Answered step by step

Verified Expert Solution

Question

1 Approved Answer

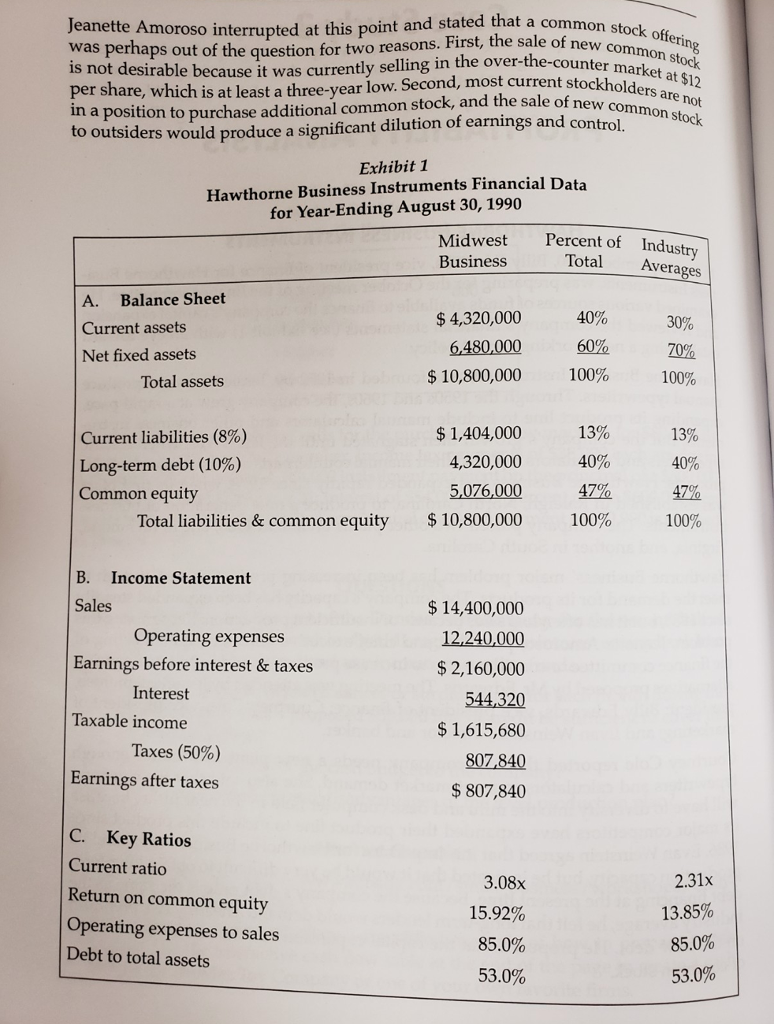

t a common stock offering ette Amoroso interrupted at this point and stated that a common was perhaps out of the question for two reasons.

