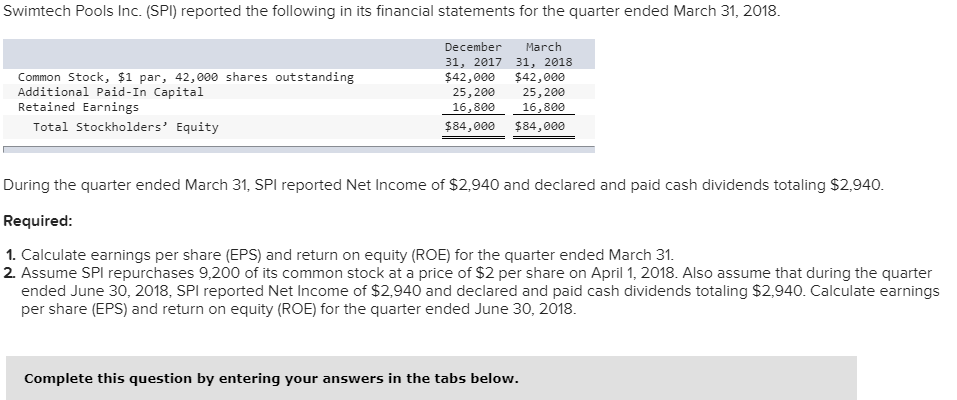

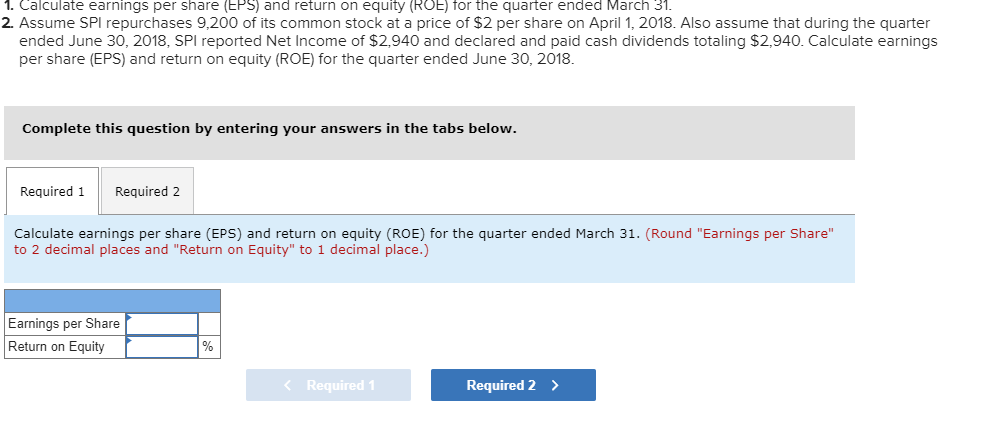

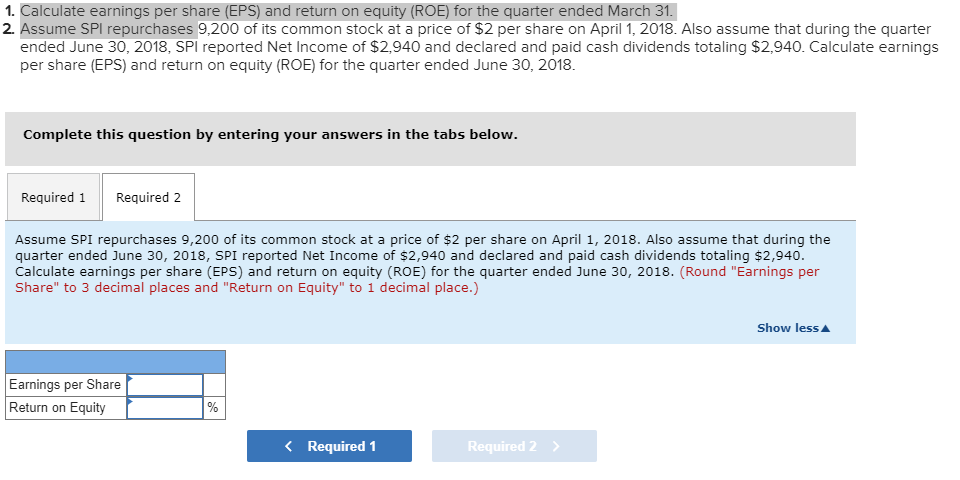

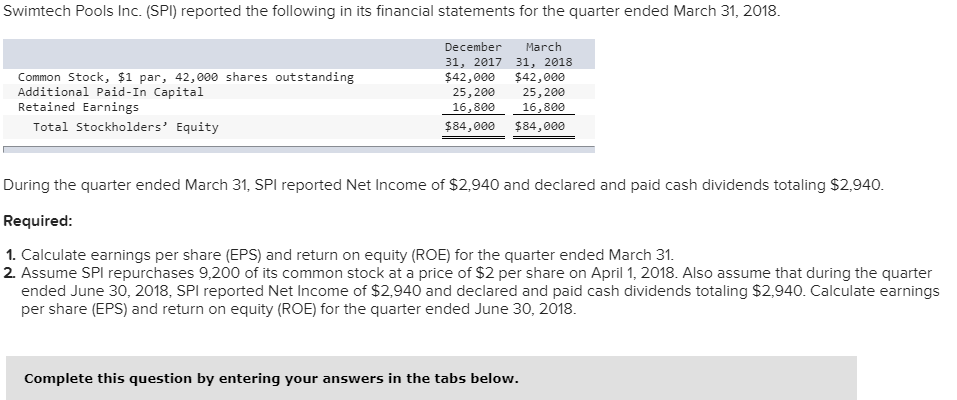

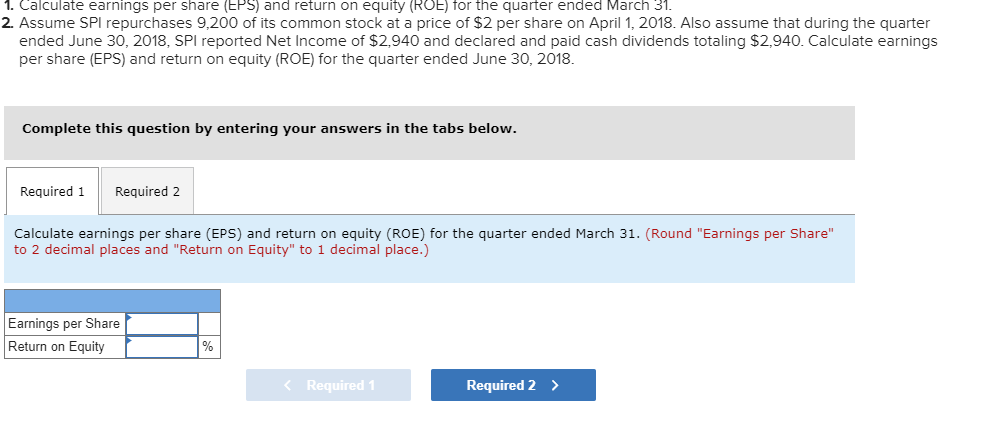

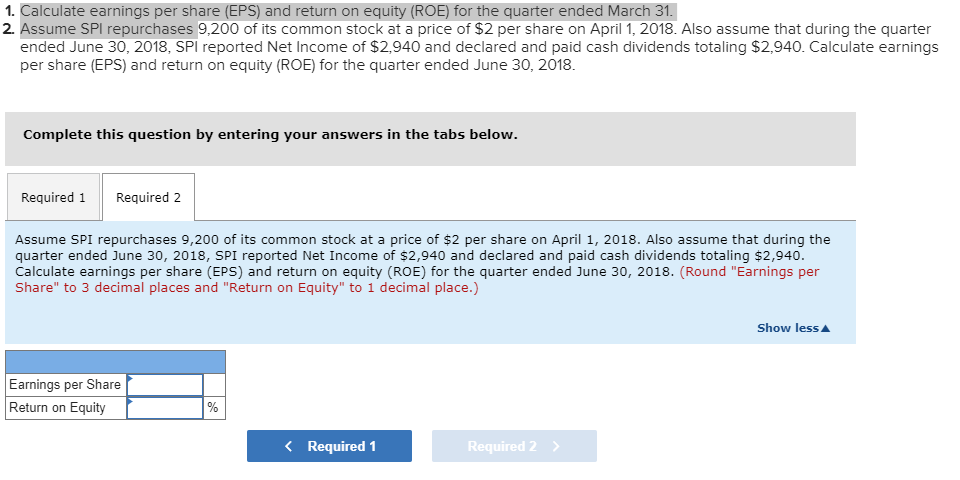

Swimtech Pools Inc. (SPI) reported the following in its financial statements for the quarter ended March 31, 2018. December March 31, 201731, 2018 $42,000 $42,000 25,200 25,200 16,800 16,800 $84,000 $84,000 Common Stock, $1 par, 42,000 shares outstanding Additional Paid-In Capital Retained Earnings Total Stockholders' Equity During the quarter ended March 31, SPI reported Net Income of $2,940 and declared and paid cash dividends totaling $2,940 Required 1. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended March 31 2. Assume SPI repurchases 9,200 of its common stock at a price of $2 per share on April 1, 2018. Also assume that during the quarter ended June 30, 2018, SPI reported Net Income of $2,940 and declared and paid cash dividends totaling $2,940. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended June 30, 2018. Complete this question by entering your answers in the tabs below 1. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended March 31 2. Assume SPI repurchases 9,200 of its common stock at a price of $2 per share on April 1, 2018. Also assume that during the quarter ended June 30, 2018, SPI reported Net Income of $2,940 and declared and paid cash dividends totaling $2,940. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended June 30, 2018. Complete this question by entering your answers in the tabs below Required 1 Required 2 Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended March 31. (Round "Earnings per Share" to 2 decimal places and "Return on Equity" to 1 decimal place.) Earnings per Share Return on Equity Required 1 Required 2 1. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended March 31. 2. Assume SPI repurchases 9,200 of its common stock at a price of $2 per share on April 1, 2018. Also assume that during the quarter ended June 30, 2018, SPI reported Net Income of $2,940 and declared and paid cash dividends totaling $2,940. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended June 30, 2018. Complete this question by entering your answers in the tabs below Required 1 Required 2 Assume SPI repurchases 9,200 of its common stock at a price of $2 per share on April 1, 2018. Also assume that during the quarter ended June 30, 2018, SPI reported Net Income of $2,940 and declared and paid cash dividends totaling $2,940. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended June 30, 2018. (Rond"Earnings per Share" to 3 decimal places and "Return on Equity" to 1 decimal place.) Show less Earnings per Share Return on Equity Required! Required 2