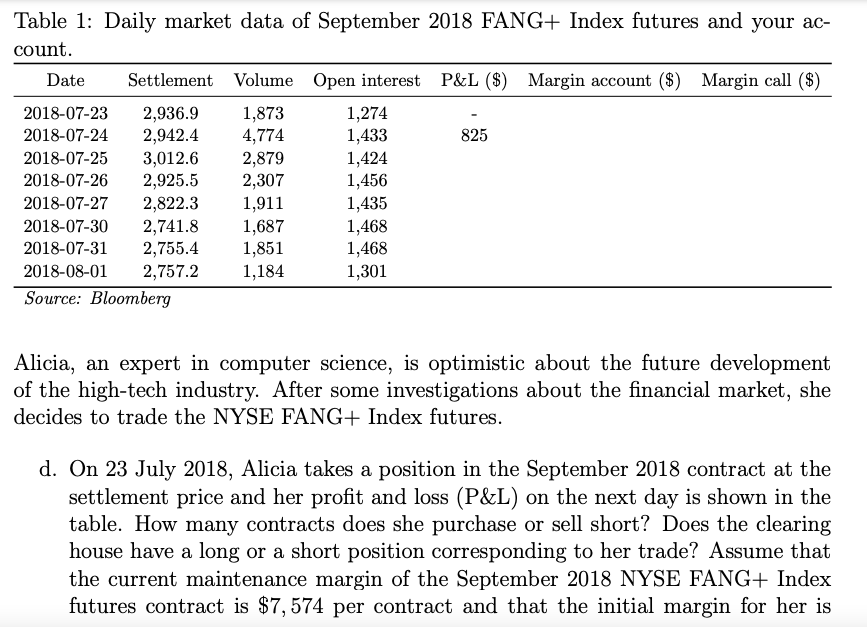

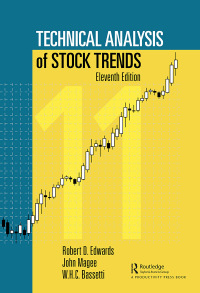

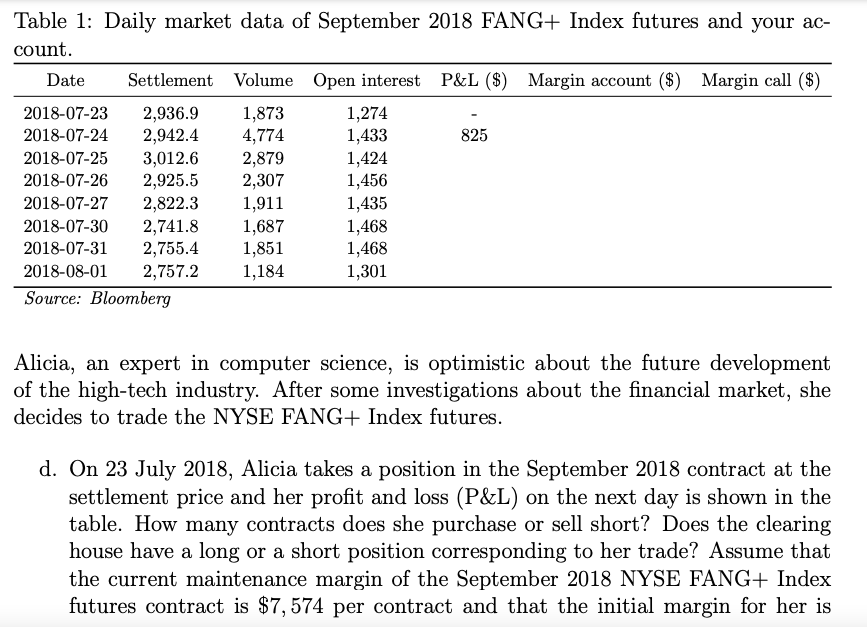

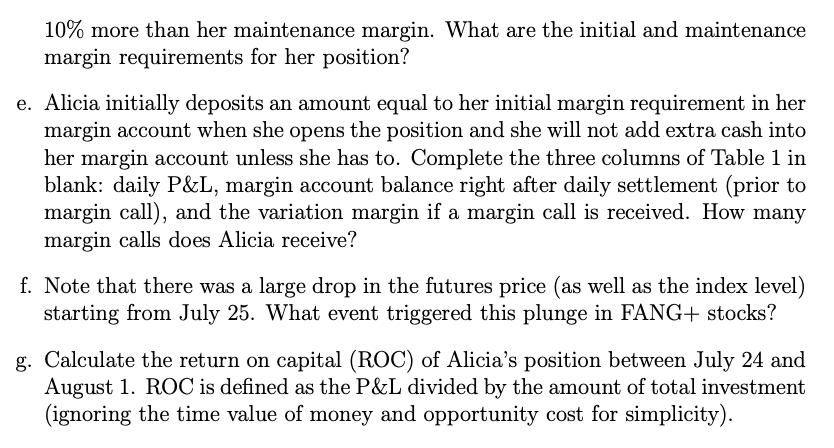

Table 1: Daily market data of September 2018 FANG+ Index futures and your ac- count. Date Settlement Volume Open interest P&L ($) Margin account ($) Margin call ($) 2018-07-23 2,936.9 1,873 1,274 2018-07-24 2,942.4 4,774 1,433 825 2018-07-25 3,012.6 2,879 1,424 2018-07-26 2,925.5 2,307 1,456 2018-07-27 2,822.3 1,911 1,435 2018-07-30 2,741.8 1,687 1,468 2018-07-31 2,755.4 1,851 1,468 2018-08-01 2,757.2 1,184 1,301 Source: Bloomberg Alicia, an expert in computer science, is optimistic about the future development of the high-tech industry. After some investigations about the financial market, she decides to trade the NYSE FANG+ Index futures. d. On 23 July 2018, Alicia takes a position in the September 2018 contract at the settlement price and her profit and loss (P&L) on the next day is shown in the table. How many contracts does she purchase or sell short? Does the clearing house have a long or a short position corresponding to her trade? Assume that the current maintenance margin of the September 2018 NYSE FANG+ Index futures contract is $7,574 per contract and that the initial margin for her is 10% more than her maintenance margin. What are the initial and maintenance margin requirements for her position? e. Alicia initially deposits an amount equal to her initial margin requirement in her margin account when she opens the position and she will not add extra cash into her margin account unless she has to. Complete the three columns of Table 1 in blank: daily P&L, margin account balance right after daily settlement (prior to margin call), and the variation margin if a margin call is received. How many margin calls does Alicia receive? f. Note that there was a large drop in the futures price (as well as the index level) starting from July 25. What event triggered this plunge in FANG+ stocks? g. Calculate the return on capital (ROC) of Alicia's position between July 24 and August 1. ROC is defined as the P&L divided by the amount of total