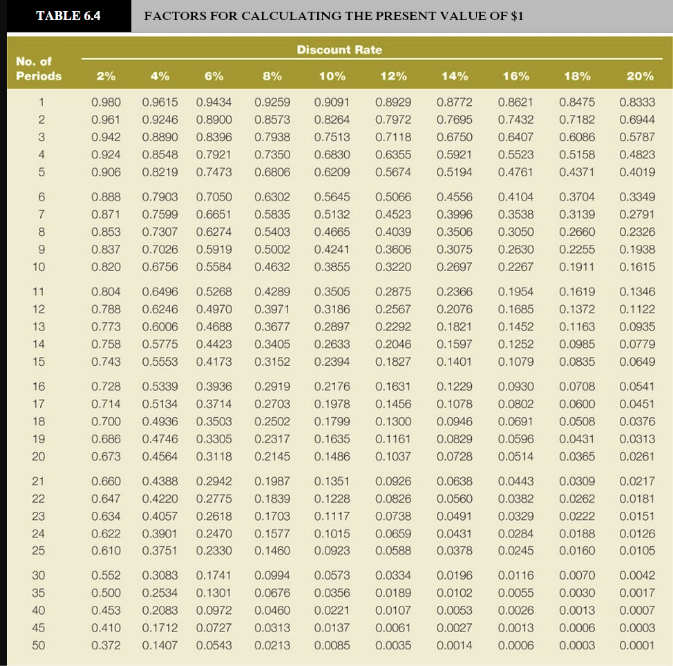

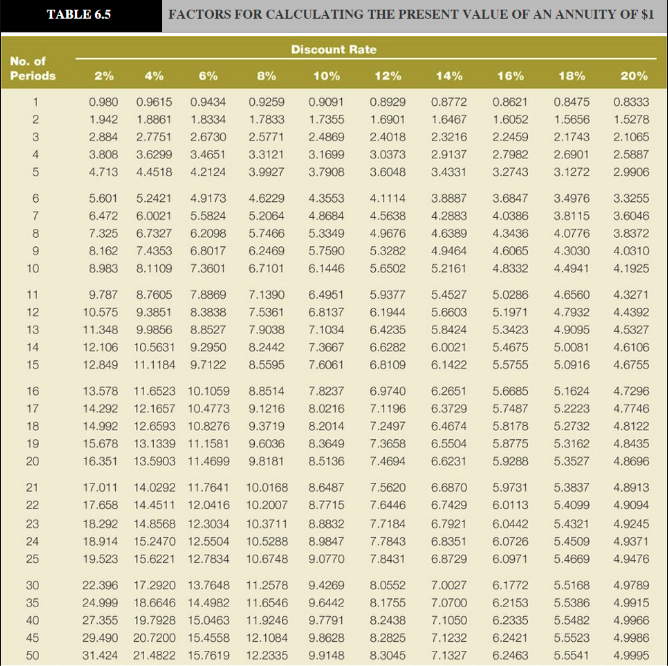

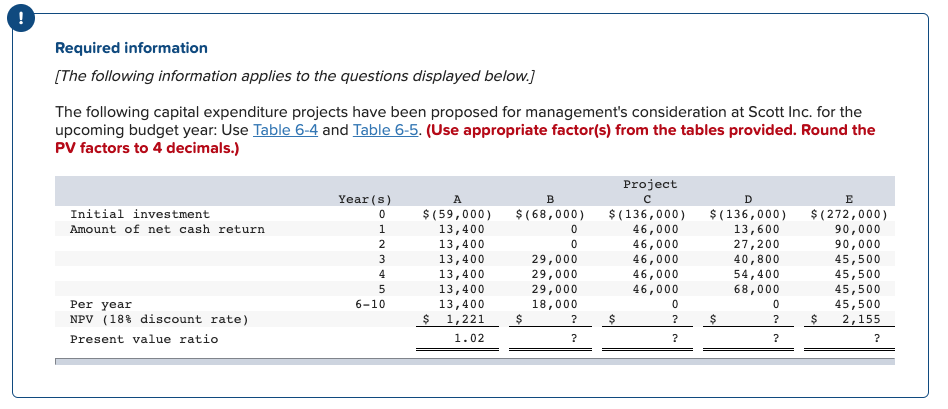

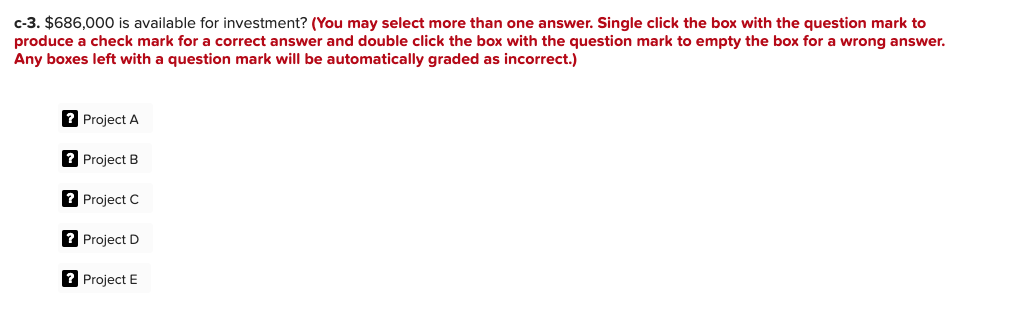

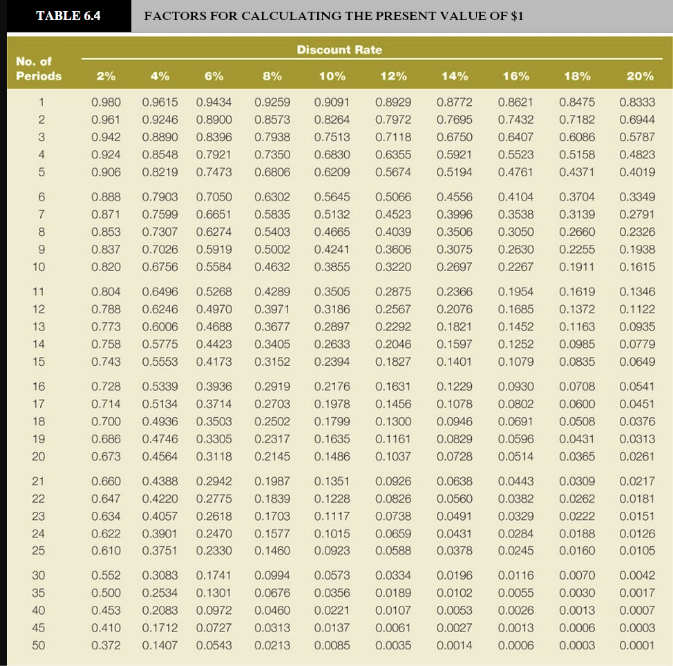

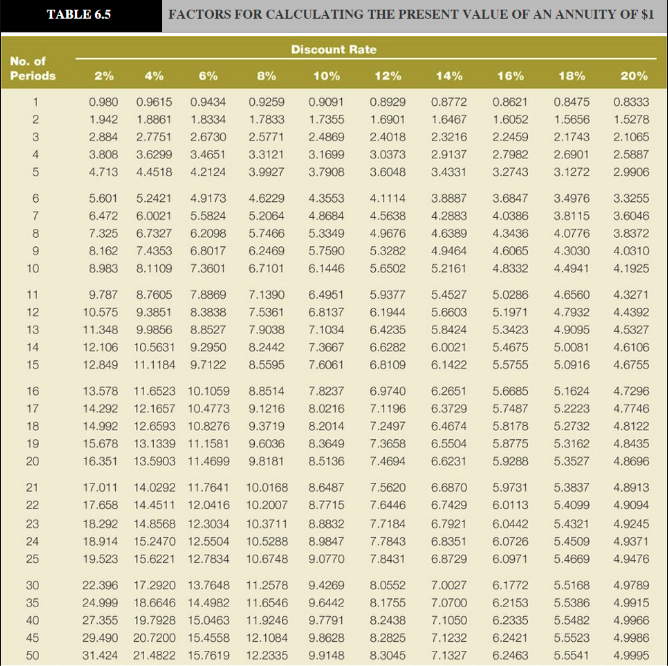

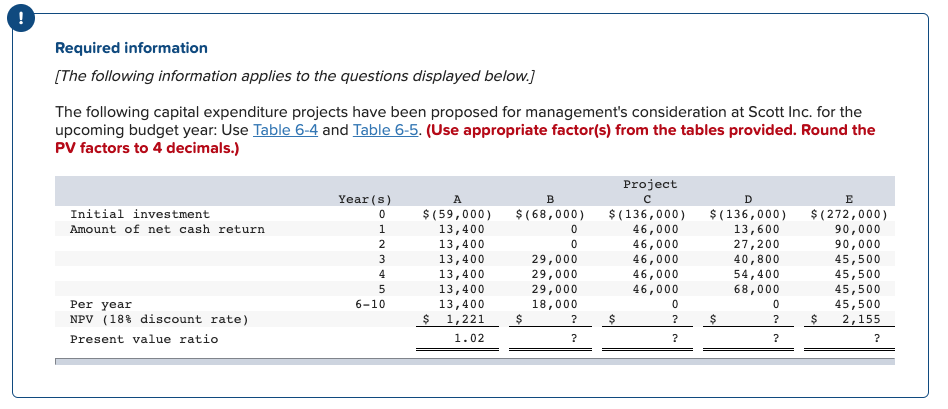

TABLE 6.4 FACTORS FOR CALCULATING THE PRESENT VALUE OF $1 Discount Rate No. of Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 0.8475 0.7182 0.6086 0.5158 0.4371 0.8333 0.6944 0.5787 0.4823 0.4019 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.9091 0.8929 0.8772 0.8264 0.7972 0.7695 0.7513 0.7118 0.6750 0.6830 0.6355 0.5921 0.62090.5674 0.5194 0.5645 0.5066 0.4556 0.5132 0.4523 0.3996 0.4665 0.40390.3506 0.4241 