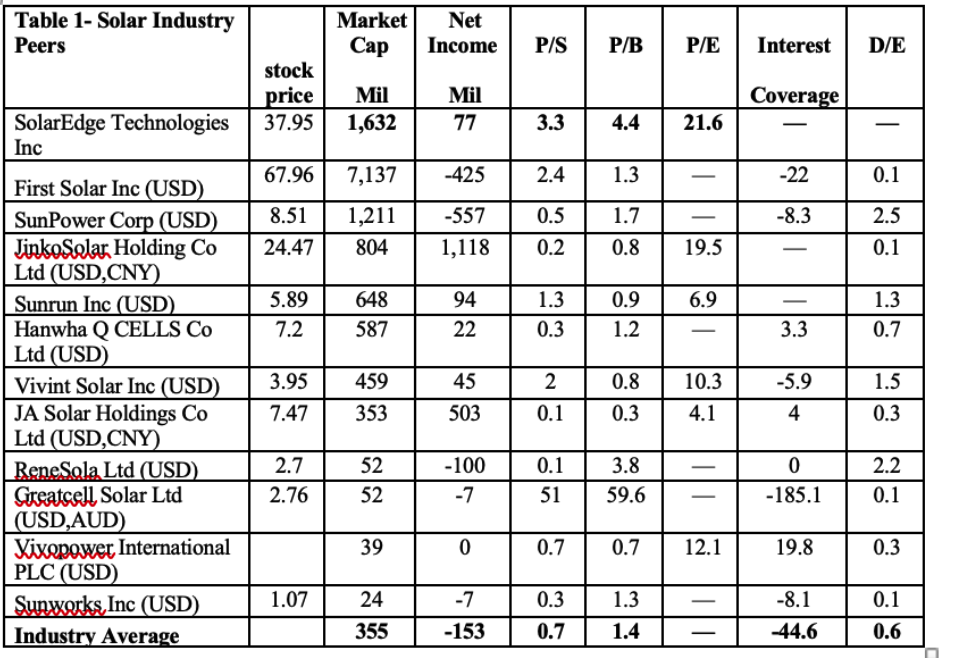

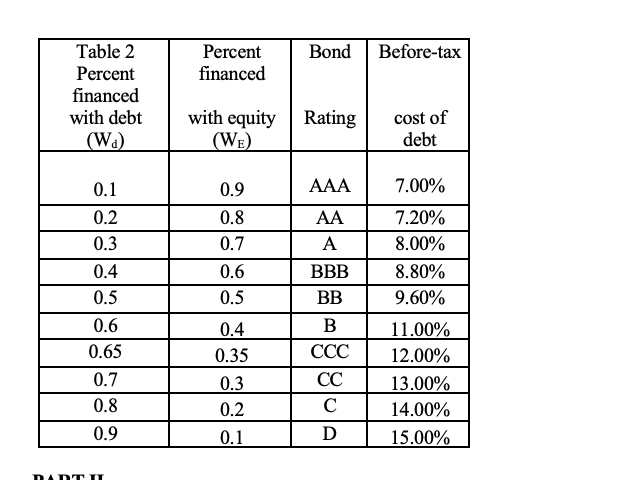

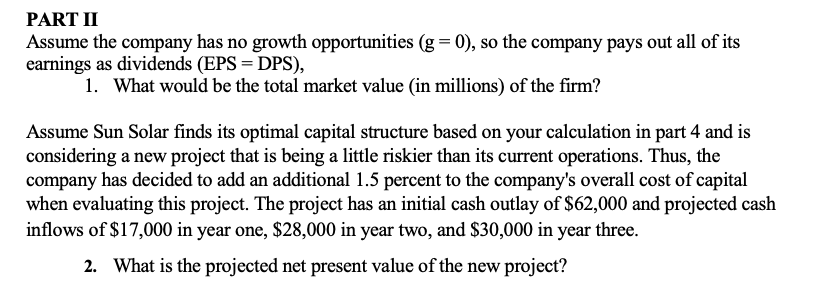

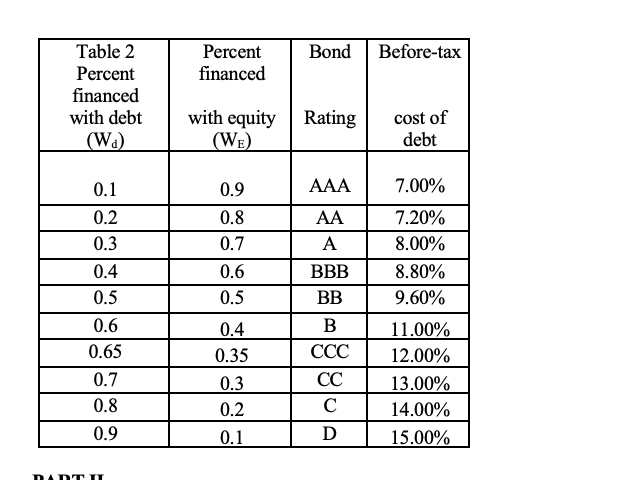

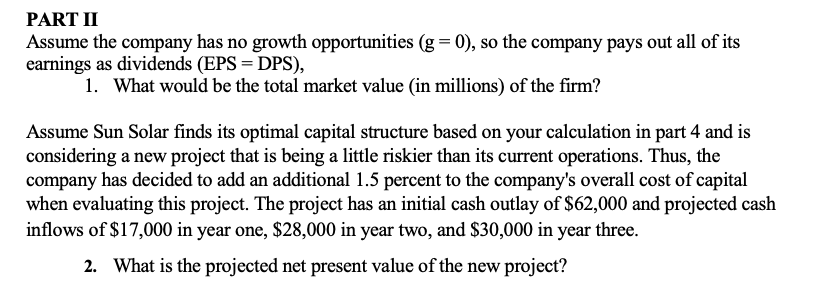

Table 1- Solar Industry Peers Market Cap Net Income P/S P/B P/E Interest D/E stock price 37.95 Mil 1,632 Mil 77 Coverage 3.3 4.4 21.6 SolarEdge Technologies Inc 67.96 7,137 -425 2.4 1.3 -22 0.1 || 5 35 | 0.5 1.7 -8.3 8.51 24.47 1,211 804 -557 1,118 2.5 0.1 0.2 0.8 19.5 94 1.3 6.9 1.3 5.89 7.2 648 587 0.9 1.2 22 0.3 3.3 0.7 459 45 2 0.8 10.3 -5.9 First Solar Inc (USD) SunPower Corp (USD) JinkoSolar Holding Co Ltd (USD,CNY) Sunrun Inc (USD) Hanwha Q CELLS Co Ltd (USD) Vivint Solar Inc (USD) JA Solar Holdings Co Ltd (USD,CNY) ReneSola Ltd (USD) Greatcell Solar Ltd (USD,AUD) Xixopower International PLC (USD) Sunworks Inc (USD) Industry Average 3.95 7.47 1.5 0.3 353 503 0.1 0.3 4.1 4 -100 2.7 2.76 52 52 | 0.1 51 3.8 59.6 0 -185.1 2.2 0.1 -7 39 0 0.7 0.7 12.1 19.8 0.3 1.07 24 -7 0.3 -8.1 0.1 1.3 1.4 355 -153 0.7 44.6 0.6 Percent financed Bond Before-tax Table 2 Percent financed with debt (W) with equity (WE) Rating cost of debt AAA 7.00% 0.1 0.2 0.3 0.4 0.5 0.6 0.65 0.9 0.8 0.7 0.6 0.5 AA A BBB BB 0.4 0.35 0.3 0.2 0.1 B CC 7.20% 8.00% 8.80% 9.60% 11.00% 12.00% 13.00% 14.00% 15.00% 0.7 0.8 0.9 D DATT TT PART II Assume the company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends (EPS = DPS), 1. What would be the total market value (in millions) of the firm? Assume Sun Solar finds its optimal capital structure based on your calculation in part 4 and is considering a new project that is being a little riskier than its current operations. Thus, the company has decided to add an additional 1.5 percent to the company's overall cost of capital when evaluating this project. The project has an initial cash outlay of $62,000 and projected cash inflows of $17,000 in year one, $28,000 in year two, and $30,000 in year three. 