investment (ignoring the time value of money and opportunity cost for simplicity). Table 1: Daily market data of September 2018 FANG+ Index futures and your ac- count. Date Settlement Volume Open interest P&L ($) Margin account ($) Margin call ($) 2018-07-23 2,936.9 1,873 1,274 2018-07-24 2,942.4 4,774 1,433 825 2018-07-25 3,012.6 2,879 1,424 2018-07-26 2,925.5 2,307 1,456 2018-07-27 2,822.3 1,911 1,435 2018-07-30 2,741.8 1,687 1,468 2018-07-31 2,755.4 1,851 1,468 2018-08-01 2,757.2 1,184 1,301 Source: Bloomberg Alicia, an expert in computer science, is optimistic about the future development of the high-tech industry. After some investigations about the financial market, she decides to trade the NYSE FANG+ Index futures. d. On 23 July 2018, Alicia takes a position in the September 2018 contract at the settlement price and her profit and loss (P&L) on the next day is shown in the table. How many contracts does she purchase or sell short? Does the clearing house have a long or a short position corresponding to her trade? Assume that the current maintenance margin of the September 2018 NYSE FANG+ Index futures contract is $7,574 per contract and that the initial margin for her is 10% more than her maintenance margin. What are the initial and maintenance margin requirements for her position? e. Alicia initially deposits an amount equal to her initial margin requirement in her margin account when she opens the position and she will not add extra cash into her margin account unless she has to. Complete the three columns of Table 1 in blank: daily P&L, margin account balance right after daily settlement (prior to margin call), and the variation margin if a margin call is received. How many margin calls does Alicia receive? f. Note that there was a large drop in the futures price (as well as the index level) starting from July 25. What event triggered this plunge in FANG+ stocks? g. Calculate the return on capital (ROC) of Alicia's position between July 24 and August 1. ROC is defined as the P&L divided by the amount of total investment (ignoring the time value of money and opportunity cost for simplicity)