Answered step by step

Verified Expert Solution

Question

1 Approved Answer

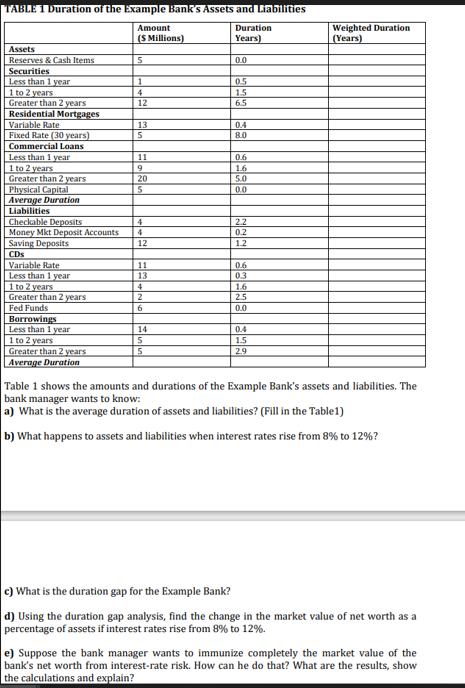

TABLE 1 Duration of the Example Bank's Assets and Liabilities Duration Years) Assets Reserves & Cash Items Securities Less than 1 year 1 to

TABLE 1 Duration of the Example Bank's Assets and Liabilities Duration Years) Assets Reserves & Cash Items Securities Less than 1 year 1 to 2 years Greater than 2 years Residential Mortgages Variable Rate Fixed Rate (30 years) Commercial Loans Less than 1 year 1 to 2 years Greater than 2 years Physical Capital Average Duration Liabilities Checkable Deposits Money Mkt Deposit Accounts Saving Deposits CDs Variable Rate Less than 1 year 1 to 2 years Greater than 2 years Fed Funds Borrowings Less than 1 year 1 to 2 years Greater than 2 years Average Duration Amount (S Millions) 5 1 4 12 13 5 11 9 20 5 4 4 12 11 13 4 2 6 14 5 5 | | | | |/|| 0.4 1.5 2.9 Weighted Duration (Years) Table 1 shows the amounts and durations of the Example Bank's assets and liabilities. The bank manager wants to know: a) What is the average duration of assets and liabilities? (Fill in the Table1) b) What happens to assets and liabilities when interest rates rise from 8% to 12%? c) What is the duration gap for the Example Bank? d) Using the duration gap analysis, find the change in the market value of net worth as a percentage of assets if interest rates rise from 8% to 12%. e) Suppose the bank manager wants to immunize completely the market value of the bank's net worth from interest-rate risk. How can he do that? What are the results, show the calculations and explain?

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Average duration of assets and liabilities To calculate the average duration of assets and liabilities we need to multiply the duration of each asset and liability by its corresponding amount and th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started