Answered step by step

Verified Expert Solution

Question

1 Approved Answer

+ t EXAMPLE 14.1 Financing Liabilities of the principal are generally reported as financing activities on the statement of cash flows, Interest payments are

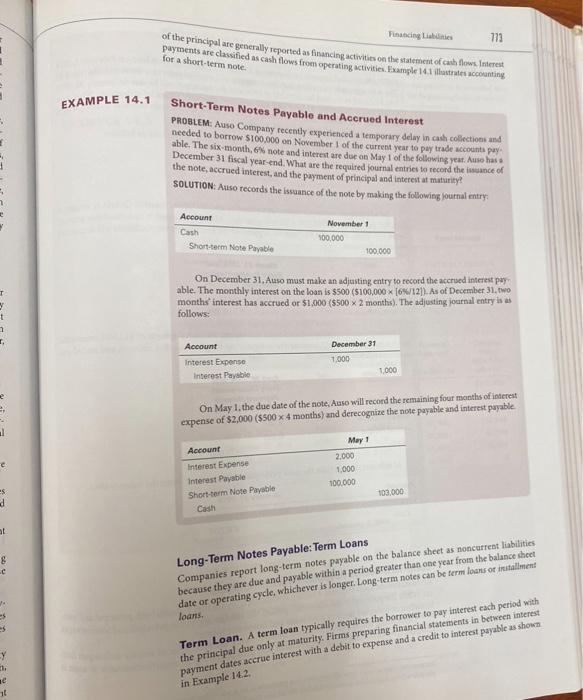

+ t EXAMPLE 14.1 Financing Liabilities of the principal are generally reported as financing activities on the statement of cash flows, Interest payments are classified as cash flows from operating activities. Example 14.1 illustrates accounting for a short-term note. Short-Term Notes Payable and Accrued Interest PROBLEM: Auso Company recently experienced a temporary delay in cash collections and needed to borrow $100,000 on November 1 of the current year to pay trade accounts pay able. The six-month, 6% note and interest are due on May 1 of the following year. Auso has a December 31 fiscal year-end. What are the required journal entries to record the issuance of the note, accrued interest, and the payment of principal and interest at maturity? SOLUTION: Auso records the issuance of the note by making the following journal entry Account Cash Short-term Note Payable November 1 100,000 100,000 On December 31, Auso must make an adjusting entry to record the accrued interest pay able. The monthly interest on the loan is $500 ($100,000 x [6%/12]). As of December 31, two months' interest has accrued or $1,000 ($500 x 2 months). The adjusting journal entry is as follows: e Account Interest Expense Interest Payable December 31 1,000 1,000 On May 1, the due date of the note, Auso will record the remaining four months of interest expense of $2,000 ($500 x 4 months) and derecognize the note payable and interest payable Account Interest Expense May 1 2,000 es Interest Payable 1,000 d Short-term Note Payable 100,000 103,000 Cash at g y e Long-Term Notes Payable: Term Loans Companies report long-term notes payable on the balance sheet as noncurrent liabilities because they are due and payable within a period greater than one year from the balance sheet date or operating cycle, whichever is longer. Long-term notes can be term loans or installment loans. Term Loan. A term loan typically requires the borrower to pay interest each period with the principal due only at maturity. Firms preparing financial statements in between interest payment dates accrue interest with a debit to expense and a credit to interest payable as shown in Example 14.2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started