Answered step by step

Verified Expert Solution

Question

1 Approved Answer

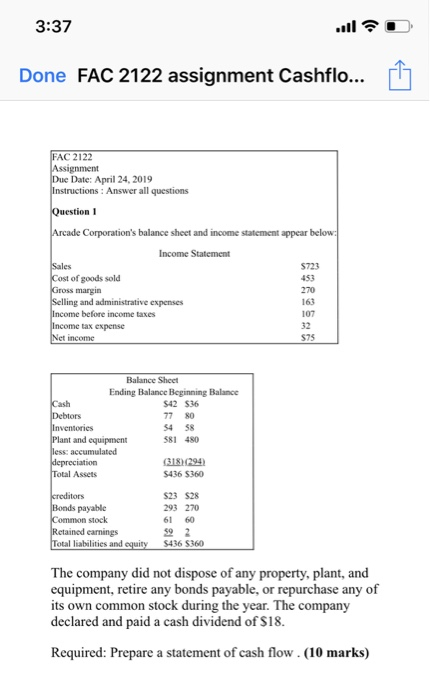

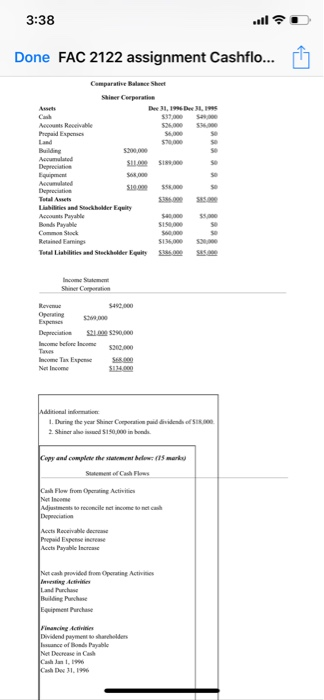

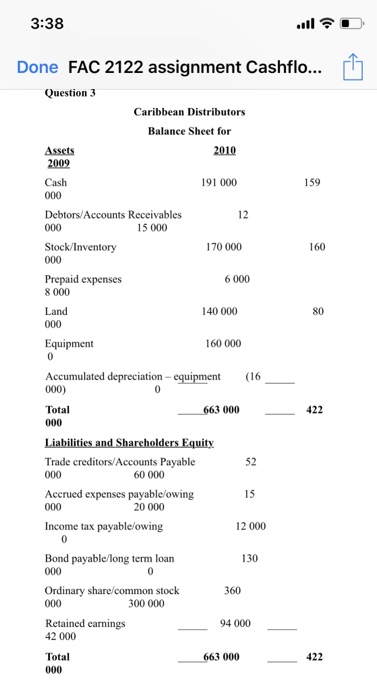

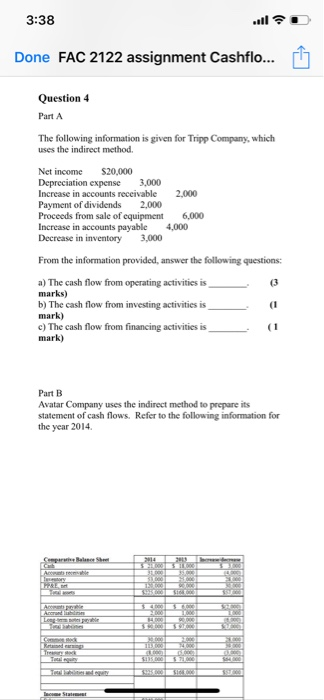

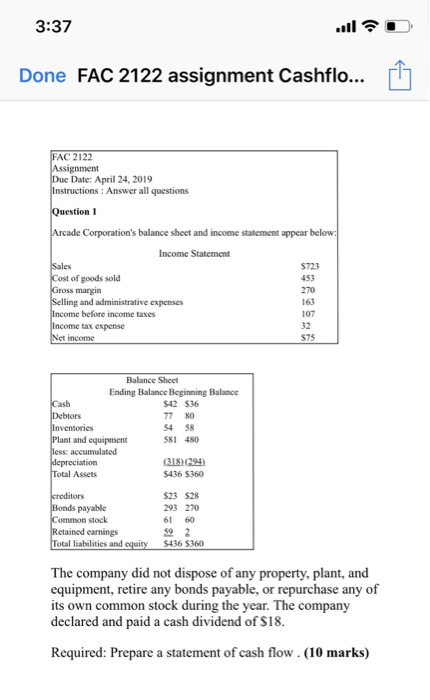

