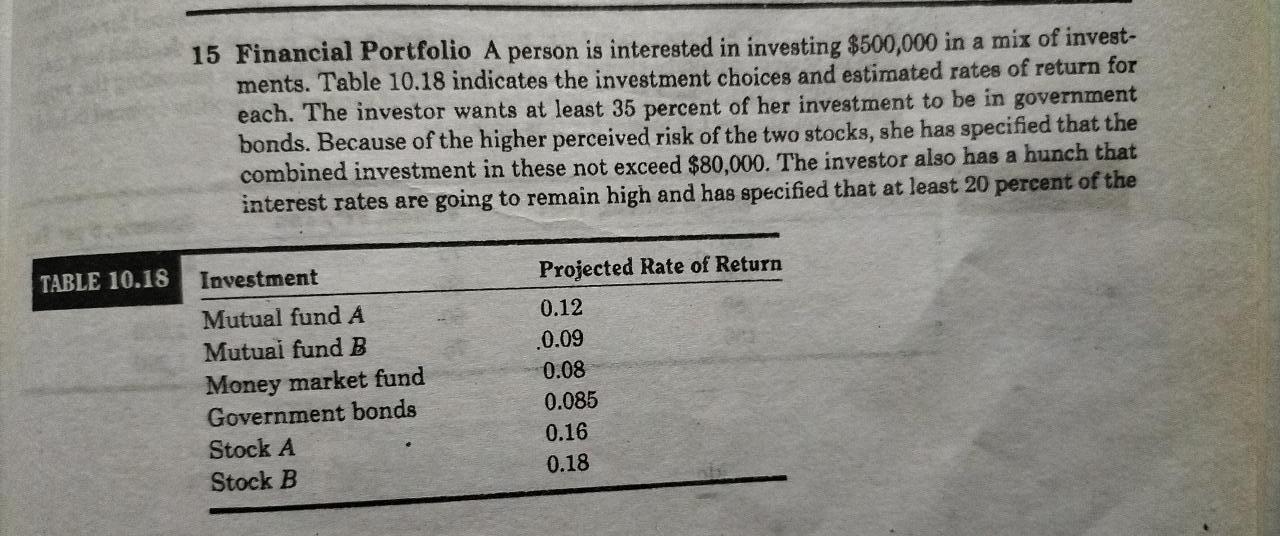

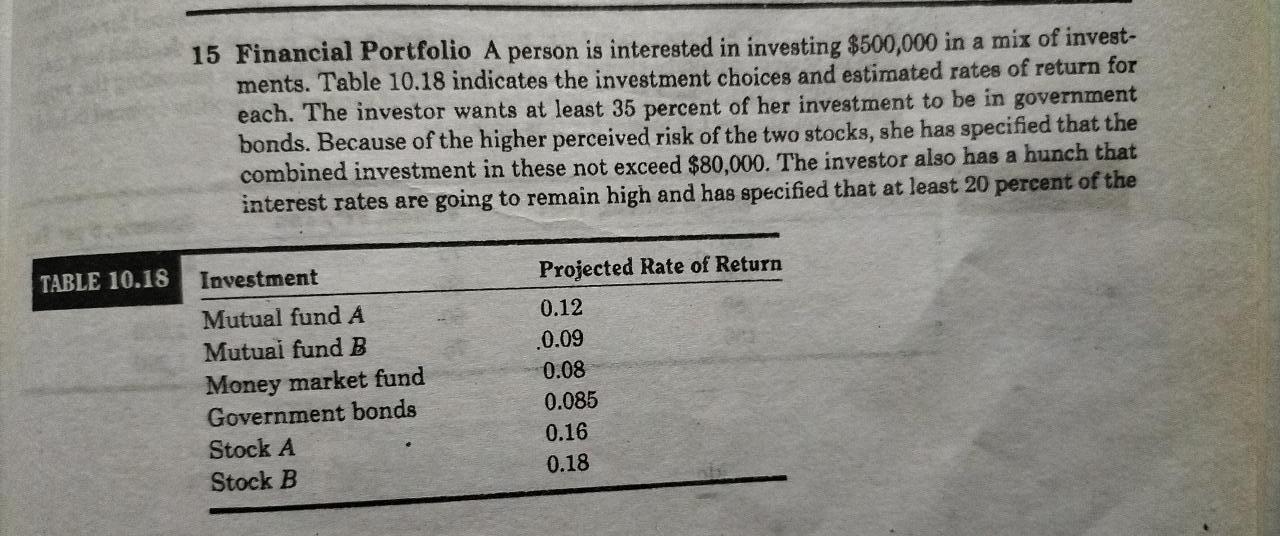

TABLE 10.18 15 Financial Portfolio A person is interested in investing $500,000 in a mix of invest- ments. Table 10.18 indicates the investment choices and estimated rates of return for each. The investor wants at least 35 percent of her investment to be in government bonds. Because of the higher perceived risk of the two stocks, she has specified that the combined investment in these not exceed $80,000. The investor also has a hunch that interest rates are going to remain high and has specified that at least 20 percent of the Investment Mutual fund A Mutual fund B Money market fund Government bonds Stock A Stock B Projected Rate of Return 0.12 0.09 0.08 0.085 0.16 0.18 investment should be in the money market fund. Her final investment condition is that the amount invested in mutual fund A should be no more than the amount invested in mutual fund B. The problem is to decide the amount of money to invest in each alterna- tive so as to maximize total annual return (in dollars). Carefully define your variables and formulate the LP model for this problem. TABLE 10.18 15 Financial Portfolio A person is interested in investing $500,000 in a mix of invest- ments. Table 10.18 indicates the investment choices and estimated rates of return for each. The investor wants at least 35 percent of her investment to be in government bonds. Because of the higher perceived risk of the two stocks, she has specified that the combined investment in these not exceed $80,000. The investor also has a hunch that interest rates are going to remain high and has specified that at least 20 percent of the Investment Mutual fund A Mutual fund B Money market fund Government bonds Stock A Stock B Projected Rate of Return 0.12 0.09 0.08 0.085 0.16 0.18 investment should be in the money market fund. Her final investment condition is that the amount invested in mutual fund A should be no more than the amount invested in mutual fund B. The problem is to decide the amount of money to invest in each alterna- tive so as to maximize total annual return (in dollars). Carefully define your variables and formulate the LP model for this