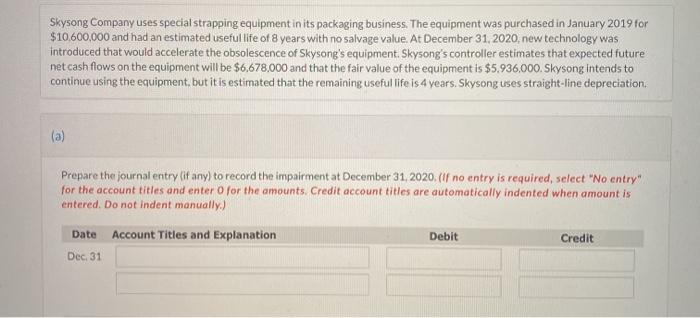

Swifty Corporation acquires a coal mine at a cost of $1,363,600. Intangible development costs total $271,000. After extraction has occurred, Swifty must restore the property (estimated fair value of the obligation is $114,000), after which it can be sold for $148,000. Swifty estimates that 10,600 tons of coal can be extracted. If 700 tons are extracted the first year, prepare the journal entry to record depletion. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Novak Company purchased equipment for $364,000 on October 1, 2020. It is estimated that the equipment will have a useful life of 8 years and a salvage value of $64,000. Estimated production is 20,000 units and estimated working hours 10,000. During 2020. Novak uses the equipment for 1.040 hours and the equipment produces 1.600 units. Compute depreciation expense under each of the following methods. Novak is on a calendar-year basis ending December 31. (Round rate per hour and rate per unit to 2 decimal places, e.g. 5.35 and final answers to 0 decimal places, e.g. 45,892.) (a) Straight-line method for 2020 (b) (c) (d) (e) Activity method (units of output) for 2020 Activity method (working hours) for 2020 Sum-of-the-years-digits method for 2022 Double-declining-balance method for 2021 $ $ $ $ $ Skysong Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2019 for $10,600,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2020, new technology was introduced that would accelerate the obsolescence of Skysong's equipment. Skysong's controller estimates that expected future net cash flows on the equipment will be $6,678,000 and that the fair value of the equipment is $5,936.000. Skysong intends to continue using the equipment, but it is estimated that the remaining useful life is 4 years. Skysong uses straight-line depreciation. (a) Prepare the journal entry (if any) to record the impairment at December 31, 2020. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Dec. 31 Debit Credit

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Solution to Swifty Corporation Particulars Debit Amount Credit Amount Inventory Ac Dr 105700 To Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started