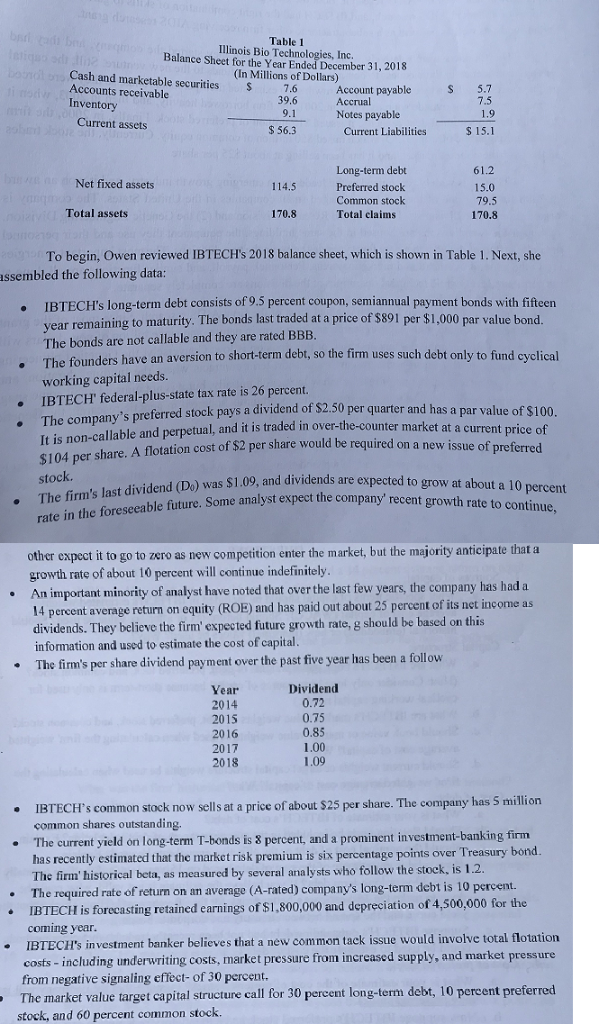

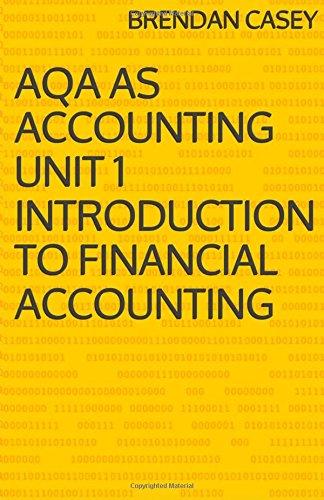

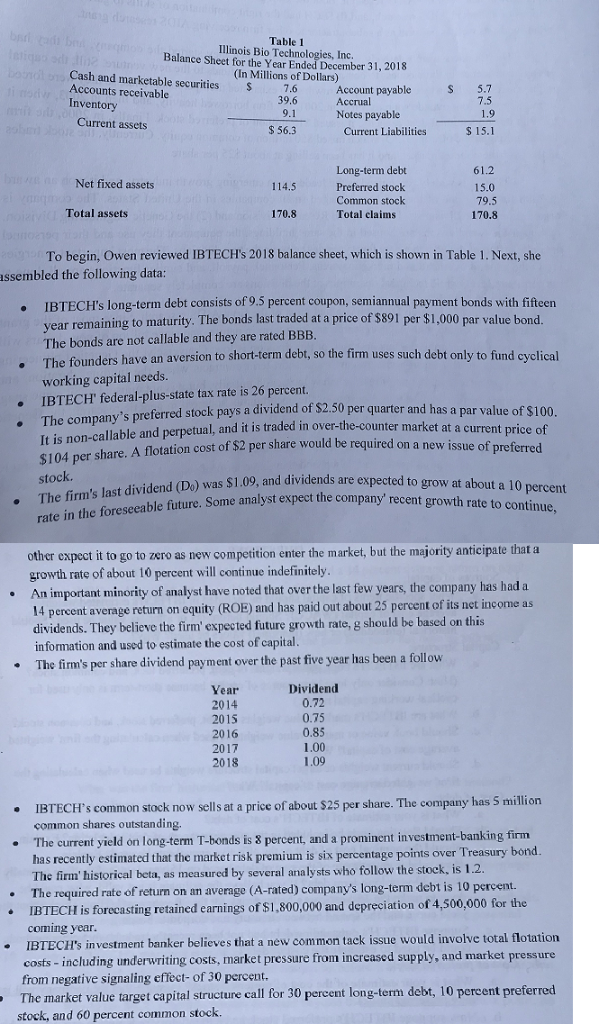

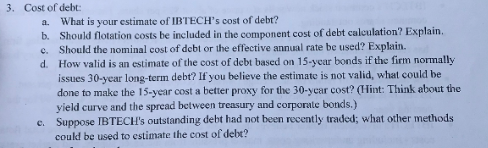

Table 1 Illinois Bio Technologies, Inc. Balance Sheet for the Year Ended December 31, 2018 Cash and marketable securities S7.6 Accounts receivable (In Millions of Dollars) Account payable Accrual Inv 9.1 Notes payable $56.3 Current assets Current Liabilities Long-term debt Preferred stock Common stock Total claims 61.2 Net fixed assets 114.5 79.5 170.8 Total assets 170.8 To begin, Owen reviewed IBTECH's 2018 balance sheet, which is shown in Table 1. Next, she assembled the following data: IBTECH's long-term debt consists of 9.5 percent coupon, semiannual payment bonds with fifteen year remai The bonds are not callable and they are rated BBB. The founders have an aversion to working capital needs ning to maturity. The bonds last traded at a price of $891 per $1,000 par value bond. short-term debt, so the firm uses such debt only to fund cyclical . IBTECH' federal-plus-state tax rate is 26 percent. . The company's referred stock pays a dividend of $2.50 per quarter and has a par value of $100 lable and perpetual, and it is traded in over-the-counter market at a current price of issue of preferred $104 per share. A flotation cost of $2 per share would be required on a new was $1.09, and dividends are expected to grow at about a 10 percent e analyst expect the compan' recent growth rate to continue, the rate in the foreseeable future. Some other expect it to go to zero as new competition enter the market, but the majority anticipate that a growth rate of about 10 percent will continue indefinitel An important minority of analyst have noted that over the last few years, the company has had a 14 percent average return on equity (ROE) and has paid out about 25 percent of its net income as dividends. They believe the firm' expected future growth rate, g should be based on this information and used to estimate the cost of capital The firm's per share dividend payment over the past five year has been a follow Dividend Year 2014 2015 2016 2017 2018 0.75 0.85 IBTECH's common stock now sells at a price of about $25 per share. The company has S million common shares outstanding. The current yield on long-term T-bonds is 8 percent, and a prominent investment-ba king firm . has recently estimated that the market risk premium is six percentage points over Treasury bond The e firm' historical beta, as measured by several analy sts who follow the stock, is 1.2. The required rate of return on an average (A-rated) company's long-term debt is 10 percent. IBTECH is forecasting retained earnings of $1,800,000 and depreciation of 4,500,000 for the coming year. IBTECH's in vestment banker believes that a new common tack issue would involve total flotation costs - including underwriting costs, market pressure from increased supply, and market pressure from negative signaling effect- of 30 percent. The market value target capital structure call for 30 percent long-term debt, 10 percent preferred stock, and 60 percent common stock. 3. Cost of debt a. b. c. d. What is your cstimate of IBTECH's cost of debt? Should flotation costs be included in the component cost of debt calculation? Explain. Should the nominal cost of debt or the effective annual rate be used? Explain. How valid is an estimate of the cost of debt based on 15-year bonds if the firm normally issues 30-year long-term debt? If you believe the estimate is not valid, what could be done to make the 15-year cost a better proxy for the 30-ycar cost? (Hint: Think about the yield curve and the spread between treasury and corporate bonds.) Suppose IBTECH's outstanding debt had not been