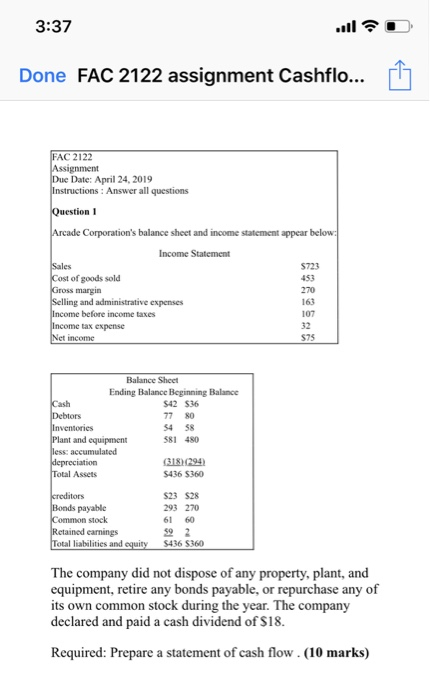

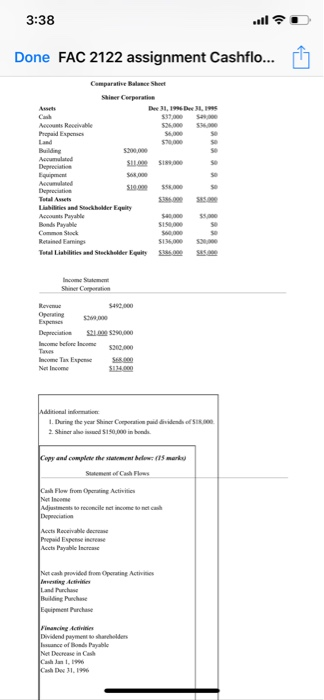

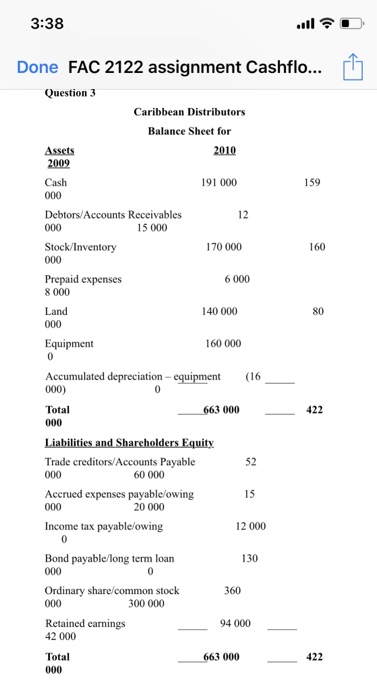

t 3:37 Done FAC 2122 assignment Cashflo... AC 2122 Date: April 24, 2019 Answer all questions Corporation's balance sheet and income statement appear Income Statement

