Question

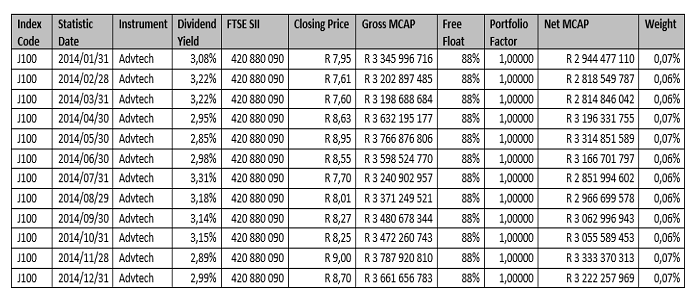

Table 1 QUESTION 1 The Advtech Group is a JSE listed company in South Africa. Advtech operates within the education and recruitment industries in South

Table 1

QUESTION 1

The Advtech Group is a JSE listed company in South Africa. Advtech operates within the education and recruitment industries in South Africa and the rest of Africa.JSE 100 is an index on the Johannesburg Stock Exchange, Advtech is a constituent of JSE100 its weight in the index is given in table 1 above.

1.1 Consider an investor with a portfolio consisting only of Advtech shares. The Treasury bill rate in 2014 was 3.06% in South Africa. Using dividend yield as (returns). Calculate the Sharpe ratio for Advtech.

1.2 Calculate the capital gains for an investor who bought Advtech Shares on 2 January 2014 and held the shares until 31 December 2014

1.3 Consider an investor with a portfolio consisting only of Advtech shares. Calculate the Treynor ratio given that the beta of Advtech is 0.8

1.4 Consider an investor with a portfolio consisting only of Advtech shares Given that the J100 market index was 3%. Calculate the Jensen alpha given that Advtech beta is 0.

1.5 Calculate the expected return of a portfolio consisting of 40% treasury bills and 60% Advtech shares. Given that the Treasury bill rate is 3.06%.

Revenue grew 11% in the year to end-December 2018, but the private education group Advtech warns that trading conditions in SA remain tough. The groups student base grew 11% in the year to end-December, but the company noted this was primarily due to its expansion strategy. Tough trading conditions had prompted a drop-off of upfront fee payments from parents, who were also increasingly delaying payments. The results were somewhat lacklustre, and enrolment growth had been subdued for both AdvTech and its rival Curro over the past 18 months, said Mergence Investment Managers equity analyst Nolwandle Mthombeni. AdvTech said on Monday that operating profit in the year to end-December rose a healthy 14% to R763m, boosted by a strong performance by the groups tertiary operations. Operating profit from its university segment grew 23% to R395m and group revenue 11% to R4.4bn to end-December. Operating profit from its schools' division inched up 1% year on year. The company decreased its dividend 12% to 30c compared with the corresponding period in 2017, noting that it was seeking to preserve cash due to its expansion strategy.

| 2021 Forecast State | Probability | Advtech | Treasury bills |

| Boom | 0,3 | 0,18 | 0,07 |

| Normal | 0,5 | 0,14 | 0,05 |

| Recession | 0,2 | 0,09 | 0,03 |

In light of this background calculate the expected return in 2021 of a portfolio consisting of 40% invested in treasury bills and 60% in Advtech shares.

Closing Price Gross MCAP Weight Index Code J100 1100 J100 J100 J100 1100 J100 J100 Statistic Instrument Dividend FTSE SII Date Yield 2014/01/31 Advtech 3,08% 420 880 090 2014/02/28 Advtech 3,22% 420 880 090 2014/03/31 Advtech 3,22% 420 880 090 2014/04/30 Advtech 2,95% 420 880 090 2014/05/30 Advtech 2,85% 420 880 090 2014/06/30 Advtech 2,98% 420 880 090 2014/07/31 Advtech 3,31% 420 880 090 2014/08/29 Advtech 3,18% 420 880 090 2014/09/30 Advtech 3,14% 420 880 090 2014/10/31 Advtech 3,15% 420 880 090 2014/11/28 Advtech 2,89% 420 880 090 2014/12/31 Advtech 2,99% 420 880 090 R7,95 R3 345 996 716 R7,61 R3 202 897 485 R7,60 R3 198 688 684 R8,63 R3 632 195 177 R8,95 R3 766 876 806 R 8,55 R3 598 524 770 R 7,70 R 3 240 902 957 R8,01 R3 371 249 521 R8,27 R3 480 678 344 R 8,25 R3 472 260 743 R 9,00 R 3 787 920 810 R8,70 R3 661 656 783 Free Portfolio Net MCAP Float Factor 88% 1,00000 R 2 944 477 110 88% 1,00000 R2 818 549 787 88% 1,00000 R 2 814 846 042 88% 1,00000 R3 196 331 755 88% 1,00000 R3 314 851 589 88% 1,00000 R3 166 701 797 88% 1,00000 R 2 851 994 602 88% 1,00000 R 2 966 699 578 88% 1,00000 R3 062 996 943 88% 1,00000 R 3 055 589 453 88% 1,00000 R 3 333 370 313 88% 1,00000 R3 222 257 969 0,07% 0,06% 0,06% 0,07% 0,07% 0,06% 0,06% 0,06% 0,06% 0,06% 0,07% 0,07% J100 J100 J100 J100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started