t League Apparel Ltd is a large garment manufacturer that operates through two manufacturing stores in Australia (Queensland and New South Wales (NSW)). The following

t

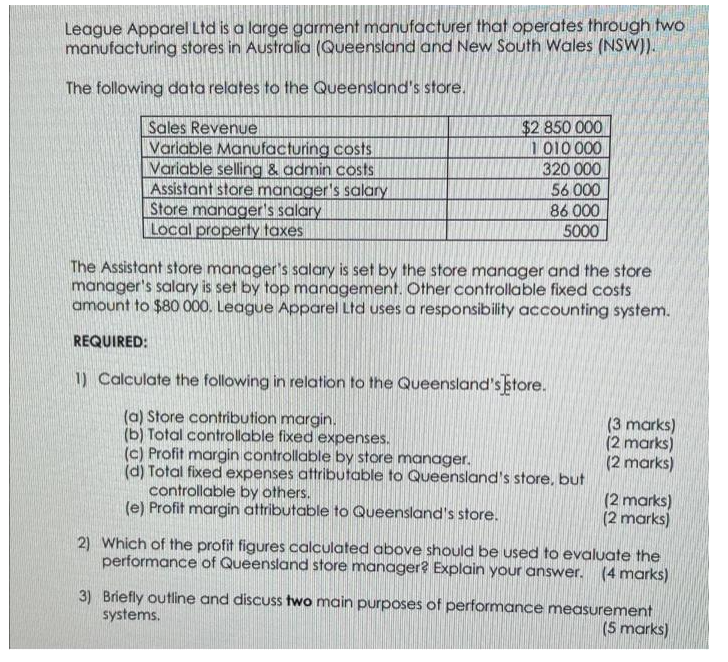

tLeague Apparel Ltd is a large garment manufacturer that operates through two manufacturing stores in Australia (Queensland and New South Wales (NSW)). The following data relates to the Queensland's store. Sales Revenue Variable Manufacturing costs Variable selling & admin costs Assistant store manager's salary Store manager's salary Local property taxes $2 850 000 1010 000 320 000 56.000 86 000 5000 The Assistant store manager's salary is set by the store manager and the store manager's salary is set by top management. Other controllable fixed costs amount to $80 000. League Apparel Ltd uses a responsibility accounting system. REQUIRED: 1) Calculate the following in relation to the Queensland's store. (a) Store contribution margin. (3 marks) (b) Total controllable fixed expenses. (2 marks) (c) Profit margin controllable by store manager. (2 marks) (d) Total fixed expenses attributable to Queensland's store, but controllable by others. (2 marks) (2 marks) (e) Profit margin attributable to Queensland's store. 2) Which of the profit figures calculated above should be used to evaluate the performance of Queensland store manager? Explain your answer. (4 marks) 3) Briefly outline and discuss two main purposes of performance measurement systems. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculations a Store contribution margin Contribution ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started