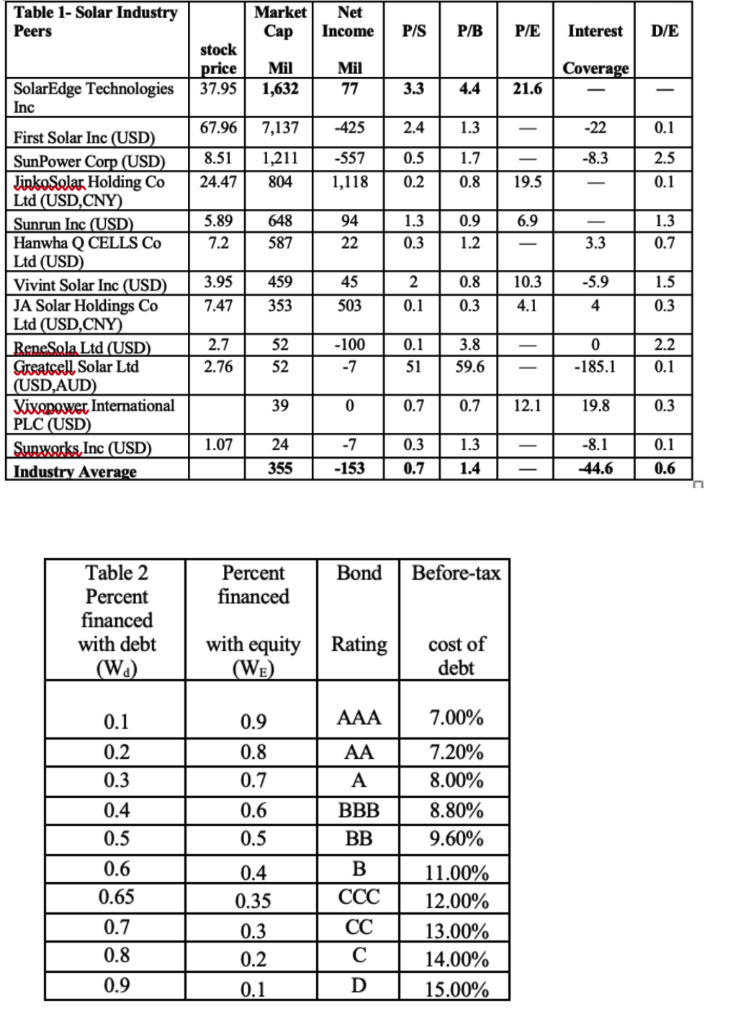

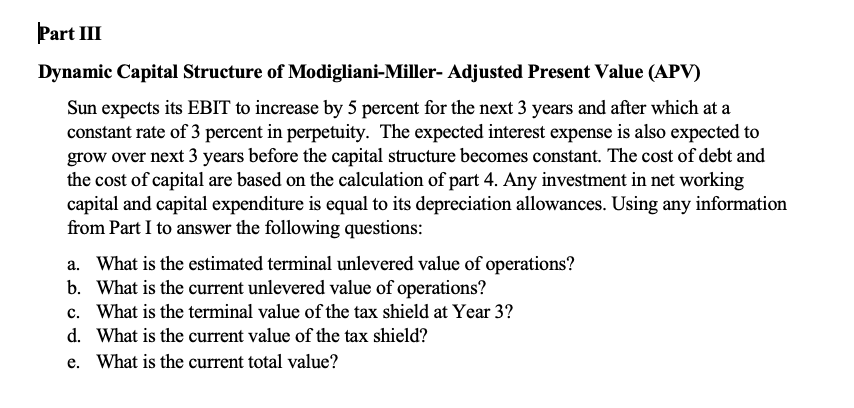

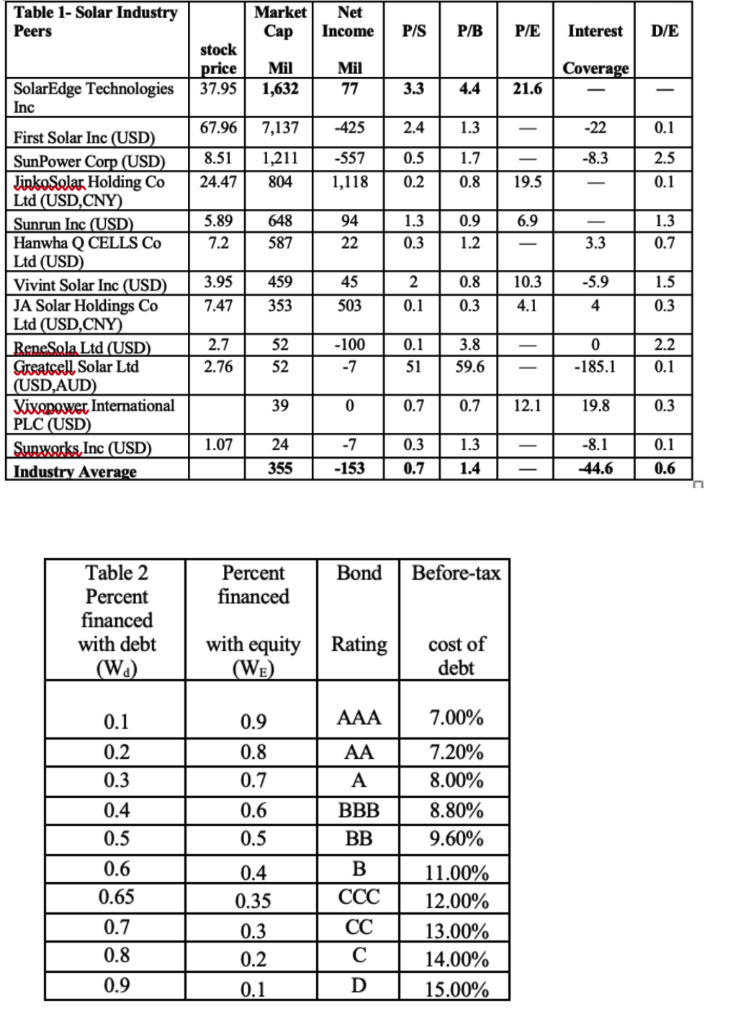

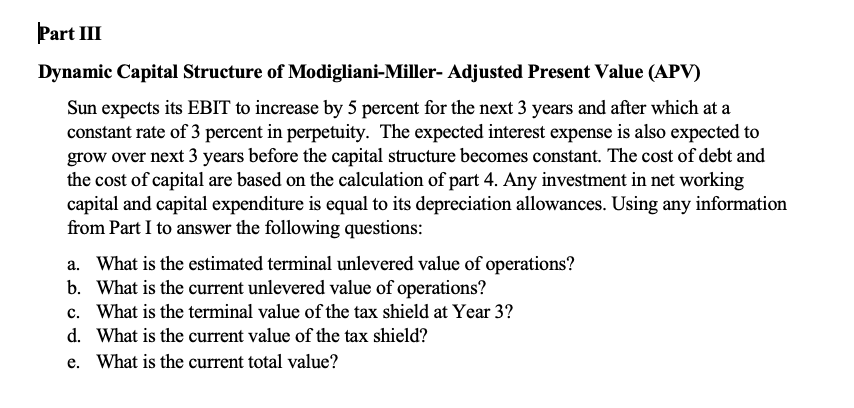

Table 1- Solar Industry Peers Market Cap Net Income P/S P/B P/E Interest D/E stock price 37.95 Coverage Mil 1,632 Mil 77 3.3 SolarEdge Technologies Inc 4.4 21.6 67.96 7,137 -425 2.4 1.3 -22 0.1 8.51 -8.3 1,211 804 -557 1,118 0.5 0.2 1.7 0.8 2.5 0.1 24.47 19.5 6.9 5.89 7.2 648 587 94 22 1.3 0.3 0.9 1.2 1.3 0.7 3.3 2 0.8 First Solar Inc (USD) SunPower Corp (USD) JinkoSolar Holding Co Ltd (USD,CNY) Sunrun Inc (USD) Hanwha Q CELLS Co Ltd (USD) Vivint Solar Inc (USD) JA Solar Holdings Co Ltd (USD, CNY) ReneSola Ltd (USD) Greatcell Solar Ltd (USD,AUD) Xixopower International PLC (USD) Sunworks, Inc (USD) Industry Average 3.95 7.47 459 353 45 503 10.3 4.1 -5.9 4 1.5 0.3 0.1 0.3 2.7 2.76 52 52 -100 -7 0.1 51 3.8 59.6 0 -185.1 2.2 0.1 39 0 0.7 0.7 12.1 19.8 0.3 1.07 0.1 24 355 -7 -153 0.3 0.7 1.3 1.4 -8.1 44.6 0.6 Bond Before-tax Percent financed Table 2 Percent financed with debt (W) with equity (We) Rating cost of debt AAA 7.00% 0.9 0.8 0.7 0.1 0.2 0.3 0.4 0.5 0.6 0.65 0.7 0.8 0.6 0.5 0.4 0.35 AA A BBB BB B CC D 7.20% 8.00% 8.80% 9.60% 11.00% 12.00% 13.00% 14.00% 15.00% 0.3 0.2 0.1 0.9 Part III Dynamic Capital Structure of Modigliani-Miller- Adjusted