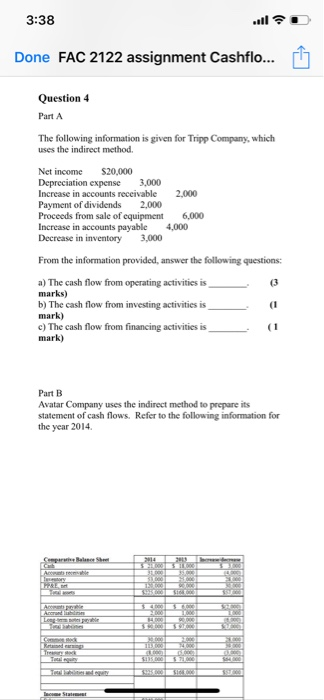

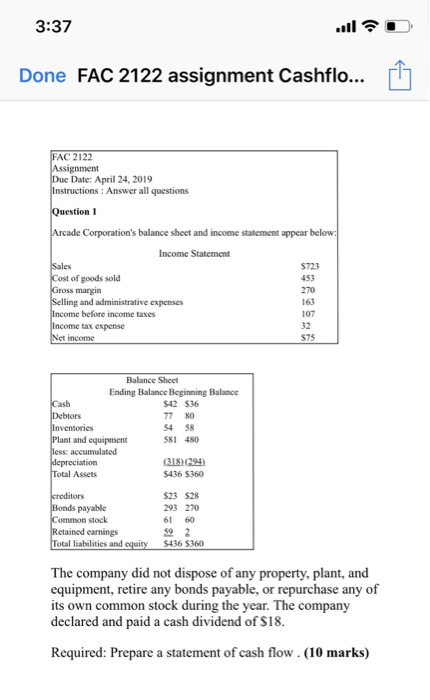

t 3:37 Done FAC 2122 assignment Cashflo... AC 2122 Date: April 24, 2019 Answer all questions Corporation's balance sheet and income statement appear Income Statement S723 453 270 163 107 32 S75 ost of goods sold g and administrative expenses before income taxes tax expense Balance Sheet Ending Balance Beginning Balance ash $42 S36 77 80 54 58 81 480 and equipment 318294 $436 S360 otal Assets S23 S28 293 270 61 60 52 2 $436 S360 ommon stock otal liabilities and The company did not dispose of any property, plant, and equipment, retire any bonds payable, or repurchase any of its own common stock during the year. The company declared and paid a cash dividend of S18 Required: Prepare a statement of cash flow . (10 marks) 3:38 Done FAC 2122 assignment Cashflo... rl Comparatise Balance Sheet 7,000 S00 ocots Reoeivale Propaid Expees 500,000 S1, Liabilies and Stockholder Equity Bonds Payable Retained Eamings 40,000000 Tetal Liblities and Steckhelder Egait 50 50 492.000 Openting Expenses Sas,000 DeprociatiSA $290000 Income before Iscome 200.00 Income Tasx Expese 114000 py and comyplete the statment bedec115 marky Sutemen o Cash Flow from Opcrating Activits Payable Incrcas of Bonds Payable Decrease in 3:38 Done FAC 2122 assignment Cashflo... [I Question 3 Caribbean Distributors Balance Sheet for Cash 191 000 159 Debtors /Accounts Receivables 12 15 000 170 000 Stock/Inventory 160 6 000 Prepaid expenses 8 000 140 000 80 Equipment 160 000 (16 Accumulated depreciation- equipment 000) Total 422 Trade creditors/Accounts Payable Accrued expenses payable/owing Income tax payable/owing Bond payable/long term loan Ordinary share/common stock Retained earnings 60 000 15 20 000 12 000 130 300 000 94 000 42 000 000_ 422 Total 3:38 Done FAC 2122 assignment Cashflo... rl Question 4 Part A Tripp Company, which The following information is given for uses the indirect method. Net income S20,000 Depreciation expense 3,000 Increase in accounts receivable 2,000 Payment of dividends 2,000 Proceeds from sale of equipment 6,000 Increase in accounts payable 4,000 Decrease in inventory 3,000 From the information provided, answer the following questions: a) The cash flow from operating activities is marks) b) The cash flow from investing activities is mark) c) The cash flow from financing activities is mark) (3 Part B Avatar Company uses the indirect method to prepare its statement of cash flows. Refer to the following information for the year 2014. t 3:37 Done FAC 2122 assignment Cashflo... AC 2122 Date: April 24, 2019 Answer all questions Corporation's balance sheet and income statement appear Income Statement S723 453 270 163 107 32 S75 ost of goods sold g and administrative expenses before income taxes tax expense Balance Sheet Ending Balance Beginning Balance S42 S36 77 80 54 58 581 480 ash and equipment 318 294 436 S36 otal Assets S23 S28 293 270 61 60 52 2 S436 S360 ommon stock otal liabilities and The company did not dispose of any property, plant, and equipment, retire any bonds payable, or repurchase any of its own common stock during the year. The company declared and paid a cash dividend of S18 Required: Prepare a statement of cash flow . (10 marks)

