Answered step by step

Verified Expert Solution

Question

1 Approved Answer

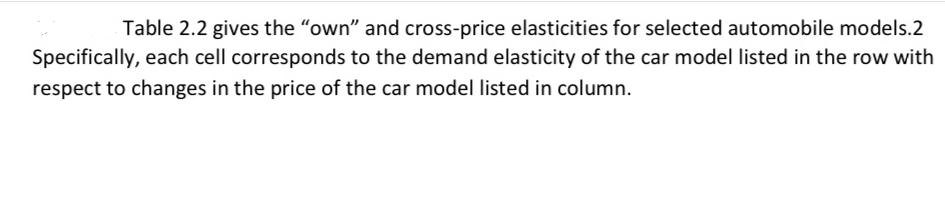

Table 2.2 gives the own and cross-price elasticities for selected automobile models.2 Specifically, each cell corresponds to the demand elasticity of the car model

Table 2.2 gives the "own" and cross-price elasticities for selected automobile models.2 Specifically, each cell corresponds to the demand elasticity of the car model listed in the row with respect to changes in the price of the car model listed in column. TABLE 2.2 Automobile demand elasticities Model Mazda 323 Cavalier Accord Taurus Century BMW 735i 323 -6.4 0.0 0.0 0.0 0.0 0.0 Cavalier 0.6 -6.4 0.1 0.1 0.1 0.0 Accord 0.2 0.2 -4.8 0.2 0.2 0.0 (a) Why are the "own" elasticities so high? (b) Are the Accord and Taurus complements or substitutes? (c) What are the Taurus's closest competitors? Taurus 0.1 0.1 0.1 -4.2 0.1 0.0 Century 0.0 0.1 0.0 0.0 -6.8 0.0 BMW 0.0 0.0 0.0 0.0 0.0 -3-5 (d) If GM lowers the price of its Chevy Cavalier, does it "cannibalize" its Buick Century sales? (e) Why is the direct elasticity for the Mazda not lower than the elasticity for more expensive models (as the rule of thumb would suggest)? (f) Suppose Honda sold 300k Accords in 2001. In 2002, the price of the Accord decreased by 2%, whereas the price of the Taurus decreased by 3%. What is the likely change in Accord sales?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Lets address each question a Why are the own elasticities so high Own elasticities measure the responsiveness of demand for a product to change...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started