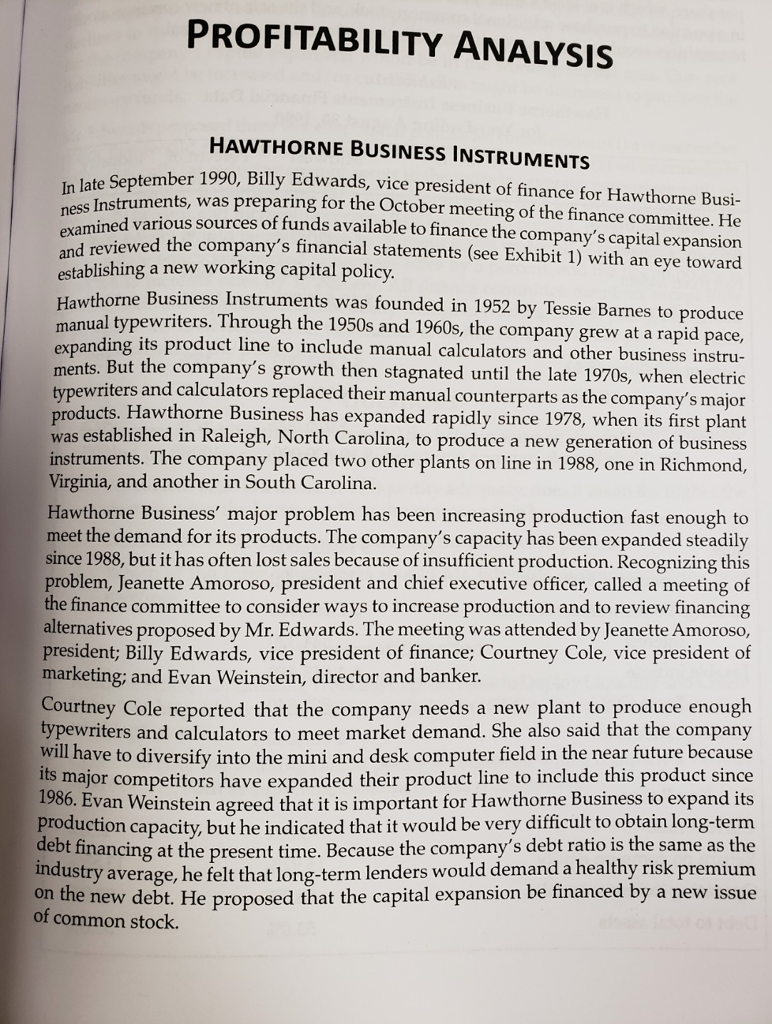

t a common stock offering ette Amoroso interrupted at this point and stated that a common was perhaps out of the question for two reasons. First, the sale of new co is not desirable because it was currently selling in the over-the-counter market per share, which is at least a three-year low. Second, most cur n a position to purchase additional common stock, and the sale of new co Jean nt stockholders are not to outsiders would produce a significant dilution of earnings and control. o stock Exhibit 1 Hawthorne Business Instruments Financial Data for Year-Ending August 30, 1990 Midwest Percent of Industry Business Total Averages A. Balance Sheet Current assets Net fixed assets 4,320,000 6,480,000 60% 70 40% 30% Total assets $10,800,000 100% 100% Current liabilities (8%) Long-term debt (10%) Common equity $1,404,000 4,320,000 13% 40% 13% 40% 5,076,000 47% 47 Total liabilities & common equity $ 10,800,000 100% 100% B. Income Statement Sales $14,400,000 12,240,000 $ 2,160,000 544,320 $ 1,615,680 807,840 $807,840 Operating expenses Earnings before interest & taxes Interest Taxable income Taxes (50%) Earnings after taxes C. Key Ratios Current ratio Return on common equity Operating expenses to sales Debt to total assets 3.08x 15.92% 850 53.0% 2.31x 13.85% 85.0% 53.0% Prepare an exhibit that will show (a) the balance sheet, (b) the income statement, and (c) the key ratios for each policy. 1. t a common stock offering ette Amoroso interrupted at this point and stated that a common was perhaps out of the question for two reasons. First, the sale of new co is not desirable because it was currently selling in the over-the-counter market per share, which is at least a three-year low. Second, most cur n a position to purchase additional common stock, and the sale of new co Jean nt stockholders are not to outsiders would produce a significant dilution of earnings and control. o stock Exhibit 1 Hawthorne Business Instruments Financial Data for Year-Ending August 30, 1990 Midwest Percent of Industry Business Total Averages A. Balance Sheet Current assets Net fixed assets 4,320,000 6,480,000 60% 70 40% 30% Total assets $10,800,000 100% 100% Current liabilities (8%) Long-term debt (10%) Common equity $1,404,000 4,320,000 13% 40% 13% 40% 5,076,000 47% 47 Total liabilities & common equity $ 10,800,000 100% 100% B. Income Statement Sales $14,400,000 12,240,000 $ 2,160,000 544,320 $ 1,615,680 807,840 $807,840 Operating expenses Earnings before interest & taxes Interest Taxable income Taxes (50%) Earnings after taxes C. Key Ratios Current ratio Return on common equity Operating expenses to sales Debt to total assets 3.08x 15.92% 850 53.0% 2.31x 13.85% 85.0% 53.0% Prepare an exhibit that will show (a) the balance sheet, (b) the income statement, and (c) the key ratios for each policy. 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started