2. What is the projected net present value of the new project? Table 1- Solar Industry Peers Market Cap Net Income P/S P/B P/E Interest D/E stock price 37.95 Mil 1,632 Mil 77 Coverage 3.3 4.4 21.6 SolarEdge Technologies Inc 67.96 7,137 -425 2.4 1.3 -22 0.1 || 5 35 | 0.5 1.7 -8.3 8.51 24.47 1,211 804 -557 1,118 2.5 0.1 0.2 0.8 19.5 94 1.3 6.9 1.3 5.89 7.2 648 587 0.9 1.2 22 0.3 3.3 0.7 459 45 2 0.8 10.3 -5.9 First Solar Inc (USD) SunPower Corp (USD) JinkoSolar Holding Co Ltd (USD,CNY) Sunrun Inc (USD) Hanwha Q CELLS Co Ltd (USD) Vivint Solar Inc (USD) JA Solar Holdings Co Ltd (USD,CNY) ReneSola Ltd (USD) Greatcell Solar Ltd (USD,AUD) Xixopower International PLC (USD) Sunworks Inc (USD) Industry Average 3.95 7.47 1.5 0.3 353 503 0.1 0.3 4.1 4 -100 2.7 2.76 52 52 | 0.1 51 3.8 59.6 0 -185.1 2.2 0.1 -7 39 0 0.7 0.7 12.1 19.8 0.3 1.07 24 -7 0.3 -8.1 0.1 1.3 1.4 355 -153 0.7 44.6 0.6 Percent financed Bond Before-tax Table 2 Percent financed with debt (W) with equity (WE) Rating cost of debt AAA 7.00% 0.1 0.2 0.3 0.4 0.5 0.6 0.65 0.9 0.8 0.7 0.6 0.5 AA A BBB BB 0.4 0.35 0.3 0.2 0.1 B CC 7.20% 8.00% 8.80% 9.60% 11.00% 12.00% 13.00% 14.00% 15.00% 0.7 0.8 0.9 D DATT TT PART II Assume the company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends (EPS = DPS), 1. What would be the total market value (in millions) of the firm? Assume Sun Solar finds its optimal capital structure based on your calculation in part 4 and is considering a new project that is being a little riskier than its current operations. Thus, the company has decided to add an additional 1.5 percent to the company's overall cost of capital when evaluating this project. The project has an initial cash outlay of $62,000 and projected cash inflows of $17,000 in year one, $28,000 in year two, and $30,000 in year three. 2. What is the projected net present value of the new project