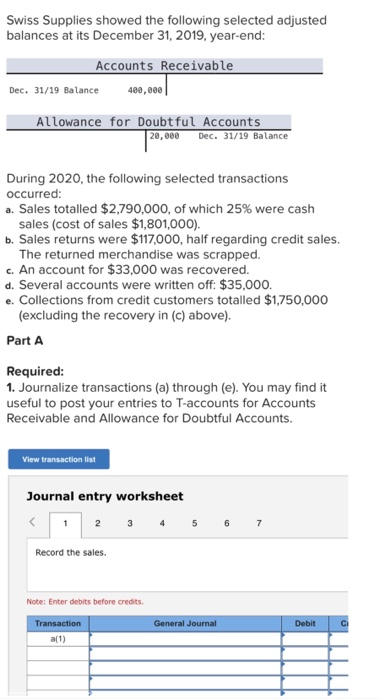

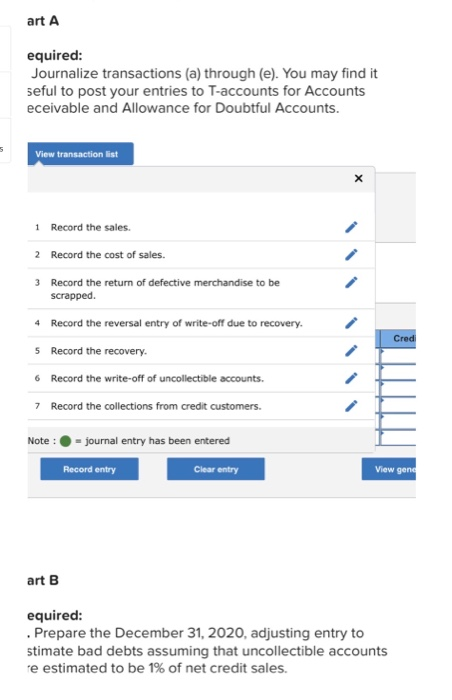

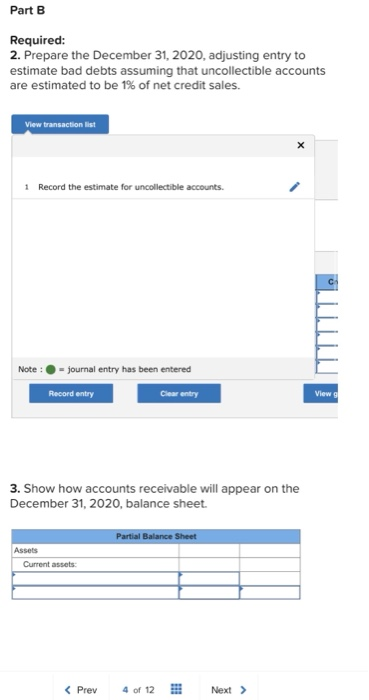

Swiss Supplies showed the following selected adjusted balances at its December 31, 2019, year-end: Accounts Receivable Dec. 31/19 Balance 400,000 Allowance for Doubtful Accounts 20,000 Dec. 31/19 Balance During 2020, the following selected transactions occurred: a. Sales totalled $2,790,000, of which 25% were cash sales (cost of sales $1,801,000). b. Sales returns were $117,000, half regarding credit sales. The returned merchandise was scrapped. c. An account for $33,000 was recovered. d. Several accounts were written off: $35,000. e. Collections from credit customers totalled $1,750,000 (excluding the recovery in (c) above). Part A Required: 1. Journalize transactions (a) through (e). You may find it useful to post your entries to T-accounts for Accounts Receivable and Allowance for Doubtful Accounts. View transaction list Journal entry worksheet 5 6 7 Record the sales. Note: Enter debits before credits General Journal Debit CI Transaction a(1) art A equired: Journalize transactions (a) through (e). You may find it seful to post your entries to T-accounts for Accounts eceivable and Allowance for Doubtful Accounts. View transaction list x 1 Record the sales 2 Record the cost of sales. 3 Record the return of defective merchandise to be scrapped. 4 Record the reversal entry of write-off due to recovery. 5 Record the recovery Record the write-off of uncollectible accounts. 7 Record the collections from credit customers. Credi Note: journal entry has been entered Record entry Clear entry View gend art B equired: . Prepare the December 31, 2020, adjusting entry to stimate bad debts assuming that uncollectible accounts re estimated to be 1% of net credit sales. Part B Required: 2. Prepare the December 31, 2020, adjusting entry to estimate bad debts assuming that uncollectible accounts are estimated to be 1% of net credit sales. View transaction list 1 Record the estimate for uncollectible accounts. Note: - journal entry has been entered Record entry Clear entry View 3. Show how accounts receivable will appear on the December 31, 2020, balance sheet. Partial Balance Sheet Assets Current assets: 3. Show how accounts receivable will appear on the December 31, 2020, balance sheet. Partial Balance Sheet Assets Current assets 4. What will bad debt expense be on the income statement for the year ended December 31, 2020? Bad debt expense Part C (independent of Part B) Required: 5. Prepare the December 31, 2020, adjusting entry to estimate bad debts assuming that uncollectible accounts are estimated to be 3% of outstanding receivables. View transaction list 1 Record the estimate for uncollectible accounts. 6. Show how accounts receivable will appear on the December 31, 2020, balance sheet. Partial Balance Sheet Assets Current assets: 7. What will bad debt expense be on the income statement for the year ended December 31, 2020? Bad debt expense