Answered step by step

Verified Expert Solution

Question

1 Approved Answer

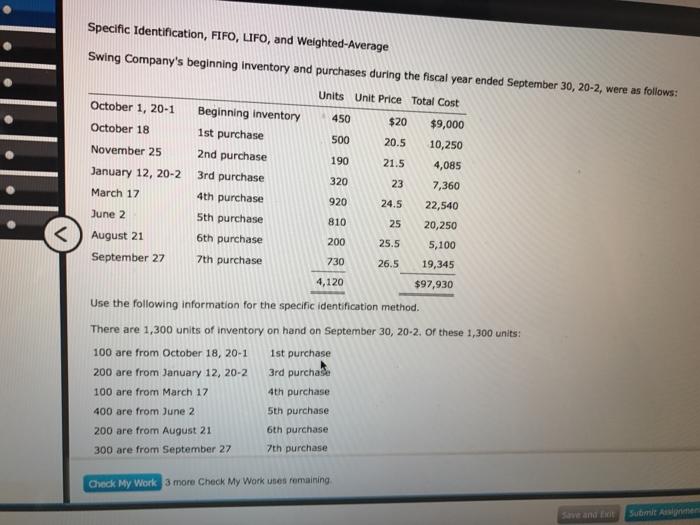

Specific Identification, FIFO, LIFO, and Weighted-Average Swing Company's beginning inventory and purchases during the fiscal year ended September 30, 20-2, were as follows: Units

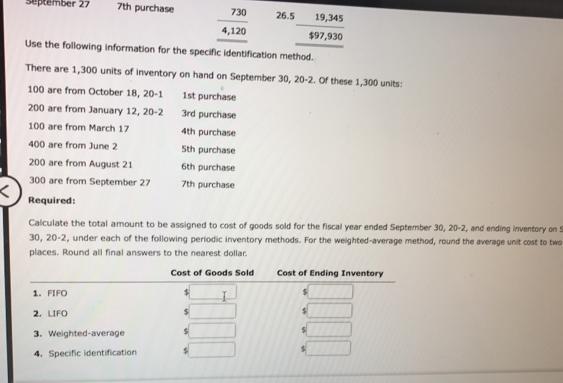

Specific Identification, FIFO, LIFO, and Weighted-Average Swing Company's beginning inventory and purchases during the fiscal year ended September 30, 20-2, were as follows: Units Unit Price Total Cost October 1, 20-1 Beginning inventory 450 $20 $9,000 October 18 1st purchase 500 20.5 10,250 November 25 2nd purchase 190 21.5 4,085 January 12, 20-2 3rd purchase 320 23 7,360 March 17 4th purchase 920 24.5 22,540 June 2 5th purchase 810 25 20,250 August 21 6th purchase 200 25.5 5,100 September 27 7th purchase 730 26.5 19,345 4,120 $97,930 Use the following information for the specific identification method. There are 1,300 units of inventory on hand on September 30, 20-2. Of these 1,300 units: 100 are from October 18, 20-1 1st purchase 200 are from January 12, 20-2 3rd purchase 100 are from March 17 4th purchase 400 are from June 2. 5th purchase 200 are from August 21 6th purchase 300 are from September 27 7th purchase Check My Work 3 more Check My Work uses remaining Save and Eit Submit Assignmen V September 27 7th purchase 730 26.5 19,345 4,120 $97,930 Use the following information for the specific identification method. There are 1,300 units of inventory on hand on September 30, 20-2. Of these 1,300 units: 100 are from October 18, 20-1 1st purchase 200 are from January 12, 20-2 3rd purchase 100 are from March 17 4th purchase 400 are from June 2 Sth purchase 200 are from August 21 6th purchase 300 are from September 27 7th purchase Required: Calculate the total amount to be assigned to cost of goods sold for the fiscal year ended September 30, 20-2, and ending inventory on S 30, 20-2, under each of the following periodic inventory methods. For the weighted-average method, round the average unit cost to twe places. Round all final answers to the nearest dollar. Cost of Goods Sold Cost of Ending Inventory 1. FIFO 2. LIFO 3. Weighted-average 4. Specific identification Specific Identification, FIFO, LIFO, and Weighted-Average Swing Company's beginning inventory and purchases during the fiscal year ended September 30, 20-2, were as follows: Units Unit Price Total Cost October 1, 20-1 Beginning inventory 450 $20 $9,000 October 18 1st purchase 500 20.5 10,250 November 25 2nd purchase 190 21.5 4,085 January 12, 20-2 3rd purchase 320 23 7,360 March 17 4th purchase 920 24.5 22,540 June 2 5th purchase 810 25 20,250 August 21 6th purchase 200 25.5 5,100 September 27 7th purchase 730 26.5 19,345 4,120 $97,930 Use the following information for the specific identification method. There are 1,300 units of inventory on hand on September 30, 20-2. Of these 1,300 units: 100 are from October 18, 20-1 1st purchase 200 are from January 12, 20-2 3rd purchase 100 are from March 17 4th purchase 400 are from June 2. 5th purchase 200 are from August 21 6th purchase 300 are from September 27 7th purchase Check My Work 3 more Check My Work uses remaining Save and Eit Submit Assignmen V September 27 7th purchase 730 26.5 19,345 4,120 $97,930 Use the following information for the specific identification method. There are 1,300 units of inventory on hand on September 30, 20-2. Of these 1,300 units: 100 are from October 18, 20-1 1st purchase 200 are from January 12, 20-2 3rd purchase 100 are from March 17 4th purchase 400 are from June 2 Sth purchase 200 are from August 21 6th purchase 300 are from September 27 7th purchase Required: Calculate the total amount to be assigned to cost of goods sold for the fiscal year ended September 30, 20-2, and ending inventory on S 30, 20-2, under each of the following periodic inventory methods. For the weighted-average method, round the average unit cost to twe places. Round all final answers to the nearest dollar. Cost of Goods Sold Cost of Ending Inventory 1. FIFO 2. LIFO 3. Weighted-average 4. Specific identification

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Solution Cost of goods sold Cost of Ending Inventory 1 FIFO 61500 34100 2 LIFO 68450 27150 3 Weighte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d86d30969e_176447.pdf

180 KBs PDF File

635d86d30969e_176447.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started