Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Swifty Maintenance Corp. has a $305 monthly contract with Crane Treat Inc. for general maintenance services. Swifty invoices Crane on the first of the

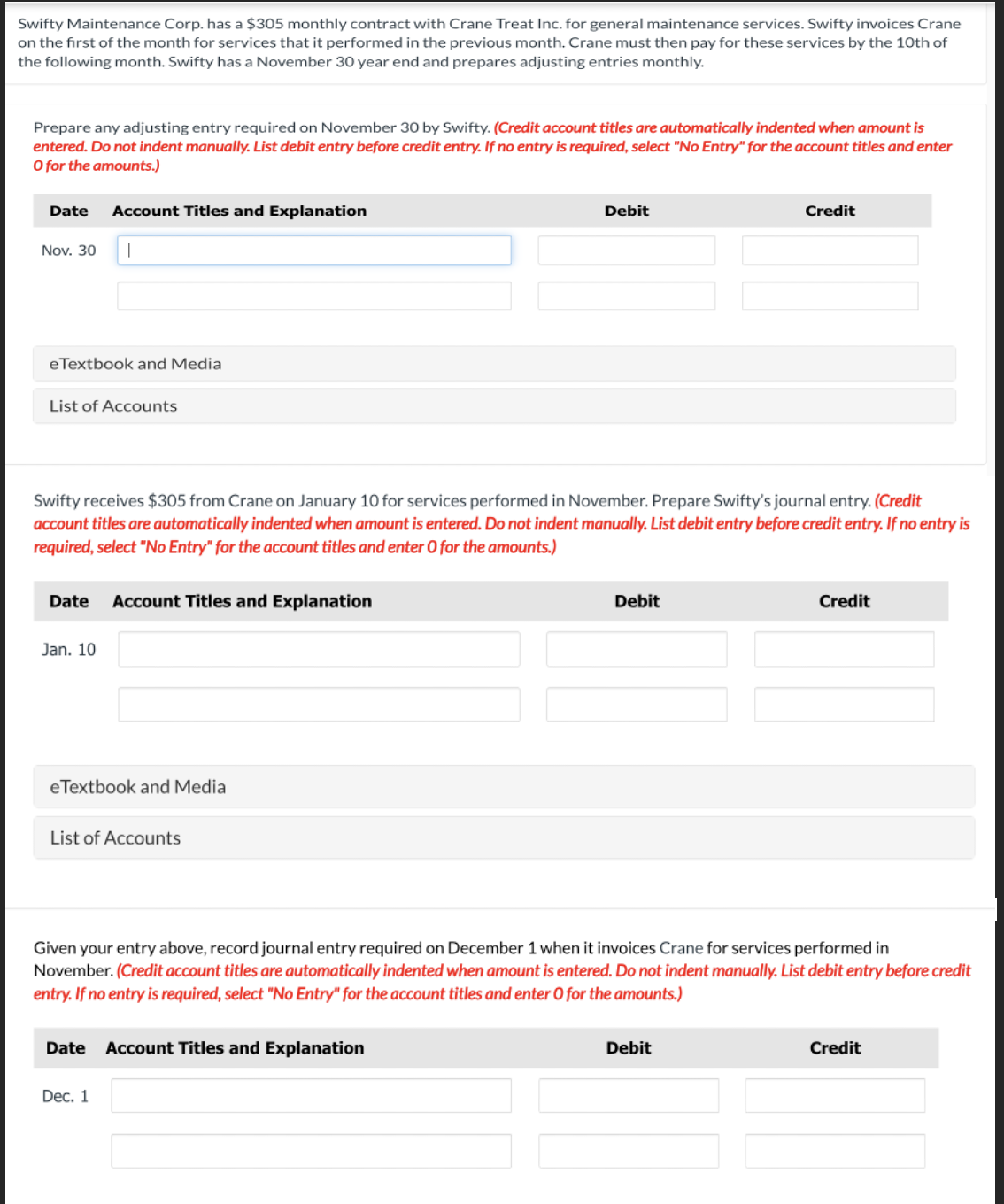

Swifty Maintenance Corp. has a $305 monthly contract with Crane Treat Inc. for general maintenance services. Swifty invoices Crane on the first of the month for services that it performed in the previous month. Crane must then pay for these services by the 10th of the following month. Swifty has a November 30 year end and prepares adjusting entries monthly. Prepare any adjusting entry required on November 30 by Swifty. (Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Nov. 30 | eTextbook and Media List of Accounts Debit Credit Swifty receives $305 from Crane on January 10 for services performed in November. Prepare Swifty's journal entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Jan. 10 Debit Credit eTextbook and Media List of Accounts Given your entry above, record journal entry required on December 1 when it invoices Crane for services performed in November. (Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Dec. 1 Debit Credit

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Adjusting entry required on November 30 by Swift...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started