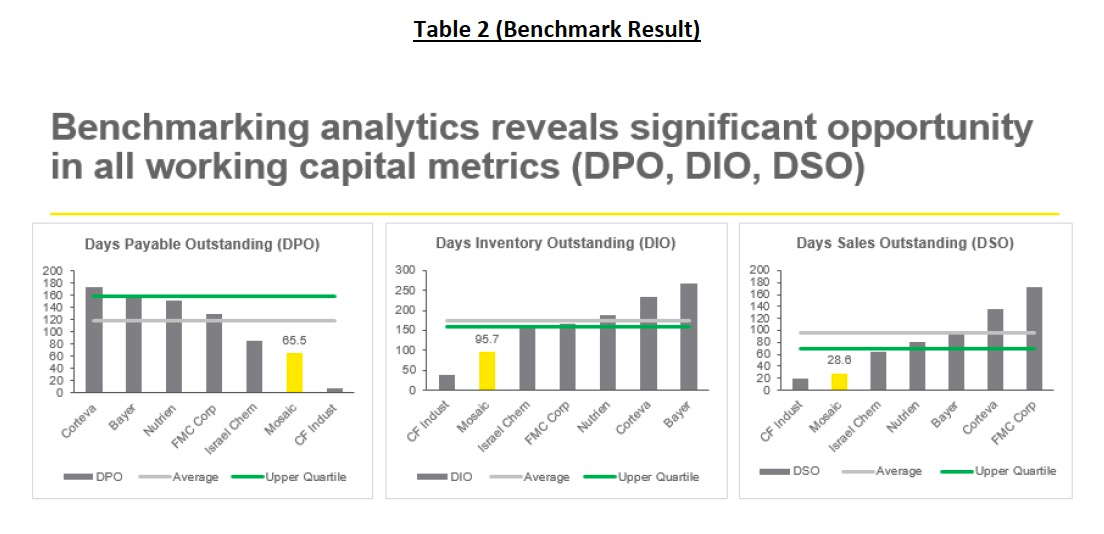

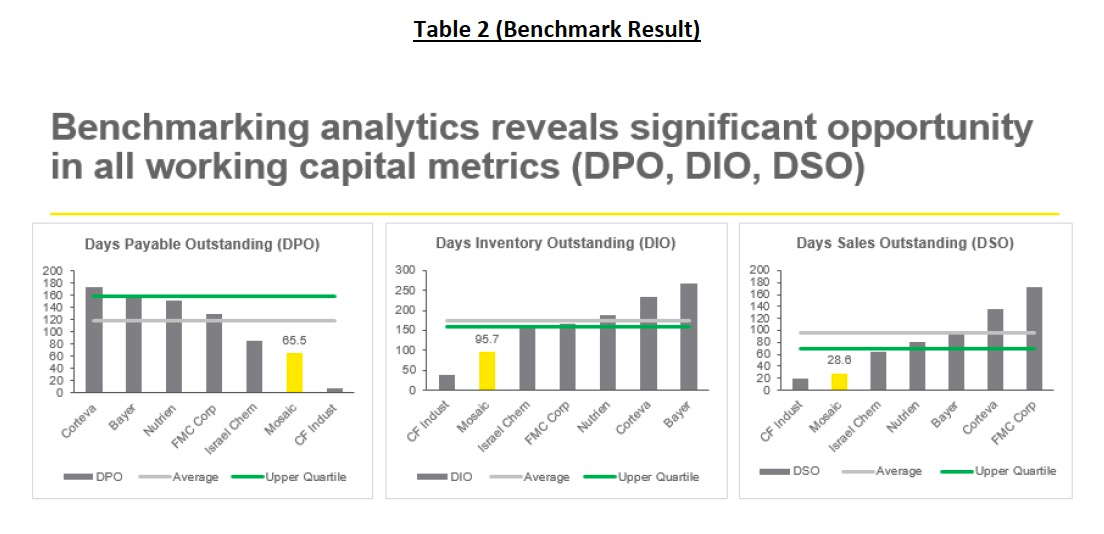

Table #2 is a working capital analysis of Mosaic by EY working capital advisory services team. Based on the benchmarking analytics of Mosaic working capital metrics in Table #2 comment on: a. Mosaic DPO b. Mosaic DIO C. Mosaic DSO d. What recommendation would you give to Mosaic based on your findings? As of 31-Dec-19, Mosaic Accounts Payable balance is $1.5B; and DPO = 66 days; average industry DPO is 118-days; and best in class (CF industry) DPO is 173 days. Calculate: e. How much more cash will Mosaic hold if they improve their DPO to average industry standard? f. How much savings will Mosaic realize if they improve their DPO to average industry standard assuming 8% cost of capital? As of 31-Dec-19, Mosaic Inventory balance was $2.0B; and DIO = 96 days; and best in class (CF industry) DIO is 39 days g. How much more cash will Mosaic hold if they improve their DIO to the best in-class (CF industry)? h. How much savings will Mosaic realize if they improve their DPO to the best in class (CF industry) assuming 8% cost of capital? As of 31-Dec-19, Mosaic Account receivable balance was $800M; and DSO = 29 days; and best in class (CF industry) DSO is 20 days i. How much more cash will Mosaic hold if they improve their DSO to the best in-class (CF industry)? j. How much savings will Mosaic realize if they improve their DPO to the best in class (CF industry) assuming 8% cost of capital? Table 2 (Benchmark Result) Benchmarking analytics reveals significant opportunity in all working capital metrics (DPO, DIO, DSO) Days Payable Outstanding (DPO) Days Inventory Outstanding (DIO) Days Sales Outstanding (DSO) 888888888 65.5 95.7 28.6 Corteva Bayer CF Indust Corteva Bayer Nutrien FMC Corp DPO - Israel Chem Mosaic CF Indust Average Mosaic Israel Chem FMC Corp Nutrien CF Indust Mosaic Israel Chem Upper Quartile DIO Average Upper Quartile DSO Nutrien Bayer