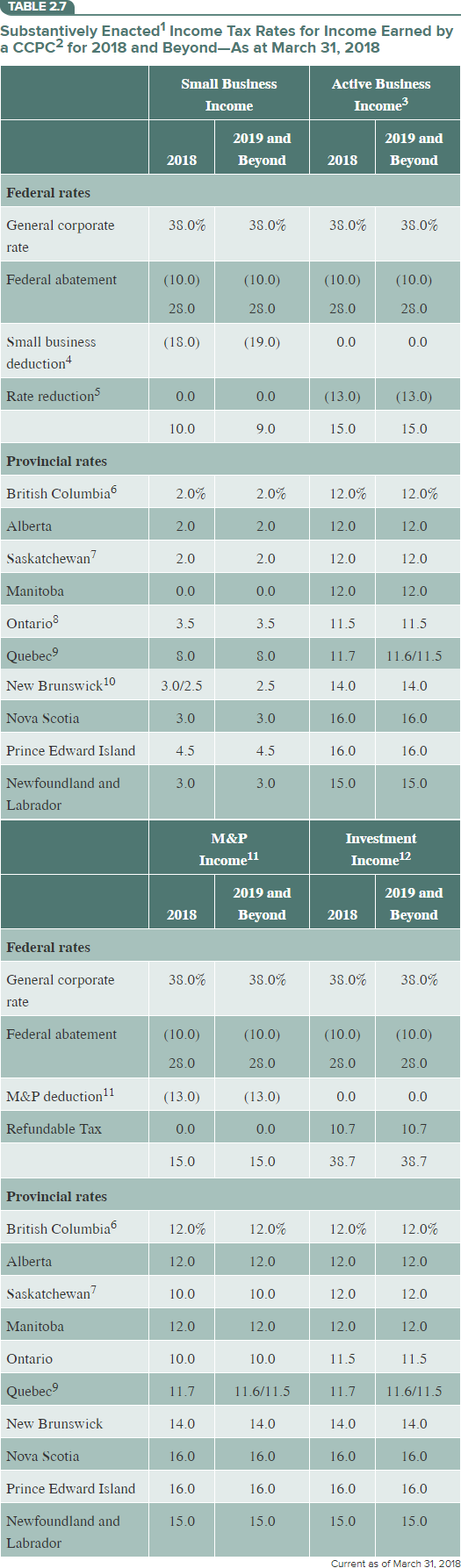

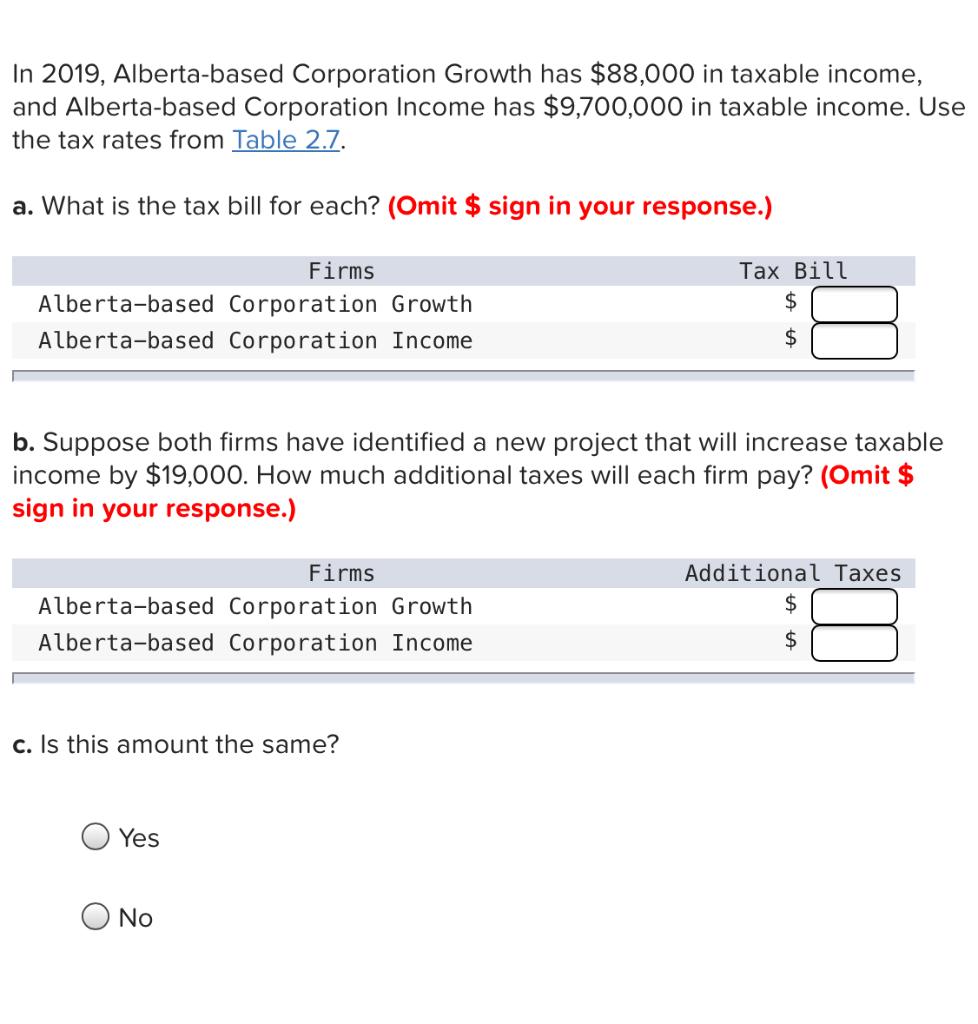

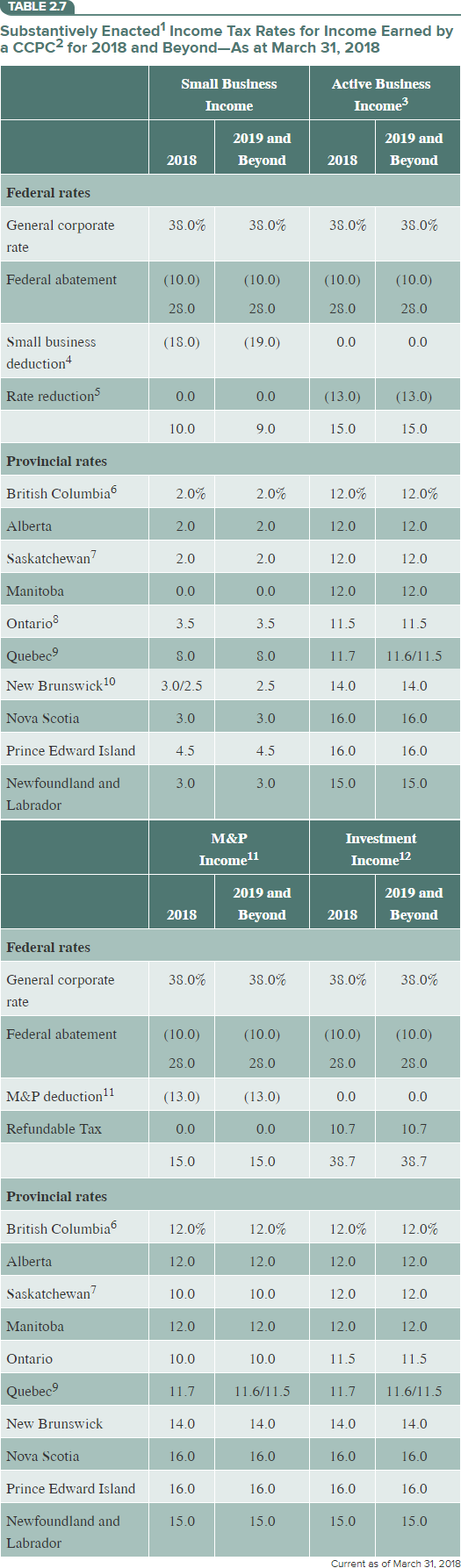

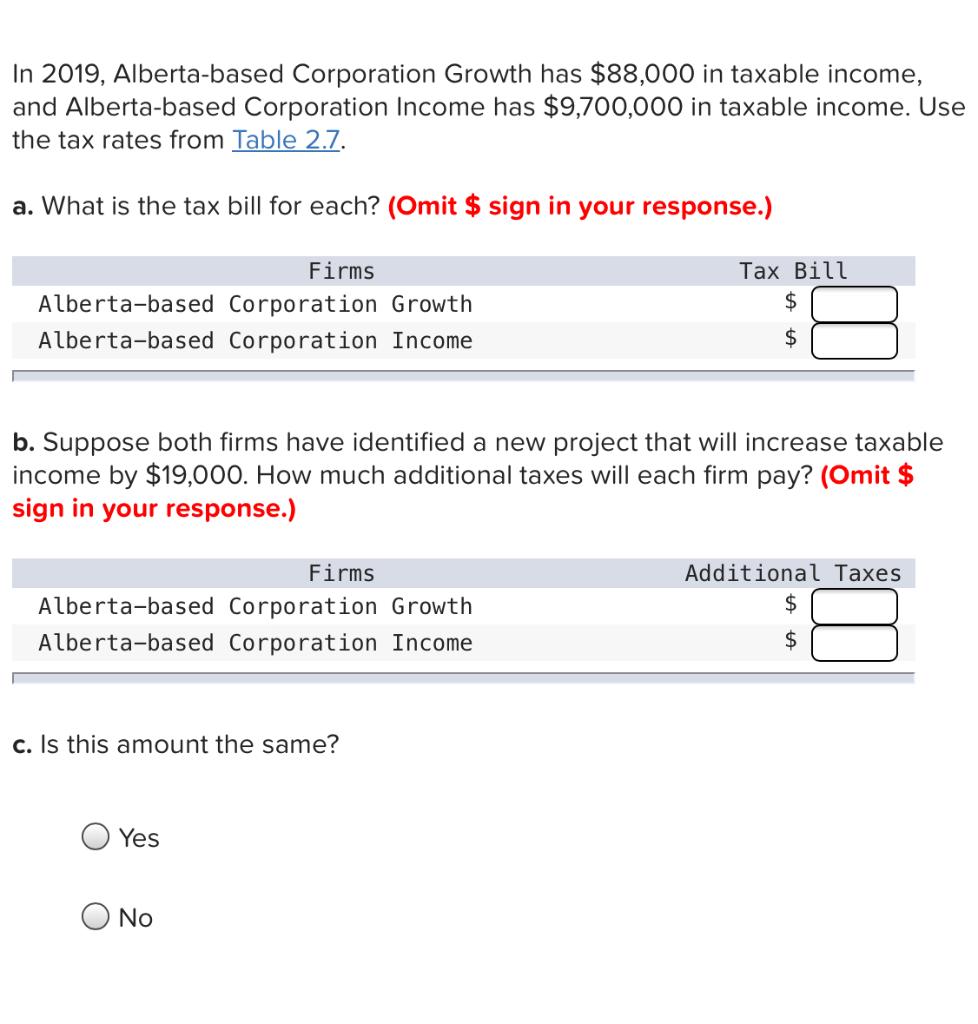

TABLE 2.7 Substantively Enacted' Income Tax Rates for Income Earned by a CCPC2 for 2018 and Beyond-As at March 31, 2018 Small Business Income Active Business Income 2019 and Beyond 2019 and Beyond 2018 2018 Federal rates General corporate 38.0% 38.0% 38.0% 38.0% rate Federal abatement (10.0) (10.0) (10.0) (10.0) 28.0 28.0 28.0 28.0 (18.0) (19.0) 0.0 0.0 Small business deduction Rate reductions 0.0 0.0 (13.0) (13.0) 10.0 9.0 15.0 15.0 Provincial rates British Columbia 2.0% 2.0% 12.0% 12.0% Alberta 2.0 2.0 12.0 12.0 Saskatchewan? 2.0 2.0 12.0 12.0 Manitoba 0.0 0.0 12.0 12.0 Ontario 3.5 3.5 11.5 11.5 S.O S.O 11.7 11.6/11.5 Quebec New Brunswick10 3.0/2.5 2.5 14.0 14.0 Nova Scotia 3.0 3.0 16.0 16.0 Prince Edward Island 4.5 4.5 16.0 16.0 3.0 3.0 15.0 15.0 Newfoundland and Labrador M&P Income 11 Investment Income 12 2019 and Beyond 2019 and Beyond 2018 2018 Federal rates General corporate 38.0% 38.0% 38.0% 38.0% rate Federal