Question

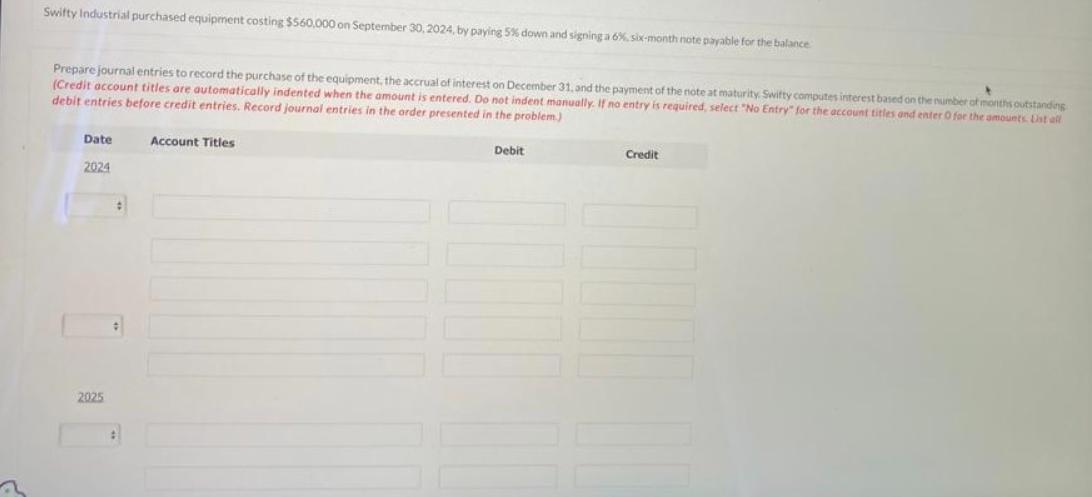

Swifty Industrial purchased equipment costing $560,000 on September 30, 2024, by paying 5% down and signing a 6%, six-month note payable for the balance

Swifty Industrial purchased equipment costing $560,000 on September 30, 2024, by paying 5% down and signing a 6%, six-month note payable for the balance Prepare journal entries to record the purchase of the equipment, the accrual of interest on December 31, and the payment of the note at maturity. Swifty computes interest based on the number of months outstanding (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date 2024 2025 # # Account Titles Debit Credit

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Kemp, Jeffrey Waybright

5th edition

134727797, 9780134728643 , 978-0134727790

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App