Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tabitha Batista is a translator who works for a consulting firm in Ottawa. Her 2023 salary is $74,200, from which her employer, a CCPC,

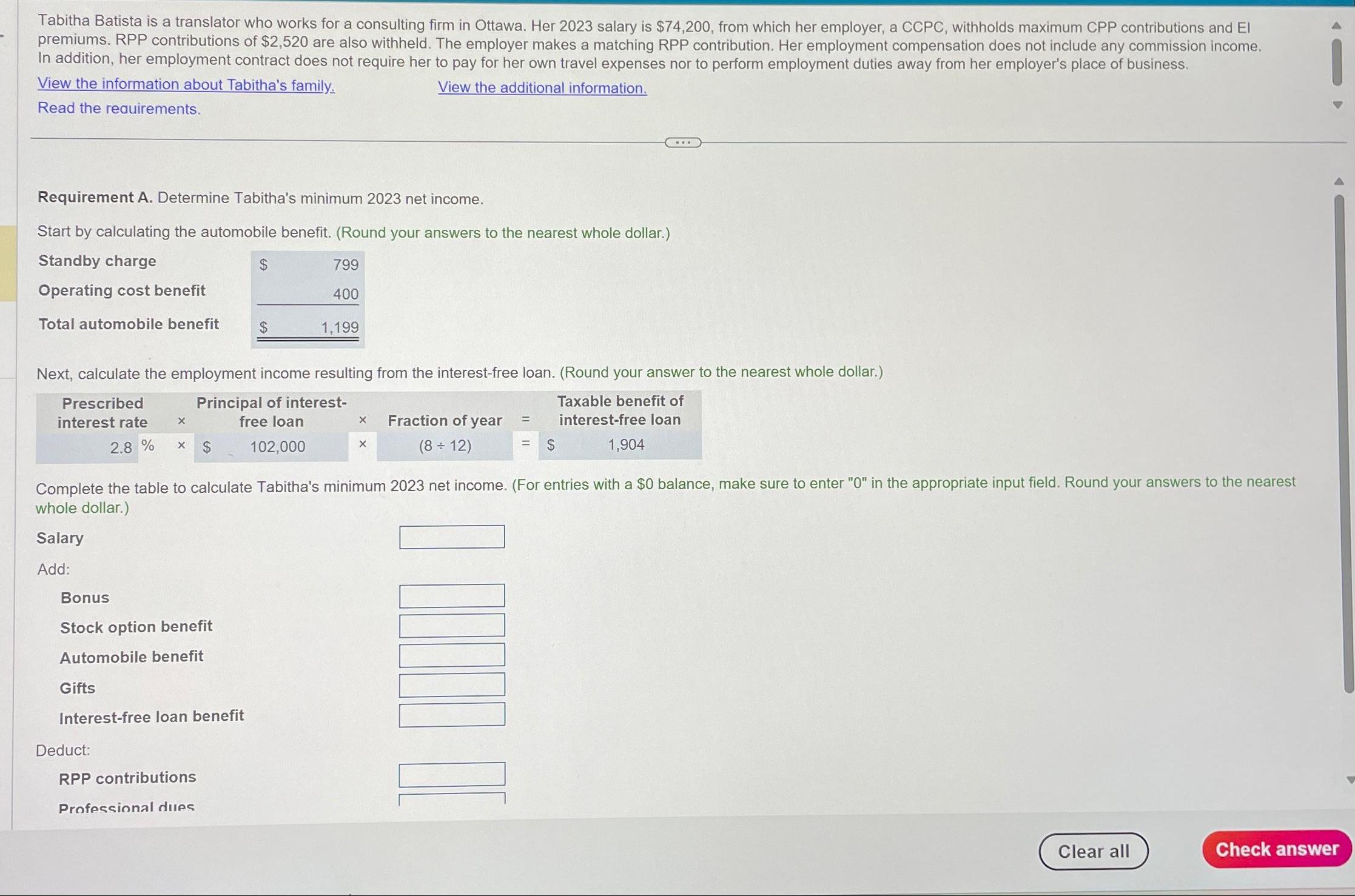

Tabitha Batista is a translator who works for a consulting firm in Ottawa. Her 2023 salary is $74,200, from which her employer, a CCPC, withholds maximum CPP contributions and El premiums. RPP contributions of $2,520 are also withheld. The employer makes a matching RPP contribution. Her employment compensation does not include any commission income. In addition, her employment contract does not require her to pay for her own travel expenses nor to perform employment duties away from her employer's place of business. View the information about Tabitha's family. View the additional information. Read the requirements. Requirement A. Determine Tabitha's minimum 2023 net income. Start by calculating the automobile benefit. (Round your answers to the nearest whole dollar.) Standby charge $ 799 Operating cost benefit 400 Total automobile benefit $ 1,199 Next, calculate the employment income resulting from the interest-free loan. (Round your answer to the nearest whole dollar.) Prescribed Principal of interest- interest rate 2.8 % x free loan X X $ 102,000 X Fraction of year (812) = Taxable benefit of interest-free loan = $ 1,904 Complete the table to calculate Tabitha's minimum 2023 net income. (For entries with a $0 balance, make sure to enter "0" in the appropriate input field. Round your answers to the nearest whole dollar.) Salary Add: Bonus Stock option benefit Automobile benefit Gifts Interest-free loan benefit Deduct: RPP contributions Professional dues Clear all Check answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure lets break down Tabithas situation and calculate her minimum 2023 net income step by step 1 Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started