Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Syarikat Jaya uses normal costing for its costing system whereby the calculation of predetermined overhead rate based on direct labours costs. On 1st December

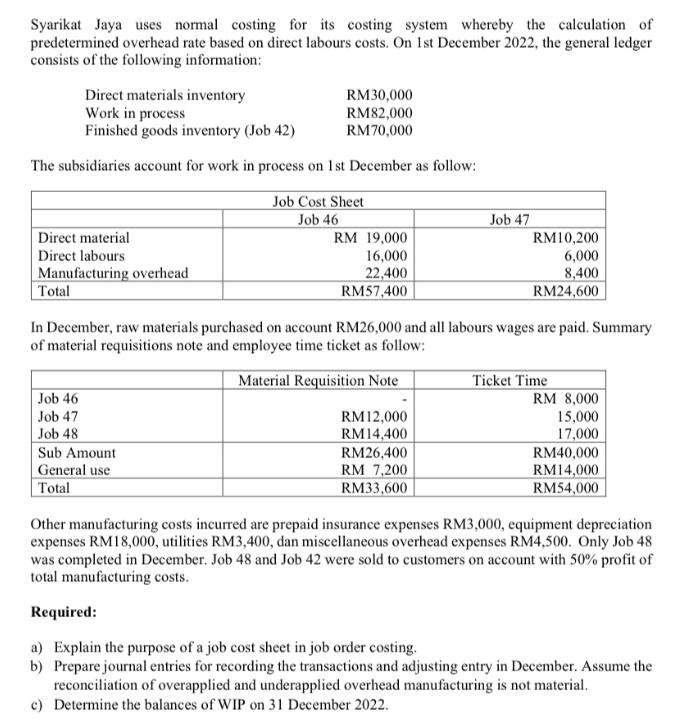

Syarikat Jaya uses normal costing for its costing system whereby the calculation of predetermined overhead rate based on direct labours costs. On 1st December 2022, the general ledger consists of the following information: Direct materials inventory Work in process Finished goods inventory (Job 42) RM30,000 RM82,000 RM70,000 The subsidiaries account for work in process on 1st December as follow: Direct material Direct labours Manufacturing overhead Total Job Cost Sheet Job 46 Job 47 RM 19,000 16,000 RM10,200 6,000 22,400 RM57,400 8,400 RM24,600 In December, raw materials purchased on account RM26,000 and all labours wages are paid. Summary of material requisitions note and employee time ticket as follow: Job 46 Job 47 Job 48 Sub Amount General use Material Requisition Note RM12,000 RM14,400 RM26,400 RM 7,200 Ticket Time RM 8,000 15,000 17,000 RM40,000 RM14,000 Total RM33,600 RM54,000 Other manufacturing costs incurred are prepaid insurance expenses RM3,000, equipment depreciation expenses RM18,000, utilities RM3,400, dan miscellaneous overhead expenses RM4,500. Only Job 48 was completed in December. Job 48 and Job 42 were sold to customers on account with 50% profit of total manufacturing costs. Required: a) Explain the purpose of a job cost sheet in job order costing. b) Prepare journal entries for recording the transactions and adjusting entry in December. Assume the reconciliation of overapplied and underapplied overhead manufacturing is not material. c) Determine the balances of WIP on 31 December 2022.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a A job cost sheet is used in job order costing to track the costs associated with a specific job or ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started