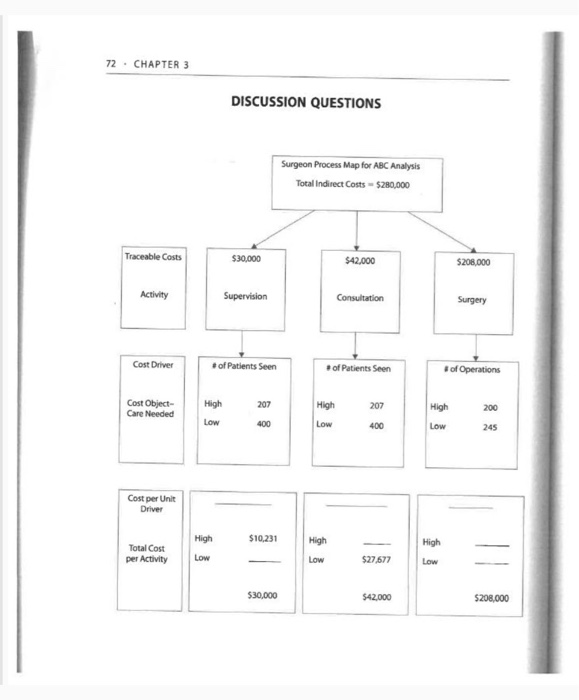

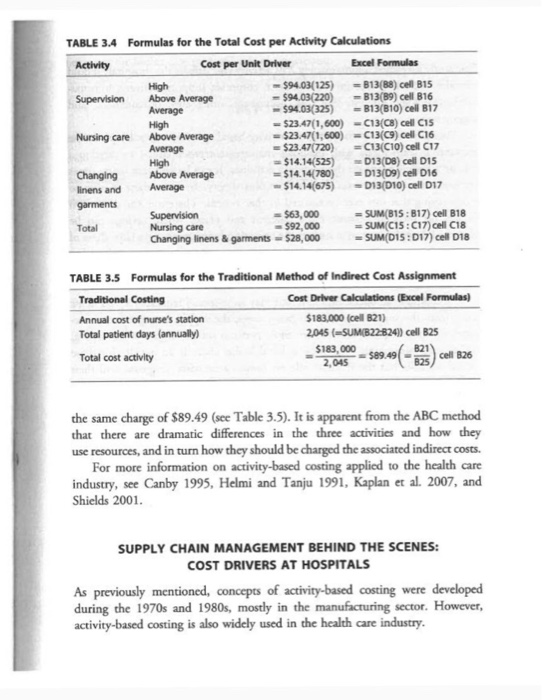

TABLE 3.4 Formulas for the Total Cost per Activity Calculations Activity Cost per Unit Driver Excel Formulas High $94.03(125) =B13(B8) cell B15 Supervision Above Average -$94.03(220) -B13(B9) cell B16 Average -$94.03(325) -B13(810) cell B17 High = $23.47(1,600) -C13(08) cell C15 Nursing care Above Average - $23.47(1,600) = C13(09) cell C16 Average = $23.47(720) =C13(CIO) cell C17 High = $14.14525) -D13(08) cell DIS Changing Above Average $14.14780) =D13(09) cell D16 linens and Average $14.14675) -D13/10) cell 017 garments Supervision 563.000 = SUM(B15:317) cell B18 Total Nursing care $92,000 SUM(C15:017) cell C18 Changing linens & garments 528,000 = SUMD15:017) cell 018 TABLE 3.5 Formulas for the Traditional Method of Indirect Cost Assignment Traditional Costing Cost Driver Calculations (Excel Formulas) Annual cost of nurse's station $183,000 (cell B21) Total patient days (annually) 2,045 (=-SUMB22B241) cell B25 5183,000 - $89.40 (-03cell 826 Total cost activity the same charge of $89.49 (see Table 3.5). It is apparent from the ABC method that there are dramatic differences in the three activities and how they use resources, and in turn how they should be charged the associated indirect costs. For more information on activity-based costing applied to the health care industry, see Canby 1995, Helmi and Tanju 1991, Kaplan et al. 2007, and Shields 2001. SUPPLY CHAIN MANAGEMENT BEHIND THE SCENES: COST DRIVERS AT HOSPITALS As previously mentioned, concepts of activity-based costing were developed during the 1970s and 1980s, mostly in the manufacturing sector. However, activity-based costing is also widely used in the health care industry. MANAGERIAL ACCOUNTING ASPECTS . 73 Fill in the blanks for the ABC analysis process map. (2.) Based on the process map, calculate the assigned indirect costs using the traditional method. Explain the pros and cons of this in comparison to activity-based costing. (3. Using the process map, which activity should be charged the highest amount of associated indirect costs? The lowest? Need Q1, 2, & 3 answered. TABLE 3.4 Formulas for the Total Cost per Activity Calculations Activity Cost per Unit Driver Excel Formulas High $94.03(125) =B13(B8) cell B15 Supervision Above Average -$94.03(220) -B13(B9) cell B16 Average -$94.03(325) -B13(810) cell B17 High = $23.47(1,600) -C13(08) cell C15 Nursing care Above Average - $23.47(1,600) = C13(09) cell C16 Average = $23.47(720) =C13(CIO) cell C17 High = $14.14525) -D13(08) cell DIS Changing Above Average $14.14780) =D13(09) cell D16 linens and Average $14.14675) -D13/10) cell 017 garments Supervision 563.000 = SUM(B15:317) cell B18 Total Nursing care $92,000 SUM(C15:017) cell C18 Changing linens & garments 528,000 = SUMD15:017) cell 018 TABLE 3.5 Formulas for the Traditional Method of Indirect Cost Assignment Traditional Costing Cost Driver Calculations (Excel Formulas) Annual cost of nurse's station $183,000 (cell B21) Total patient days (annually) 2,045 (=-SUMB22B241) cell B25 5183,000 - $89.40 (-03cell 826 Total cost activity the same charge of $89.49 (see Table 3.5). It is apparent from the ABC method that there are dramatic differences in the three activities and how they use resources, and in turn how they should be charged the associated indirect costs. For more information on activity-based costing applied to the health care industry, see Canby 1995, Helmi and Tanju 1991, Kaplan et al. 2007, and Shields 2001. SUPPLY CHAIN MANAGEMENT BEHIND THE SCENES: COST DRIVERS AT HOSPITALS As previously mentioned, concepts of activity-based costing were developed during the 1970s and 1980s, mostly in the manufacturing sector. However, activity-based costing is also widely used in the health care industry. MANAGERIAL ACCOUNTING ASPECTS . 73 Fill in the blanks for the ABC analysis process map. (2.) Based on the process map, calculate the assigned indirect costs using the traditional method. Explain the pros and cons of this in comparison to activity-based costing. (3. Using the process map, which activity should be charged the highest amount of associated indirect costs? The lowest? Need Q1, 2, & 3 answered