Corteva FMC Corp - Average - -Upper Quartile Table #2 is a working capital analysis of Mosaic by EY working capital advisory services team. Based on the benchmarking analytics of Mosaic working capital metrics in Table #2 comment on: a. Mosaic DPO b. Mosaic DIO C. Mosaic DSO d. What recommendation would you give to Mosaic based on your findings? As of 31-Dec-19, Mosaic Accounts Payable balance is $1.5B; and DPO = 66 days; average industry DPO is 118-days; and best in class (CF industry) DPO is 173 days. Calculate: e. How much more cash will Mosaic hold if they improve their DPO to average industry standard? f. How much savings will Mosaic realize if they improve their DPO to average industry standard assuming 8% cost of capital? As of 31-Dec-19, Mosaic Inventory balance was $2.0B; and DIO = 96 days; and best in class (CF industry) DIO is 39 days g. How much more cash will Mosaic hold if they improve their DIO to the best in-class (CF industry)? h. How much savings will Mosaic realize if they improve their DPO to the best in class (CF industry) assuming 8% cost of capital? As of 31-Dec-19, Mosaic Account receivable balance was $800M; and DSO = 29 days; and best in class (CF industry) DSO is 20 days i. How much more cash will Mosaic hold if they improve their DSO to the best in-class (CF industry)? j. How much savings will Mosaic realize if they improve their DPO to the best in class (CF industry) assuming 8% cost of capital? Table 2 (Benchmark Result) Benchmarking analytics reveals significant opportunity in all working capital metrics (DPO, DIO, DSO) Days Payable Outstanding (DPO) Days Inventory Outstanding (DIO) Days Sales Outstanding (DSO) 888888888 65.5 95.7 28.6 Corteva Bayer CF Indust Corteva Bayer Nutrien FMC Corp DPO - Israel Chem Mosaic CF Indust Average Mosaic Israel Chem FMC Corp Nutrien CF Indust Mosaic Israel Chem Upper Quartile DIO Average Upper Quartile DSO Nutrien Bayer Corteva FMC Corp - Average - -Upper Quartile