Present Value (APV) Sun expects its EBIT to increase by 5 percent for the next 3 years and after which at a constant rate of 3 percent in perpetuity. The expected interest expense is also expected to grow over next 3 years before the capital structure becomes constant. The cost of debt and the cost of capital are based on the calculation of part 4. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. Using any information from Part I to answer the following questions: a. What is the estimated terminal unlevered value of operations? b. What is the current unlevered value of operations? c. What is the terminal value of the tax shield at Year 3? d. What is the current value of the tax shield? e. What is the current total value? Table 1- Solar Industry Peers Market Cap Net Income P/S P/B P/E Interest D/E stock price 37.95 Coverage Mil 1,632 Mil 77 3.3 SolarEdge Technologies Inc 4.4 21.6 67.96 7,137 -425 2.4 1.3 -22 0.1 8.51 -8.3 1,211 804 -557 1,118 0.5 0.2 1.7 0.8 2.5 0.1 24.47 19.5 6.9 5.89 7.2 648 587 94 22 1.3 0.3 0.9 1.2 1.3 0.7 3.3 2 0.8 First Solar Inc (USD) SunPower Corp (USD) JinkoSolar Holding Co Ltd (USD,CNY) Sunrun Inc (USD) Hanwha Q CELLS Co Ltd (USD) Vivint Solar Inc (USD) JA Solar Holdings Co Ltd (USD, CNY) ReneSola Ltd (USD) Greatcell Solar Ltd (USD,AUD) Xixopower International