Question: TA Innovations Ltd ( TAI ) is gearing up to launch a state - of - the - art robotic companion. Non -

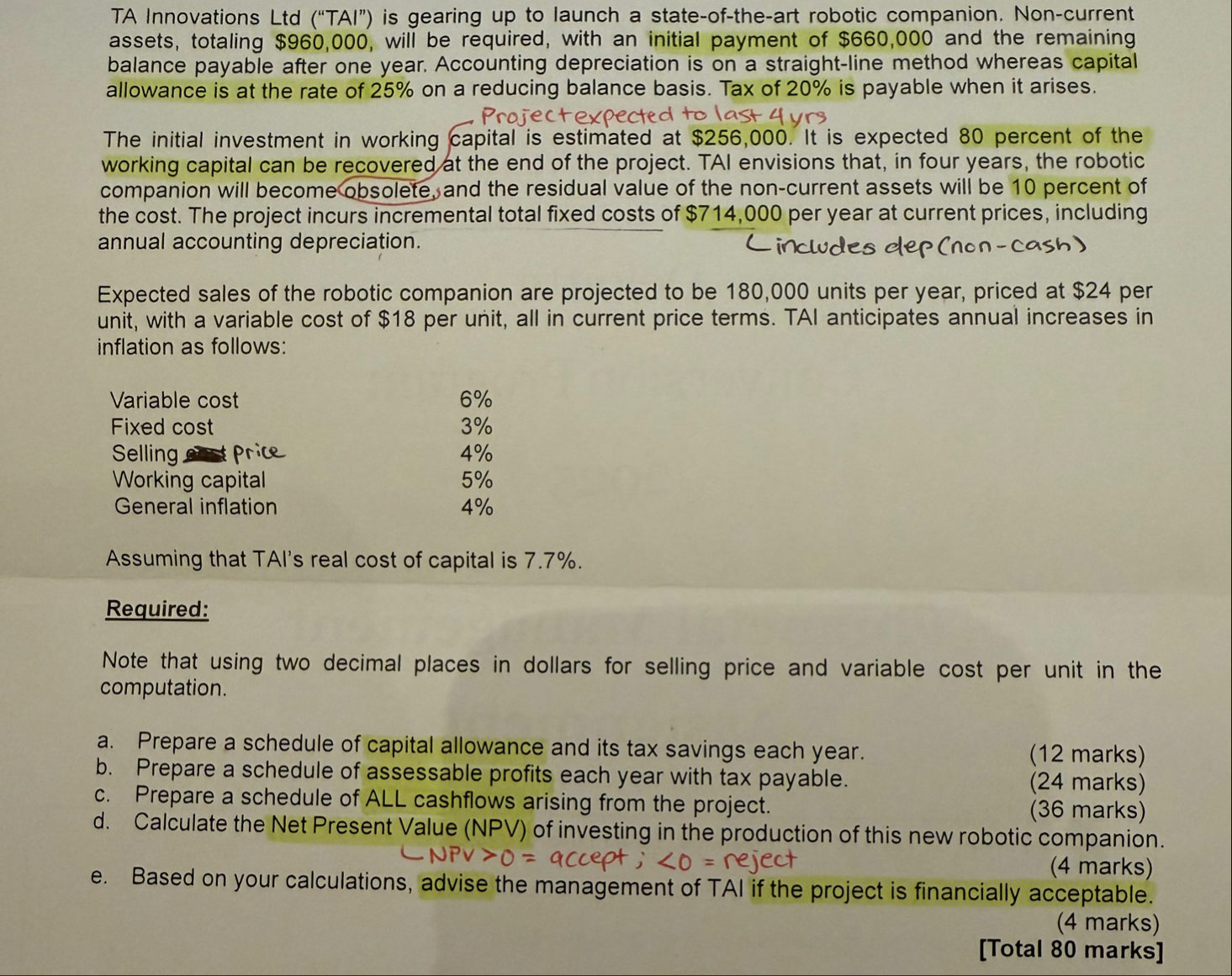

TA Innovations Ltd TAI is gearing up to launch a stateoftheart robotic companion. Noncurrent assets, totaling $ will be required, with an initial payment of $ and the remaining balance payable after one year. Accounting depreciation is on a straightline method whereas capital allowance is at the rate of on a reducing balance basis. Tax of is payable when it arises.

Project expected to last yrs

The initial investment in working capital is estimated at $ It is expected percent of the working capital can be recovered at the end of the project. TAI envisions that, in four years, the robotic companion will become obsolete, and the residual value of the noncurrent assets will be percent of the cost. The project incurs incremental total fixed costs of $ per year at current prices, including annual accounting depreciation.

C

includes dep noncash

Expected sales of the robotic companion are projected to be units per year, priced at $ per unit, with a variable cost of $ per unit, all in current price terms. TAI anticipates annual increases in inflation as follows:

tableVariable cost

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock