Answered step by step

Verified Expert Solution

Question

1 Approved Answer

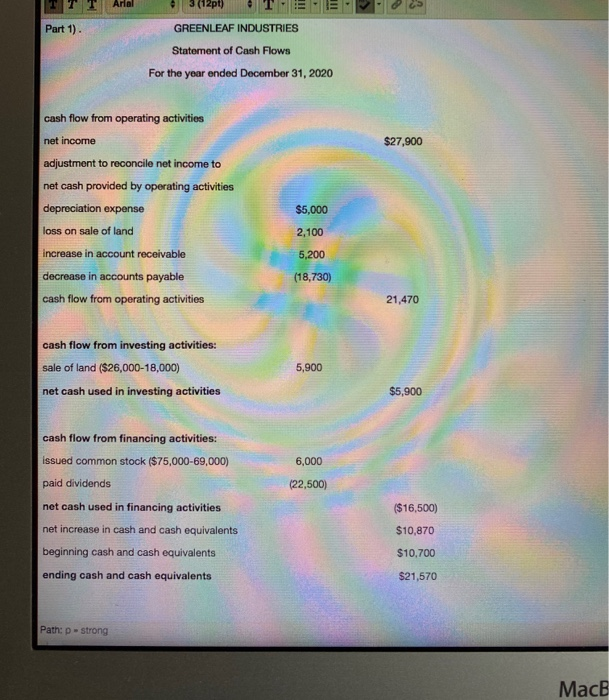

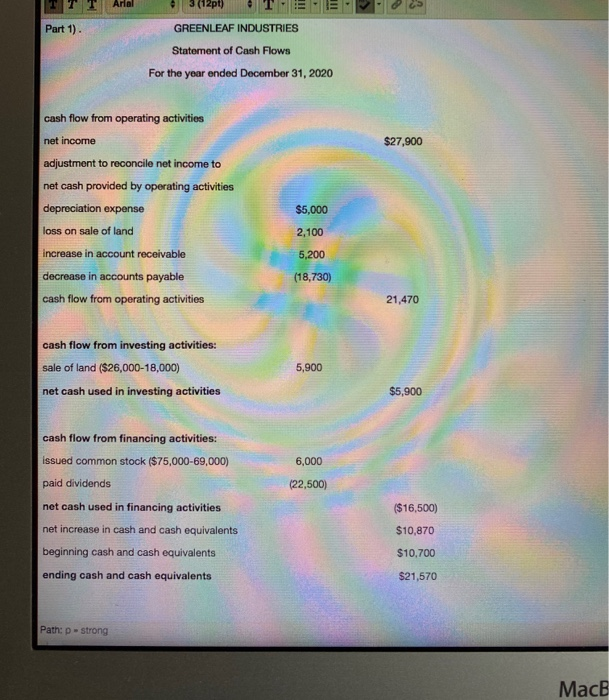

T 1 Arial 3 (127) Part 1) GREENLEAF INDUSTRIES Statement of Cash Flows For the year ended December 31, 2020 $27,900 cash flow from operating

T 1 Arial 3 (127) Part 1) GREENLEAF INDUSTRIES Statement of Cash Flows For the year ended December 31, 2020 $27,900 cash flow from operating activities net income adjustment to reconcile net income to net cash provided by operating activities depreciation expense $5,000 loss on sale of land 2,100 5,200 increase in account receivable decrease in accounts payable cash flow from operating activities (18,730) 21,470 cash flow from investing activities: sale of land ($26,000-18,000) net cash used in investing activities 5,900 $5,900 6,000 (22,500) cash flow from financing activities: issued common stock ($75,000-69,000) paid dividends net cash used in financing activities net increase in cash and cash equivalents beginning cash and cash equivalents ending cash and cash equivalents ($16,500) $10,870 $10,700 $21,570 Path: p - strong MacB PART 2: MEMO 50 POINTS Write a memo to Cedric Pederson (your summer internship supervisor) that explains what the statement of cash flow you just prepared says about the company. At minimum, discuss, but don't limit yourself to, the following items in your memo: 1. Which section of the statement do you believe is the most important? Why? 2. Just looking at the statement for this year (without comparing to previous years), do you see any area(s) on which the company should focus? Explain clearly. 3. What do you recommend the company do to improve its cash flow position? Format, grammar, and content will be evaluated

T 1 Arial 3 (127) Part 1) GREENLEAF INDUSTRIES Statement of Cash Flows For the year ended December 31, 2020 $27,900 cash flow from operating activities net income adjustment to reconcile net income to net cash provided by operating activities depreciation expense $5,000 loss on sale of land 2,100 5,200 increase in account receivable decrease in accounts payable cash flow from operating activities (18,730) 21,470 cash flow from investing activities: sale of land ($26,000-18,000) net cash used in investing activities 5,900 $5,900 6,000 (22,500) cash flow from financing activities: issued common stock ($75,000-69,000) paid dividends net cash used in financing activities net increase in cash and cash equivalents beginning cash and cash equivalents ending cash and cash equivalents ($16,500) $10,870 $10,700 $21,570 Path: p - strong MacB PART 2: MEMO 50 POINTS Write a memo to Cedric Pederson (your summer internship supervisor) that explains what the statement of cash flow you just prepared says about the company. At minimum, discuss, but don't limit yourself to, the following items in your memo: 1. Which section of the statement do you believe is the most important? Why? 2. Just looking at the statement for this year (without comparing to previous years), do you see any area(s) on which the company should focus? Explain clearly. 3. What do you recommend the company do to improve its cash flow position? Format, grammar, and content will be evaluated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started