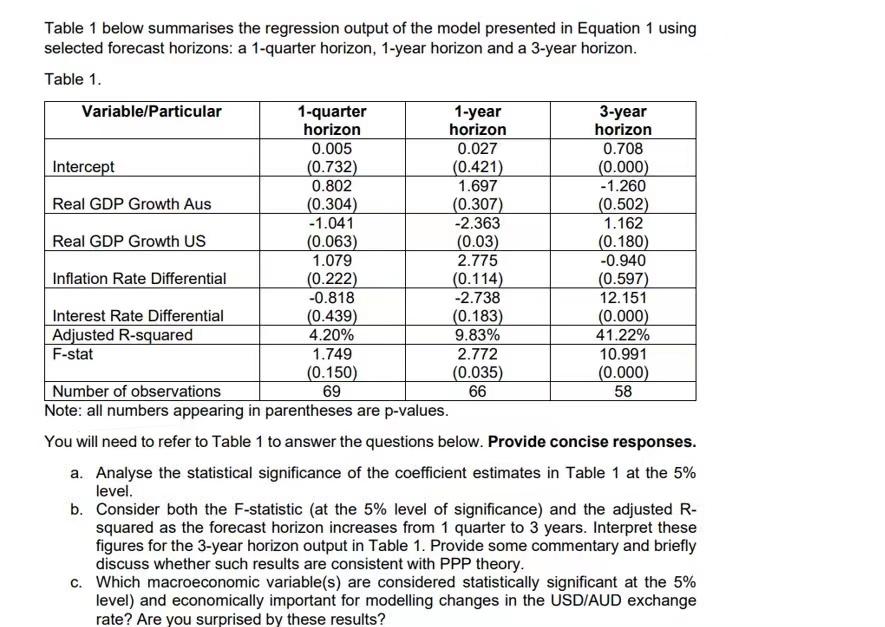

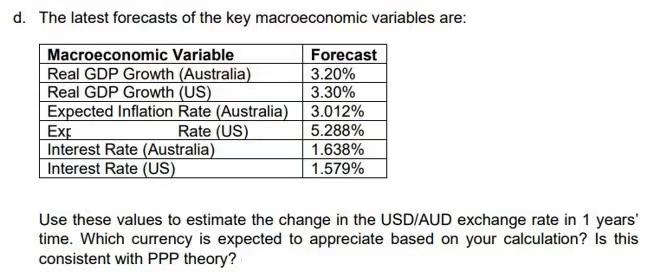

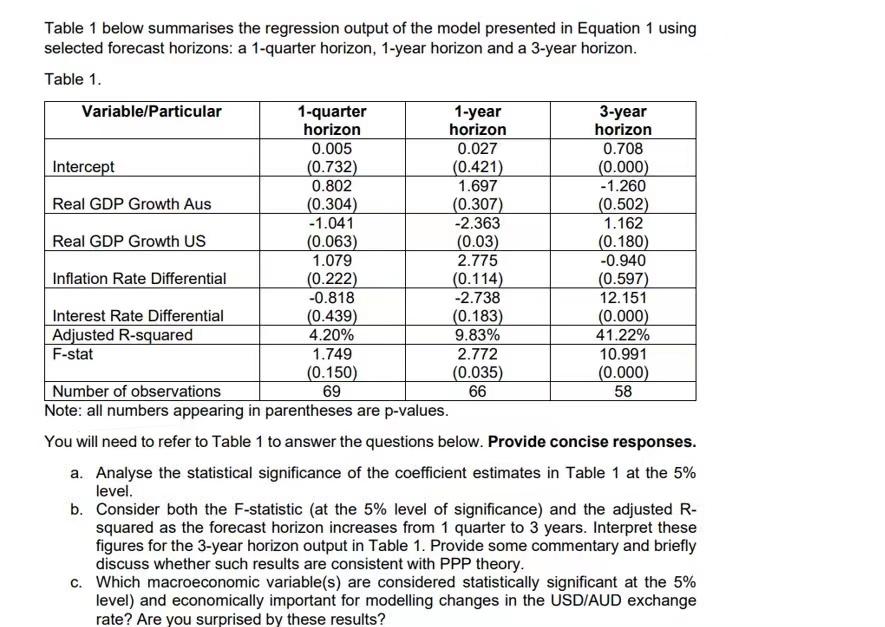

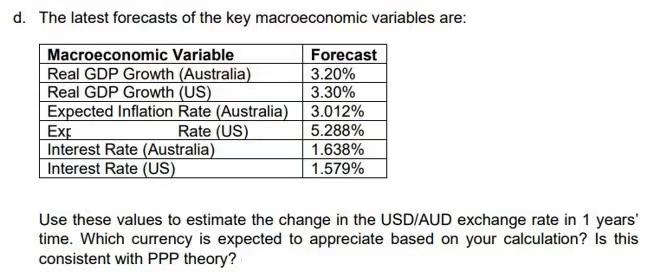

Table 1 below summarises the regression output of the model presented in Equation 1 using selected forecast horizons: a 1-quarter horizon, 1-year horizon and a 3-year horizon. Table 1. Variable/Particular 1-quarter 1-year 3-year horizon horizon horizon 0.005 0.027 0.708 Intercept (0.732) (0.421) (0.000) 0.802 1.697 -1.260 Real GDP Growth Aus (0.304) (0.307) (0.502) -1.041 -2.363 1.162 Real GDP Growth US (0.063) (0.03) (0.180) 1.079 2.775 -0.940 Inflation Rate Differential (0.222) (0.114) (0.597) -0.818 -2.738 12.151 Interest Rate Differential (0.439) (0.183) (0.000) Adjusted R-squared 4.20% 9.83% 41.22% F-stat 1.749 2.772 10.991 (0.150) (0.035) (0.000) Number of observations 69 66 58 Note: all numbers appearing in parentheses are p-values. You will need to refer to Table 1 to answer the questions below. Provide concise responses. a. Analyse the statistical significance of the coefficient estimates in Table 1 at the 5% level. b. Consider both the F-statistic (at the 5% level of significance) and the adjusted R- squared as the forecast horizon increases from 1 quarter to 3 years. Interpret these figures for the 3-year horizon output in Table 1. Provide some commentary and briefly discuss whether such results are consistent with PPP theory. C. Which macroeconomic variable(s) are considered statistically significant at the 5% level) and economically important for modelling changes in the USD/AUD exchange rate? Are you surprised by these results? d. The latest forecasts of the key macroeconomic variables are: Macroeconomic Variable Forecast Real GDP Growth (Australia) 3.20% Real GDP Growth (US) 3.30% Expected Inflation Rate (Australia) 3.012% Exp Rate (US) 5.288% Interest Rate (Australia) 1.638% Interest Rate (US) 1.579% Use these values to estimate the change in the USD/AUD exchange rate in 1 years' time. Which currency is