PLC (USD) Sunworks, Inc (USD) Industry Average 3.95 7.47 459 353 45 503 10.3 4.1 -5.9 4 1.5 0.3 0.1 0.3 2.7 2.76 52 52 -100 -7 0.1 51 3.8 59.6 0 -185.1 2.2 0.1 39 0 0.7 0.7 12.1 19.8 0.3 1.07 0.1 24 355 -7 -153 0.3 0.7 1.3 1.4 -8.1 44.6 0.6 Bond Before-tax Percent financed Table 2 Percent financed with debt (W) with equity (We) Rating cost of debt AAA 7.00% 0.9 0.8 0.7 0.1 0.2 0.3 0.4 0.5 0.6 0.65 0.7 0.8 0.6 0.5 0.4 0.35 AA A BBB BB B CC D 7.20% 8.00% 8.80% 9.60% 11.00% 12.00% 13.00% 14.00% 15.00% 0.3 0.2 0.1 0.9 Part III Dynamic Capital Structure of Modigliani-Miller- Adjusted Present Value (APV) Sun expects its EBIT to increase by 5 percent for the next 3 years and after which at a constant rate of 3 percent in perpetuity. The expected interest expense is also expected to grow over next 3 years before the capital structure becomes constant. The cost of debt and the cost of capital are based on the calculation of part 4. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. Using any information from Part I to answer the following questions: a. What is the estimated terminal unlevered value of operations? b. What is the current unlevered value of operations? c. What is the terminal value of the tax shield at Year 3? d. What is the current value of the tax shield? e. What is the current total value