abatement (10.0) (10.0) (10.0) (10.0) 28.0 28.0 28.0 28.0 M&P deduction 11 (13.0) (13.0) 0.0 0.0 Refundable Tax 0.0 0.0 10.7 10.7 15.0 15.0 38.7 38.7 Provincial rates British Columbia 12.0% 12.0% 12.0% 12.0% Alberta 12.0 12.0 12.0 12.0 Saskatchewan? 10.0 10.0 12.0 12.0 Manitoba 12.0 12.0 12.0 12.0 Ontario 10.0 10.0 11.5 11.5 Quebec 11.7 11.6/11.5 11.7 11.6/11.5 New Brunswick 14.0 14.0 14.0 14.0 Nova Scotia 16.0 16.0 16.0 16.0 Prince Edward Island 16.0 16.0 16.0 16.0 15.0 15.0 15.0 15.0 Newfoundland and Labrador Current as of March 31, 2018 In 2019, Alberta-based Corporation Growth has $88,000 in taxable income, and Alberta-based Corporation Income has $9,700,000 in taxable income. Use the tax rates from Table 2.7. a. What is the tax bill for each? (Omit $ sign in your response.) Firms Alberta-based Corporation Growth Alberta-based Corporation Income Tax Bill $ $ b. Suppose both firms have identified a new project that will increase taxable income by $19,000. How much additional taxes will each firm pay? (Omit $ sign in your response.) Firms Alberta-based Corporation Growth