Question

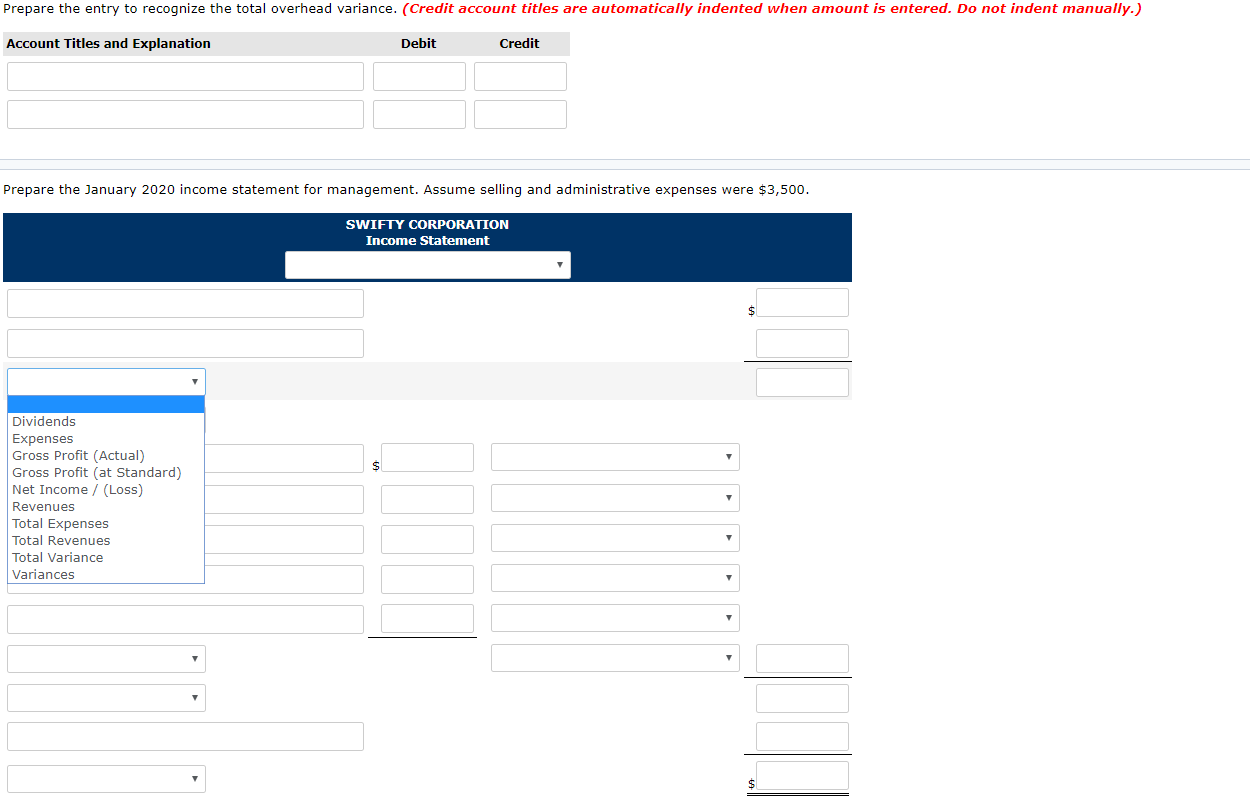

Swifty Corporation uses standard costs with its job order cost accounting system. In January, an order (Job No. 12) for 1,000 units of Product B

Swifty Corporation uses standard costs with its job order cost accounting system. In January, an order (Job No. 12) for 1,000 units of Product B was received. The standard cost of one unit of Product B is as follows.

| Direct materials | 3 pounds at $1.00 per pound | $3.00 | ||

| Direct labor | 1.50 hour at $10.00 per hour | 15.00 | ||

| Overhead | 2 hours (variable $4.30 per machine hour; fixed $3.30 per machine hour) | 15.20 | ||

| Standard cost per unit | $33.20 |

Normal capacity for the month was 4,030 machine hours. During January, the following transactions applicable to Job No. 12 occurred.

| 1. | Purchased 3,100 pounds of raw materials on account at $1.06 per pound. | |

| 2. | Requisitioned 3,100 pounds of raw materials for Job No. 12. | |

| 3. | Incurred 1,580 hours of direct labor at a rate of $9.90 per hour. | |

| 4. | Worked 1,580 hours of direct labor on Job No. 12. | |

| 5. | Incurred manufacturing overhead on account $16,670. | |

| 6. | Applied overhead to Job No. 12 on basis of standard machine hours allowed. | |

| 7. | Completed Job No. 12. | |

| 8. | Billed customer for Job No. 12 at a selling price of $75,000. |

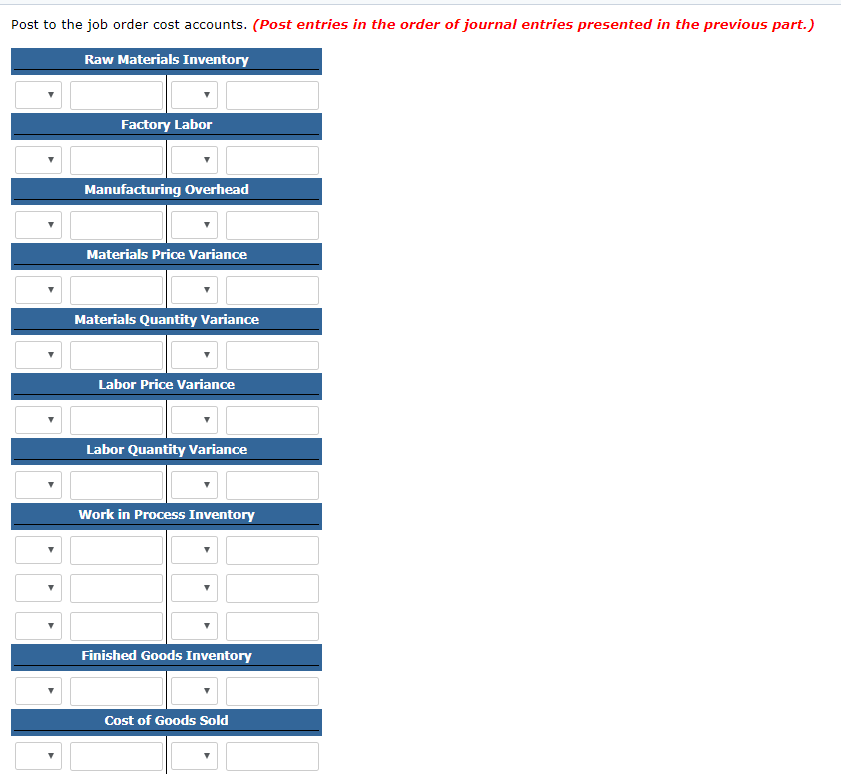

Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

| No. | Account Titles and Explanation | Debit | Credit |

| 1. | |||

| 2. | |||

| 3. | |||

| 4. | |||

| 5. | |||

| 6. | |||

| 7. | |||

| 8. | |||

| (To record sales.) | |||

| (To record cost of goods sold.) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started