Answered step by step

Verified Expert Solution

Question

1 Approved Answer

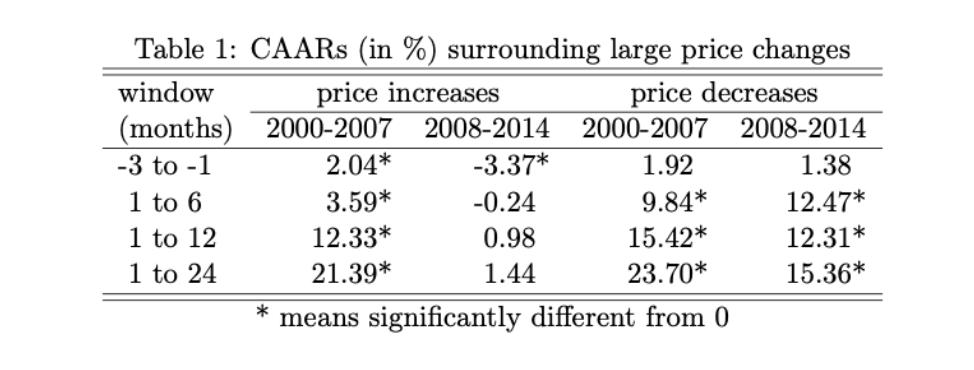

Table 1 shows cumulative average abnormal returns (CAARs) before and after the event months (which is month 0) and in two sub-periods(2000-2007 and 2008-2014). Can

Table 1 shows cumulative average abnormal returns (CAARs) before and after the event months (which is month 0) and in two sub-periods(2000-2007 and 2008-2014).

Can someone explain to me how to see why the data show that the efficient market hypothesis is being contradicted? As I understand it is based on an underreaction and overreaction to the market, but how can I interpret the table to see that the EMH is contradicted?

Table 1: CAARs (in %) surrounding large price changes window (months) -3 to -1 1 to 6 1 to 12 1 to 24 price increases 2000-2007 2.04* 3.59* 12.33* 21.39* price decreases 2008-2014 2000-2007 2008-2014 -3.37* -0.24 0.98 1.44 1.92 9.84* 15.42* 23.70* * means significantly different from 0 1.38 12.47* 12.31* 15.36*

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

An important debate among investors is whether the stock market is efficientthat is whether it reflects all the information made available to market participants at any given time The efficient market ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started