Alberta-based Corporation Income Additional Taxes $ A c. Is this amount the same? Yes No TABLE 2.7 Substantively Enacted' Income Tax Rates for Income Earned by a CCPC2 for 2018 and Beyond-As at March 31, 2018 Small Business Income Active Business Income 2019 and Beyond 2019 and Beyond 2018 2018 Federal rates General corporate 38.0% 38.0% 38.0% 38.0% rate Federal abatement (10.0) (10.0) (10.0) (10.0) 28.0 28.0 28.0 28.0 (18.0) (19.0) 0.0 0.0 Small business deduction Rate reductions 0.0 0.0 (13.0) (13.0) 10.0 9.0 15.0 15.0 Provincial rates British Columbia 2.0% 2.0% 12.0% 12.0% Alberta 2.0 2.0 12.0 12.0 Saskatchewan? 2.0 2.0 12.0 12.0 Manitoba 0.0 0.0 12.0 12.0 Ontario 3.5 3.5 11.5 11.5 S.O S.O 11.7 11.6/11.5 Quebec New Brunswick10 3.0/2.5 2.5 14.0 14.0 Nova Scotia 3.0 3.0 16.0 16.0 Prince Edward Island 4.5 4.5 16.0 16.0 3.0 3.0 15.0 15.0 Newfoundland and Labrador M&P Income 11 Investment Income 12 2019 and Beyond 2019 and Beyond 2018 2018 Federal rates General corporate 38.0% 38.0% 38.0% 38.0% rate Federal abatement (10.0) (10.0) (10.0) (10.0) 28.0 28.0 28.0 28.0 M&P deduction 11 (13.0) (13.0) 0.0 0.0 Refundable Tax 0.0 0.0 10.7 10.7 15.0 15.0 38.7 38.7 Provincial rates British Columbia 12.0% 12.0% 12.0% 12.0% Alberta 12.0 12.0 12.0 12.0 Saskatchewan? 10.0 10.0 12.0 12.0 Manitoba 12.0 12.0 12.0 12.0 Ontario 10.0 10.0 11.5 11.5 Quebec 11.7 11.6/11.5 11.7 11.6/11.5 New Brunswick 14.0 14.0 14.0 14.0 Nova Scotia 16.0 16.0 16.0 16.0 Prince Edward Island 16.0 16.0 16.0 16.0 15.0 15.0 15.0 15.0 Newfoundland and Labrador Current as of March 31, 2018 In 2019, Alberta-based Corporation Growth has $88,000 in taxable income, and Alberta-based Corporation Income has $9,700,000 in taxable income. Use the tax rates from Table 2.7. a. What is the tax bill for each? (Omit $ sign in your response.) Firms Alberta-based Corporation Growth Alberta-based Corporation Income Tax Bill $ $ b. Suppose both firms have identified a new project that will increase taxable income by $19,000. How much additional taxes will each firm pay? (Omit $ sign in your response.) Firms Alberta-based Corporation Growth Alberta-based Corporation Income Additional Taxes $ A c. Is this amount the same? Yes No