Answered step by step

Verified Expert Solution

Question

1 Approved Answer

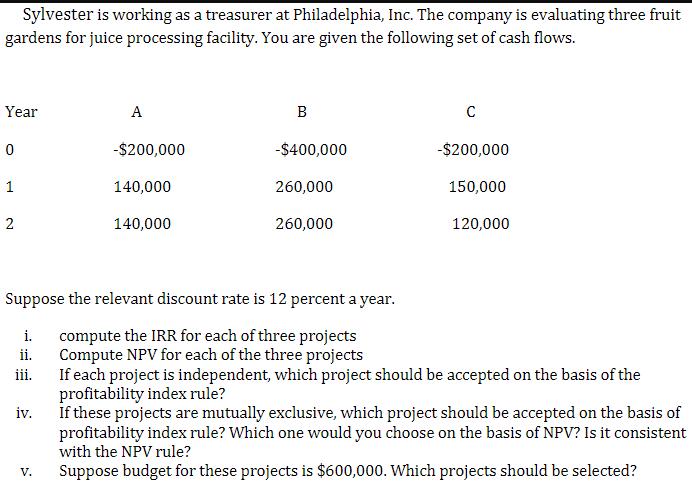

Sylvester is working as a treasurer at Philadelphia, Inc. The company is evaluating three fruit gardens for juice processing facility. You are given the

Sylvester is working as a treasurer at Philadelphia, Inc. The company is evaluating three fruit gardens for juice processing facility. You are given the following set of cash flows. Year 0 1 2 iv. A V. -$200,000 140,000 140,000 B -$400,000 260,000 260,000 -$200,000 150,000 Suppose the relevant discount rate is 12 percent a year. i. compute the IRR for each of three projects Compute NPV for each of the three projects ii. iii. If each project is independent, which project should be accepted on the basis of the profitability index rule? 120,000 If these projects are mutually exclusive, which project should be accepted on the basis of profitability index rule? Which one would you choose on the basis of NPV? Is it consistent with the NPV rule? Suppose budget for these projects is $600,000. Which projects should be selected?

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To compute the Internal Rate of Return IRR for each project we need to find the discount rate that makes the net present value NPV equal to zero We ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started