Answered step by step

Verified Expert Solution

Question

1 Approved Answer

t tab n Home Insert Draw Page Layout 1 2 B2 3 4 5 AutoSave OFF 6 7 8 Paste 9 10 11 12 13

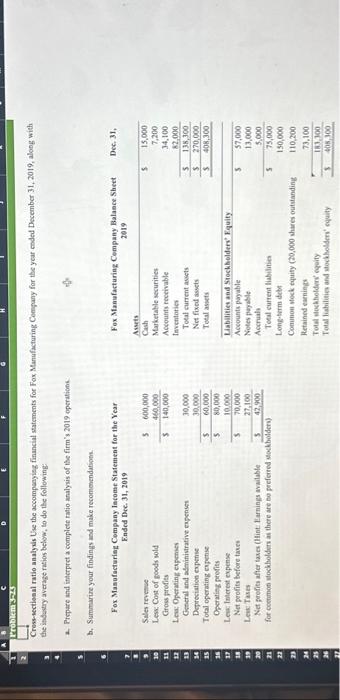

t tab n Home Insert Draw Page Layout 1 2 B2 3 4 5 AutoSave OFF 6 7 8 Paste 9 10 11 12 13 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 caps lock Times New Roman 14 BIUV A B Problem 3-23 esc 5.0 ... V Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses General and administrative expenses ! 1 V Q b. Summarize your findings and make recommendations. A D Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? x fx I control option Z Formulas Data Fox Manufacturing Company Income Statement for the Year Ended Dec. 31, 2019 2 V ' ' A Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes (Hint: Earnings available $ for common stockholders as there are no preferred stockholders) F2 W E S Cross-sectional ratio analysis Use the accompanying financial statements for Fox Manufacturing Company for the year ended December 31, 2019, along with the industry average ratios below, to do the following: a. Prepare and interpret a complete ratio analysis of the firm's 2019 operations. #3 X H command $ 80 F3 $ E Review ||||||| $ $ $ D F Answers (insert your answers in the highlighted cells; use cell references, equations, and functions wherever possible) Contents Problem 3-4 Problem 3-19 Problem 3-23 Problem 3-26 + Ready Accessibility: Investigate 600,000 460,000 140,000 30,000 30,000 60,000 80,000 10,000 70,000 27,100 42,900 S94 View C Q F4 R G F % Goo Automate Tell me ab Wrap Text 5 Chapter 3 HW Assignment Template (4)-3- Merge & Center v Assets Cash H Marketable securities Accounts receivable Inventories F5 V Fox Manufacturing Company Balance Sheet Total current assets Net fixed assets Total assets T Liabilities and Stockholders' Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock equity (20,000 shares outstanding Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 22-2 General $ % 950 000 V 6 G F6 MacBook Air 2019 Y B & 7 H F7 U N T * 00 $ $ $ $ $ $ $ 8 Conditional Format Cell Formatting as Table Styles J K Dec. 31, 15,000 7,200 34,100 82,000 138,300 270,000 408,300 57,000 13,000 5,000 75,000 150,000 110,200 73,100 183,300 408,300 F8 I ( 9 V M K L F9 M O g

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started