Answered step by step

Verified Expert Solution

Question

1 Approved Answer

t 2. Net present value (NPV) The capital budgeting process is comprehensive and is based on cortain assumptions, models, and benchmarks. This process often begins

t

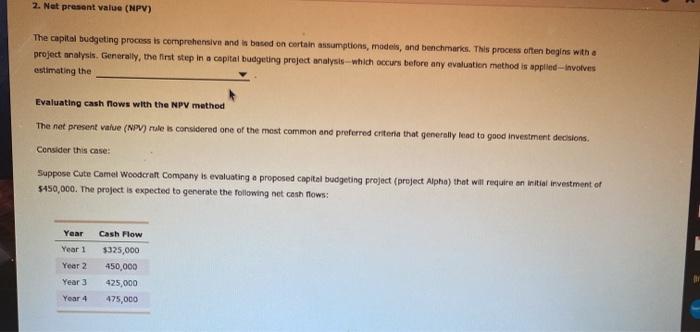

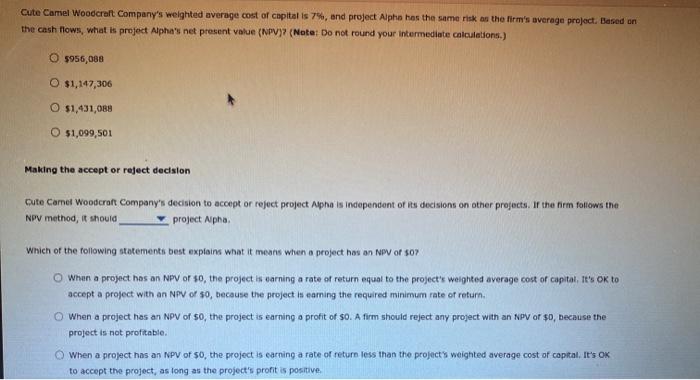

2. Net present value (NPV) The capital budgeting process is comprehensive and is based on cortain assumptions, models, and benchmarks. This process often begins with a project analysis. Generally, the first step in a capital budgeting project analysis which occurs before any evaluation method is applied -- Involves estimating the Evaluating cash rows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Cute Comel Woodcran Company is evaluating e proposed capital budgeting project (project Alpho) that will require an initial investment of $450,000. The project is expected to generate the following net cash flows: Year Year 1 Year 2 Cash Flow $325,000 450,000 425,000 475,000 Year 3 Year 4 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started