expected to appreciate based on your calculation? Is this consistent with PPP theory? Table 1 below summarises the regression output of the model presented in Equation 1 using selected forecast horizons: a 1-quarter horizon, 1-year horizon and a 3-year horizon. Table 1. Variable/Particular 1-quarter 1-year 3-year horizon horizon horizon 0.005 0.027 0.708 Intercept (0.732) (0.421) (0.000) 0.802 1.697 -1.260 Real GDP Growth Aus (0.304) (0.307) (0.502) -1.041 -2.363 1.162 Real GDP Growth US (0.063) (0.03) (0.180) 1.079 2.775 -0.940 Inflation Rate Differential (0.222) (0.114) (0.597) -0.818 -2.738 12.151 Interest Rate Differential (0.439) (0.183) (0.000) Adjusted R-squared 4.20% 9.83% 41.22% F-stat 1.749 2.772 10.991 (0.150) (0.035) (0.000) Number of observations 69 66 58 Note: all numbers appearing in parentheses are p-values. You will need to refer to Table 1 to answer the questions below. Provide concise responses. a. Analyse the statistical significance of the coefficient estimates in Table 1 at the 5% level. b. Consider both the F-statistic (at the 5% level of significance) and the adjusted R- squared as the forecast horizon increases from 1 quarter to 3 years. Interpret these figures for the 3-year horizon output in Table 1. Provide some commentary and briefly discuss whether such results are consistent with PPP theory. C. Which macroeconomic variable(s) are considered statistically significant at the 5% level) and economically important for modelling changes in the USD/AUD exchange rate? Are you surprised by these results? d. The latest forecasts of the key macroeconomic variables are: Macroeconomic Variable Forecast Real GDP Growth (Australia) 3.20% Real GDP Growth (US) 3.30% Expected Inflation Rate (Australia) 3.012% Exp Rate (US) 5.288% Interest Rate (Australia) 1.638% Interest Rate (US) 1.579% Use these values to estimate the change in the USD/AUD exchange rate in 1 years' time. Which currency is expected to appreciate based on your calculation? Is this consistent with PPP theory