Answered step by step

Verified Expert Solution

Question

1 Approved Answer

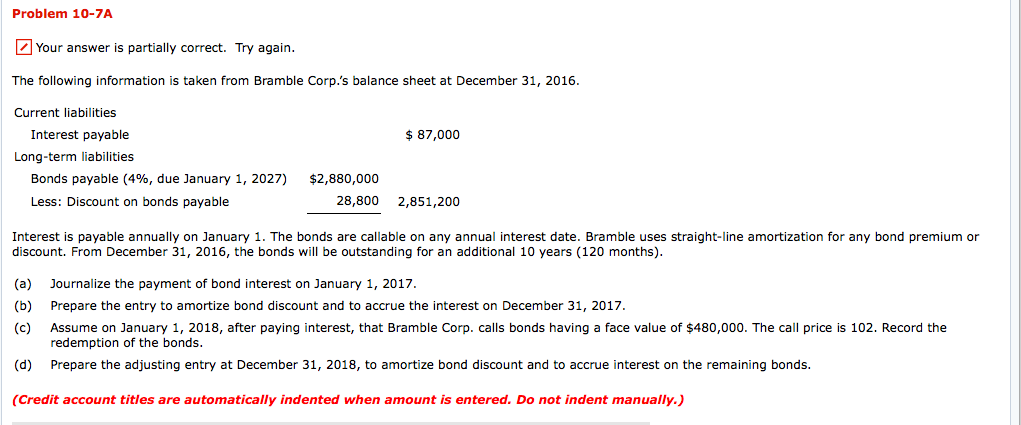

T Problem 10-7A Your answer is partially correct. Try again. The following information is taken from Bramble Corp.'s balance sheet at December 31, 2016. Current

T

T

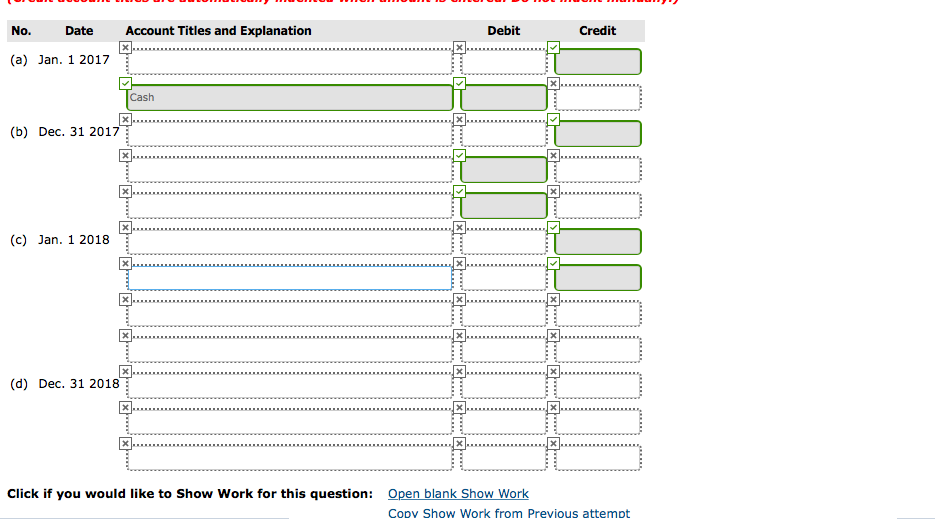

Problem 10-7A Your answer is partially correct. Try again. The following information is taken from Bramble Corp.'s balance sheet at December 31, 2016. Current liabilities 87,000 Interest payable Long-term liabilities Bonds payable (4%, due January 1, 2027) $2,880,000 Less: Discount on bonds payable 28,800 2,851,200 Interest is payable annually on January 1. The bonds are callable on any annual interest date. Bramble uses straight-line amortization for any bond premium or discount. From December 31, 2016, the bonds will be outstanding for an additional 10 years (120 months). (a) Journalize the payment of bond interest on January 1, 2017 (b) Prepare the entry to amortize bond discount and to accrue the interest on December 31, 2017. (c) Assume on January 1, 2018, after paying interest, that Bramble Corp. calls bonds having a face value of $480,000. The call price is 102. Record the redemption of the bonds. Prepare the adjusting entry at December 31, 2018, to amortize bond discount and to accrue interest on the remaining bonds. (d) (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Problem 10-7A Your answer is partially correct. Try again. The following information is taken from Bramble Corp.'s balance sheet at December 31, 2016. Current liabilities 87,000 Interest payable Long-term liabilities Bonds payable (4%, due January 1, 2027) $2,880,000 Less: Discount on bonds payable 28,800 2,851,200 Interest is payable annually on January 1. The bonds are callable on any annual interest date. Bramble uses straight-line amortization for any bond premium or discount. From December 31, 2016, the bonds will be outstanding for an additional 10 years (120 months). (a) Journalize the payment of bond interest on January 1, 2017 (b) Prepare the entry to amortize bond discount and to accrue the interest on December 31, 2017. (c) Assume on January 1, 2018, after paying interest, that Bramble Corp. calls bonds having a face value of $480,000. The call price is 102. Record the redemption of the bonds. Prepare the adjusting entry at December 31, 2018, to amortize bond discount and to accrue interest on the remaining bonds. (d) (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started