Answered step by step

Verified Expert Solution

Question

1 Approved Answer

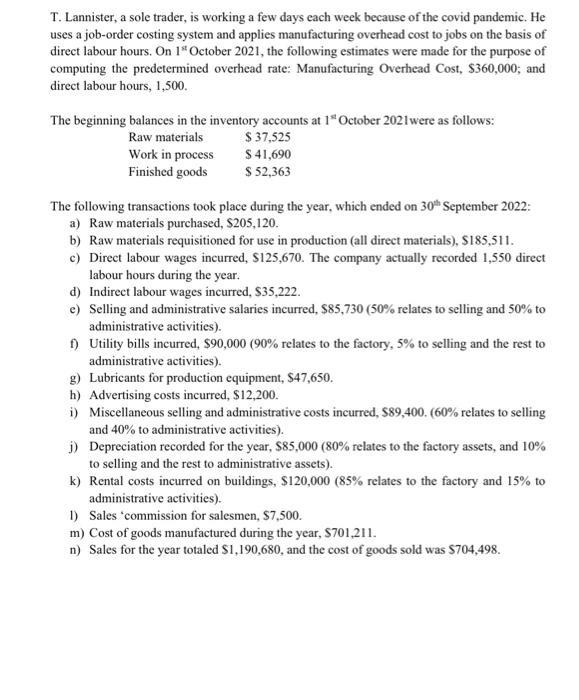

T. Lannister, a sole trader, is working a few days each week because of the covid pandemic. He uses a job-order costing system and

T. Lannister, a sole trader, is working a few days each week because of the covid pandemic. He uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of direct labour hours. On 1" October 2021, the following estimates were made for the purpose of computing the predetermined overhead rate: Manufacturing Overhead Cost, $360,000; and direct labour hours, 1,500. The beginning balances in the inventory accounts at 1 October 2021 were as follows: Raw materials Work in process Finished goods $ 37,525 $ 41,690 $ 52,363 The following transactions took place during the year, which ended on 30th September 2022: a) Raw materials purchased, $205,120. b) Raw materials requisitioned for use in production (all direct materials), $185,511. c) Direct labour wages incurred, $125,670. The company actually recorded 1,550 direct labour hours during the year. d) Indirect labour wages incurred, $35,222. e) Selling and administrative salaries incurred, $85,730 (50% relates to selling and 50% to administrative activities). f) Utility bills incurred, $90,000 (90% relates to the factory, 5% to selling and the rest to administrative activities). g) Lubricants for production equipment, $47,650. h) Advertising costs incurred, $12,200. i) Miscellaneous selling and administrative costs incurred, $89,400. (60% relates to selling and 40% to administrative activities). j) Depreciation recorded for the year, $85,000 (80% relates to the factory assets, and 10% to selling and the rest to administrative assets). k) Rental costs incurred on buildings, $120,000 (85% relates to the factory and 15% to administrative activities). 1) Sales 'commission for salesmen, $7,500. m) Cost of goods manufactured during the year, $701,211. n) Sales for the year totaled $1,190,680, and the cost of goods sold was $704,498. REQUIRED: 1) Calculate manufacturing overhead applied to the jobs. Show the details of a calculation. 2) Prepare a Schedule of the Costs of Goods Manufactured for the year ended 30th September 2022. 3) Determine whether overhead was over- or under-applied for the period. Show the details of a calculation. 4) Prepare a Schedule of Cost of Goods Sold for the year ended 30th September 2022. 5) Prepare an Income Statement for the year ended 30th September 2022. In the Income Statement, split costs between administration and selling expense. 6) Job # 144 was one of the many jobs started and completed during the year by T. Lannister. The time taken by direct labour to do the whole job # 144 was 5 hours. This job required $ 1,220 in direct materials. The direct labour rate was $ 170 per hour. If the job contained 6 units and T. Lannister billed the job at 160% of the unit product cost on the job cost sheet, what price per unit would have been charged to the customer? ***End of Question***

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started