Answered step by step

Verified Expert Solution

Question

1 Approved Answer

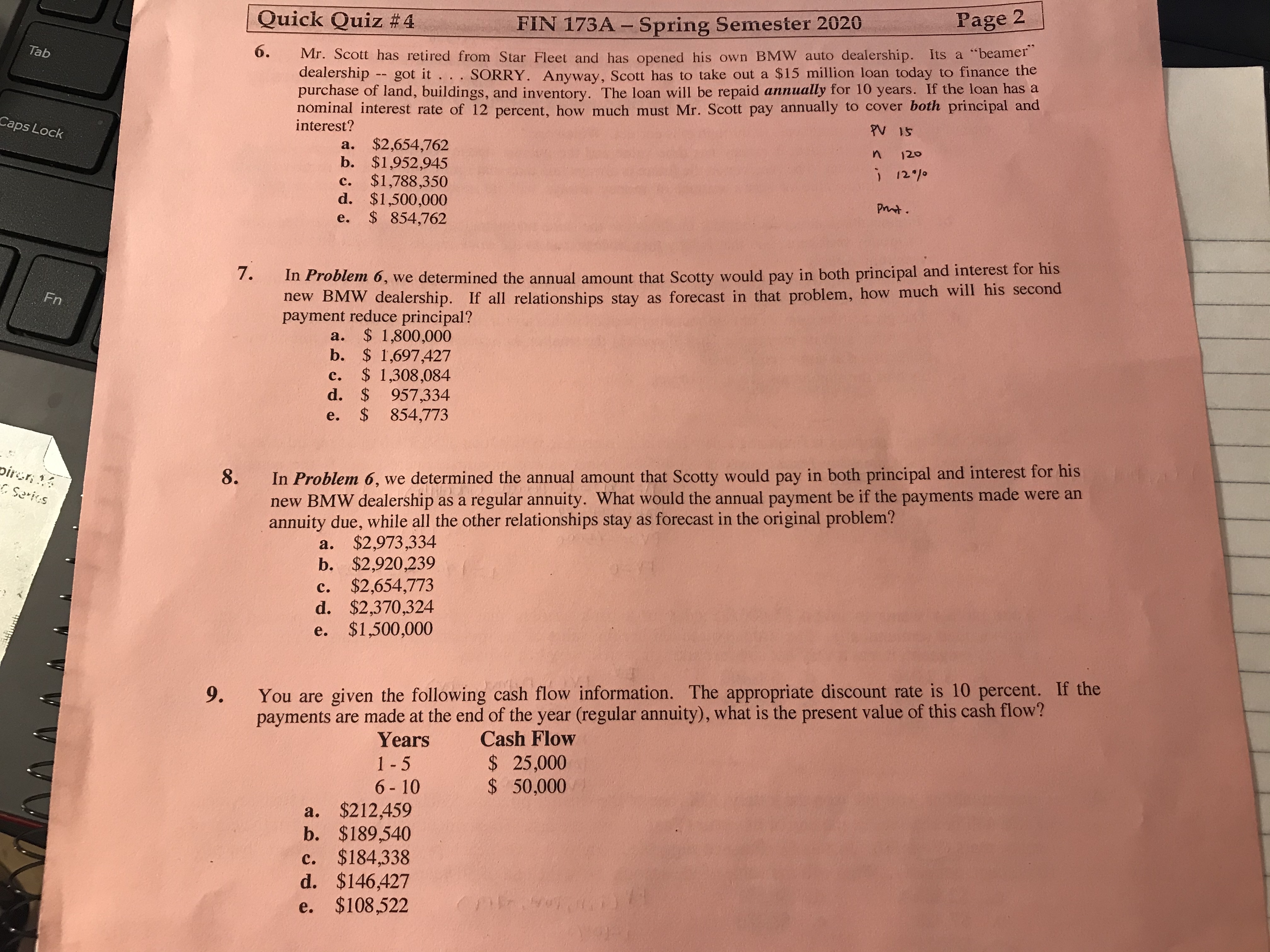

Tab Caps Lock Quick Quiz #4 FIN 173A- Spring Semester 2020 Page 2 6. Mr. Scott has retired from Star Fleet and has opened

Tab Caps Lock Quick Quiz #4 FIN 173A- Spring Semester 2020 Page 2 6. Mr. Scott has retired from Star Fleet and has opened his own BMW auto dealership. Its a "beamer" dealership -- got it. . . SORRY. Anyway, Scott has to take out a $15 million loan today to finance the purchase of land, buildings, and inventory. The loan will be repaid annually for 10 years. If the loan has a nominal interest rate of 12 percent, how much must Mr. Scott pay annually to cover both principal and interest? a. $2,654,762 b. $1,952,945 c. $1,788,350 d. $1,500,000 PV 15 n 120 i 12% Prut. Fn Diren 14 Series 7. 8. e. $ 854,762 In Problem 6, we determined the annual amount that Scotty would pay in both principal and interest for his new BMW dealership. If all relationships stay as forecast in that problem, how much will his second payment reduce principal? a. $ 1,800,000 b. $ 1,697,427 c. $ 1,308,084 d. $ 957,334 e. $ 854,773 In Problem 6, we determined the annual amount that Scotty would pay in both principal and interest for his new BMW dealership as a regular annuity. What would the annual payment be if the payments made were an annuity due, while all the other relationships stay as forecast in the original problem? a. $2,973,334 b. $2,920,239 c. $2,654,773 d. $2,370,324 e. $1,500,000 9. You are given the following cash flow information. The appropriate discount rate is 10 percent. If the payments are made at the end of the year (regular annuity), what is the present value of this cash flow? Years 1-5 Cash Flow $ 25,000 6-10 $ 50,000 a. $212,459 b. $189,540 c. $184,338 d. $146,427 e. $108,522

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started