recently traded; what other methods could be used to estimate the cost of debt? c. Table 1 Illinois Bio Technologies, Inc. Balance Sheet for the Year Ended December 31, 2018 Cash and marketable securities S7.6 Accounts receivable (In Millions of Dollars) Account payable Accrual Inv 9.1 Notes payable $56.3 Current assets Current Liabilities Long-term debt Preferred stock Common stock Total claims 61.2 Net fixed assets 114.5 79.5 170.8 Total assets 170.8 To begin, Owen reviewed IBTECH's 2018 balance sheet, which is shown in Table 1. Next, she assembled the following data: IBTECH's long-term debt consists of 9.5 percent coupon, semiannual payment bonds with fifteen year remai The bonds are not callable and they are rated BBB. The founders have an aversion to working capital needs ning to maturity. The bonds last traded at a price of $891 per $1,000 par value bond. short-term debt, so the firm uses such debt only to fund cyclical . IBTECH' federal-plus-state tax rate is 26 percent. . The company's referred stock pays a dividend of $2.50 per quarter and has a par value of $100 lable and perpetual, and it is traded in over-the-counter market at a current price of issue of preferred $104 per share. A flotation cost of $2 per share would be required on a new was $1.09, and dividends are expected to grow at about a 10 percent e analyst expect the compan' recent growth rate to continue, the rate in the foreseeable future. Some other expect it to go to zero as new competition enter the market, but the majority anticipate that a growth rate of about 10 percent will continue indefinitel An important minority of analyst have noted that over the last few years, the company has had a 14 percent average return on equity (ROE) and has paid out about 25 percent of its net income as dividends. They believe the firm' expected future growth rate, g should be based on this information and used to estimate the cost of capital The firm's per share dividend payment over the past five year has been a follow Dividend Year 2014 2015 2016 2017 2018 0.75 0.85 IBTECH's common stock now sells at a price of about $25 per share. The company has S million common shares outstanding. The current yield on long-term T-bonds is 8 percent, and a prominent investment-ba king firm . has recently estimated that the market risk premium is six percentage points over Treasury bond The e firm' historical beta, as measured by several analy sts who follow the stock, is 1.2. The required rate of return on an average (A-rated) company's long-term debt is 10 percent. IBTECH is forecasting retained earnings of $1,800,000 and depreciation of 4,500,000 for the coming year. IBTECH's in vestment banker believes that a new common tack issue would involve total flotation costs - including underwriting costs, market pressure from increased supply, and market pressure from negative signaling effect- of 30 percent. The market value target capital structure call for 30 percent long-term debt, 10 percent preferred stock, and 60 percent common stock. 3. Cost of debt a. b. c. d. What is your cstimate of IBTECH's cost of debt? Should flotation costs be included in the component cost of debt calculation? Explain. Should the nominal cost of debt or the effective annual rate be used? Explain. How valid is an estimate of the cost of debt based on 15-year bonds if the firm normally issues 30-year long-term debt? If you believe the estimate is not valid, what could be done to make the 15-year cost a better proxy for the 30-ycar cost? (Hint: Think about the yield curve and the spread between treasury and corporate bonds.) Suppose IBTECH's outstanding debt had not been recently traded; what other methods could be used to estimate the cost of debt? c