t 3:37 Done FAC 2122 assignment Cashflo... AC 2122 Date: April 24, 2019 Answer all questions Corporation's balance sheet and income statement appear Income Statement S723 453 270 163 107 32 S75 ost of goods sold g and administrative expenses before income taxes tax expense Balance Sheet Ending Balance Beginning Balance ash $42 S36 77 80 54 58 81 480 and equipment 318294 $436 S360 otal Assets S23 S28 293 270 61 60 52 2 $436 S360 ommon stock otal liabilities and The company did not dispose of any property, plant, and equipment, retire any bonds payable, or repurchase any of its own common stock during the year. The company declared and paid a cash dividend of S18 Required: Prepare a statement of cash flow . (10 marks) 3:38 Done FAC 2122 assignment Cashflo... rl Comparatise Balance Sheet 7,000 S00 ocots Reoeivale Propaid Expees 500,000 S1, Liabilies and Stockholder Equity Bonds Payable Retained Eamings 40,000000 Tetal Liblities and Steckhelder Egait 50 50 492.000 Openting Expenses Sas,000 DeprociatiSA $290000 Income before Iscome 200.00 Income Tasx Expese 114000 py and comyplete the statment bedec115 marky Sutemen o Cash Flow from Opcrating Activits Payable Incrcas of Bonds Payable Decrease in 3:38 Done FAC 2122 assignment Cashflo... [I Question 3 Caribbean Distributors Balance Sheet for Cash 191 000 159 Debtors /Accounts Receivables 12 15 000 170 000 Stock/Inventory 160 6 000 Prepaid expenses 8 000 140 000 80 Equipment 160 000 (16 Accumulated depreciation- equipment 000) Total 422 Trade creditors/Accounts Payable Accrued expenses payable/owing Income tax payable/owing Bond payable/long term loan Ordinary share/common stock Retained earnings 60 000 15 20 000 12 000 130 300 000 94 000 42 000 000_ 422 Total 3:38 Done FAC 2122 assignment Cashflo... rl Question 4 Part A Tripp Company, which The following information is given for uses the indirect method. Net income S20,000 Depreciation expense 3,000 Increase in accounts receivable 2,000 Payment of dividends 2,000 Proceeds from sale of equipment 6,000 Increase in accounts payable 4,000 Decrease in inventory 3,000 From the information provided, answer the following questions: a) The cash flow from operating activities is marks) b) The cash flow from investing activities is mark) c) The cash flow from financing activities is mark) (3 Part B Avatar Company uses the indirect method to prepare its statement of cash flows. Refer to the following information for the year 2014. t 3:37 Done FAC 2122 assignment Cashflo... AC 2122 Date: April 24, 2019 Answer all questions Corporation's balance sheet and income statement appear Income Statement S723 453 270 163 107 32 S75 ost of goods sold g and administrative expenses before income taxes tax expense Balance Sheet Ending Balance Beginning Balance S42 S36 77 80 54 58 581 480 ash and equipment 318 294 436 S36 otal Assets S23 S28 293 270 61 60 52 2 S436 S360 ommon stock otal liabilities and The company did not dispose of any property, plant, and equipment, retire any bonds payable, or repurchase any of its own common stock during the year. The company declared and paid a cash dividend of S18 Required: Prepare a statement of cash flow . (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started