Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Syndi holds both a QAFP designation and a license to sell securities in B.C. Her long-time client, Jake, has requested a meeting with her

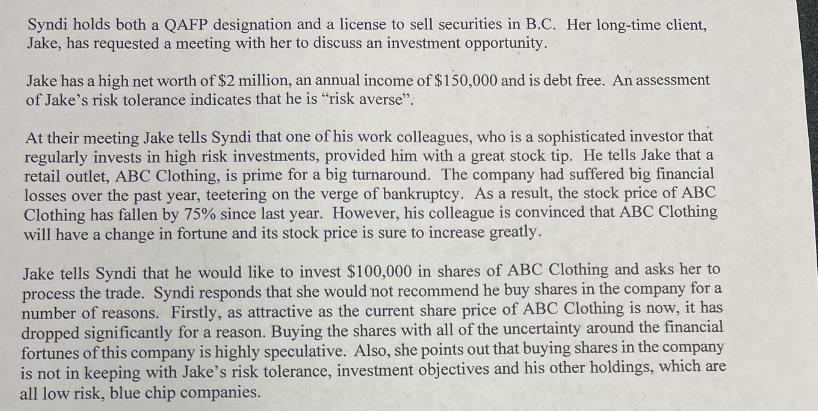

Syndi holds both a QAFP designation and a license to sell securities in B.C. Her long-time client, Jake, has requested a meeting with her to discuss an investment opportunity. Jake has a high net worth of $2 million, an annual income of $150,000 and is debt free. An assessment of Jake's risk tolerance indicates that he is "risk averse". At their meeting Jake tells Syndi that one of his work colleagues, who is a sophisticated investor that regularly invests in high risk investments, provided him with a great stock tip. He tells Jake that a retail outlet, ABC Clothing, is prime for a big turnaround. The company had suffered big financial losses over the past year, teetering on the verge of bankruptcy. As a result, the stock price of ABC Clothing has fallen by 75% since last year. However, his colleague is convinced that ABC Clothing will have a change in fortune and its stock price is sure to increase greatly. Jake tells Syndi that he would like to invest $100,000 in shares of ABC Clothing and asks her to process the trade. Syndi responds that she would not recommend he buy shares in the company for a number of reasons. Firstly, as attractive as the current share price of ABC Clothing is now, it has dropped significantly for a reason. Buying the shares with all of the uncertainty around the financial fortunes of this company is highly speculative. Also, she points out that buying shares in the company is not in keeping with Jake's risk tolerance, investment objectives and his other holdings, which are all low risk, blue chip companies. She also reminds Jake that he is very uneasy whenever his portfolio of stocks suffers a minor price decrease and that his first reaction is always to immediately sell, realizing a loss in the process. She is clear that the proposed investment is neither prudent nor appropriate for him and recommends that he not invest in ABC Clothing. Jake appreciates her candor and does not dispute any of the objections Syndi raised. However, he is certain ABC Clothing will be a great turnaround story and insists on proceeding with the speculative investment. Should Syndi acquiesce and process the transaction as instructed by her client? Y / N What Rule of Conduct applies in this case? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

No Syndi should not acquiesce and process the transaction as instructed by her client The Rule of Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started