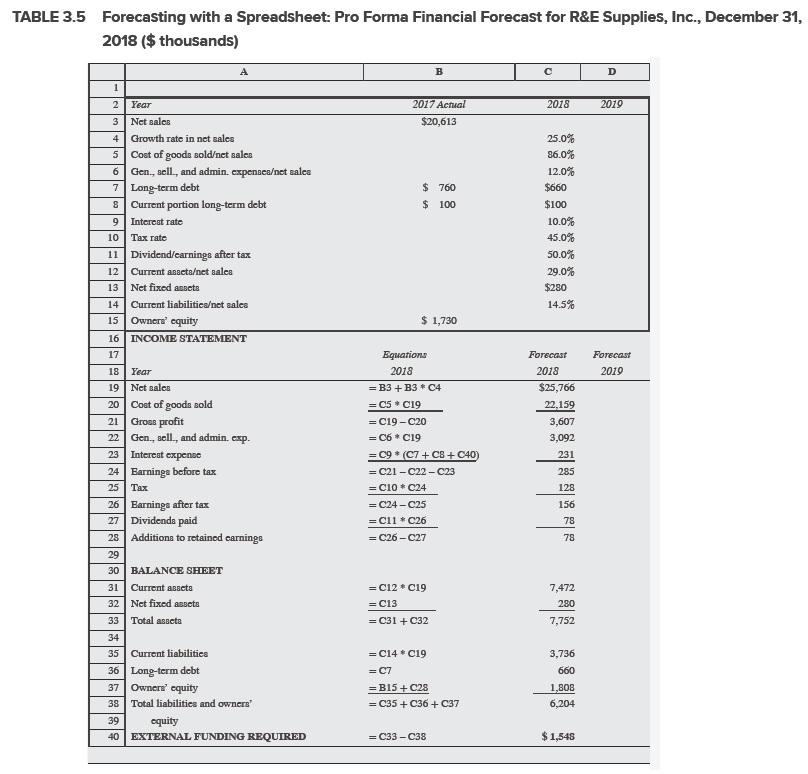

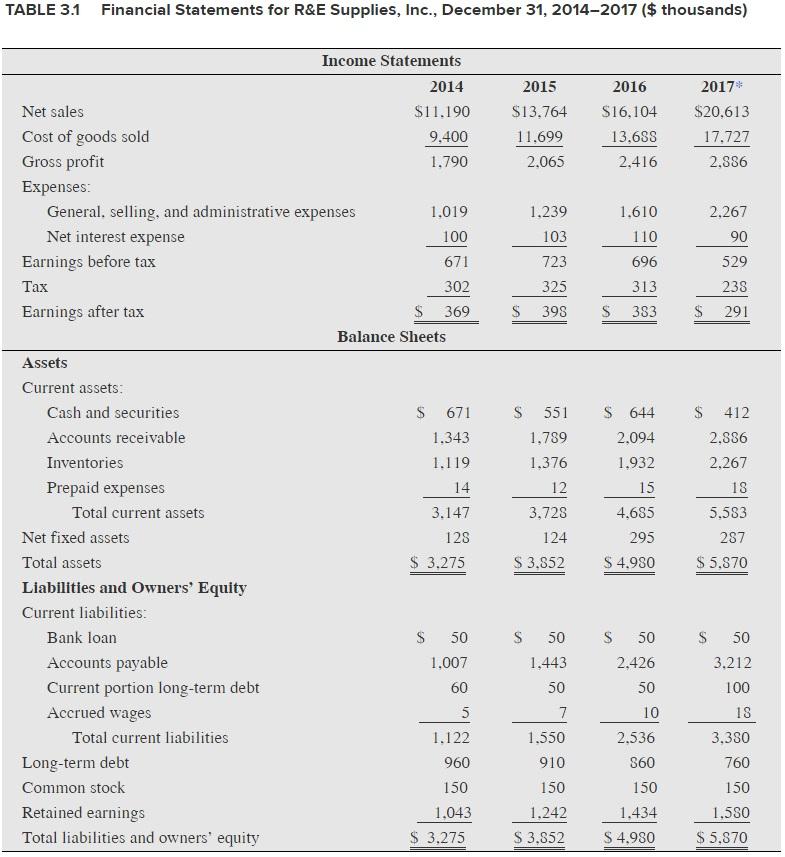

Table 3.1 presents R&E Supplies' financial statements for the period 2014 through 2017, and Table 3.5 presents a pro forma financial forecast for 2018. Use

Table 3.1 presents R&E Supplies' financial statements for the period 2014 through 2017, and Table 3.5 presents a pro forma financial forecast for 2018. Use the information in these tables to answer the following questions.

a. Calculate R&E's sustainable growth rate in each year from 2015 through 2018. Assume the dividend payout ratio was the same in 2015-17 as forecasted in 2018. (Round your answers to 1 decimal place.)

TABLE 3.5 Forecasting with a Spreadsheet: Pro Forma Financial Forecast for R&E Supplies, Inc., December 31, 2018 ($ thousands) A D 2 Year 2017 Actual 2018 2019 3 Net salcs $20,613 4 Growth rate in net sales 25.0% Cost of gooda sold/net nalea 6 Gen., scll, and admin. expenaca/net aalca 7 Long-term debt 8 Current portion long-term debt 5 86.0% 12.0% $ 760 $60 $ 100 $100 9 Intereat rate 10.0% 10 rate 45.0% 11 Dividend/carnings after tax 50.0% 12 Current asacta/net sales 29.0% 13 Net fixed assets $280 14 Current liabilitica/net sales 14.5% Owners' equity INCOME STATEMENT 15 $ 1,730 16 17 Equations Forecast Forecast 18 Year 2018 2018 2019 19 Net aales = B3 + B3 * C4 $25,766 Cost of goods sold Grosa profit Gen., sell., and admin. exp. 20 = C5 * C19 22,159 21 = C19 -C20 3,607 22 = C6 * C19 3,092 = C9 * (C7 + CB+ C40) 23 Intereat expense 231 24 Barninga before tax = C21 - C22 - C23 285 25 = Cl0 * C24 128 26 Earninga after tax 27 Dividenda paid 28 Additiona to retained carninge = C24 - C25 156 = C11 * C26 78 = C26 - C27 78 29 30 BALANCE SHEET 31 Current asseta = C12 * C19 7,472 32 Net fixed anseta = C13 280 33 Total asseta = C31 + C32 7,752 34 35 Current liabilitics = C14 * C19 3,736 36 Long-term debt Ownern' equity 38 Total liabilities and owners = C7 660 37 =B15 + C28 1,808 = C35 + C36 + C37 6,204 39 equity 40 EXTERNAL FUNDING REQUIRED = C33 - C38 $1,548

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a sustainable growth rate Return to equity 1 share payout rate Divorce payout dividend pa...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started