0.3606 0.3075 0.3855 0.3220 0.2697 0.8621 0.7432 0.6407 0.5523 0.4761 0.4104 0.3538 0.3050 0.2630 0.2267 0 0.804 0.788 0.773 0.758 0.743 0.6496 0.6246 0.6006 0.5775 0.5553 0.5268 0.4970 0.4688 0.4423 0.4173 0.4289 0.3971 0.3677 0.3405 0.3152 0.3505 0.3186 0.2897 0.2633 0.2875 .2567 0.2292 0.2046 0.1827 0.1954 0.1685 0.1452 0.1079 0.728 0.714 0.700 0.686 0.673 0.5339 0.5134 0.4936 0.4746 0.4564 0.3936 0.3714 0.3503 0.3305 0.3118 0.2919 0.2703 0.2502 0.2317 0.2145 0.0930 0.0802 0.0691 0.0596 0.0514 0.2366 0.2076 0.1821 0.1597 0.1401 0.1229 0.1078 0.0946 0.0829 0.0728 0.0638 0.0560 0.0491 0.0431 0.0378 0.0196 0.0102 0.0053 0.0027 0.0014 0.660 0.647 0.634 0.622 0.610 0.3704 0.3349 0.3139 0.2791 0.2660 0.2326 0.2255 0.1938 0.1911 0.1615 0.1619 0.1346 0.1372 0.1122 0.11630.0935 0.0985 0.0779 0.0835 0.0649 0.0708 0.0541 0.0600 0.0451 0.0508 0.0376 0.0431 0.043 0.0313 0.0365 0.0261 0.0309 0.0217 0.0262 0.0181 0.0222 0.0151 0.0188 0.0126 0.0160 0.0105 0.0070 0.0042 0.0030 0.0017 0.0013 0.0007 0.0006 0.0003 0.0003 0.0001 0.2176 0.1978 0.1799 0.1635 0.1486 0.1351 0.1228 0.1117 0.1015 0.0923 0.0573 0.0356 0.0221 0.0137 0.0085 0.4388 0.2942 0.42200.2775 0.4057 0.2618 0.3901 0.2470 0.3751 0.2330 0.1631 0.1456 0.1300 0.1161 0.1037 0.0926 0.0826 0.0738 0.0659 0.0588 0.0334 0.0189 0.0107 0.0061 0.0035 0.1987 0.1839 0.1703 0.1577 0.1460 0.0443 0.0382 0.0329 0.0284 0.0245 0.0116 0.0055 0.0026 0.0013 0.0006 0.552 0.500 0.453 0.410 0.372 0.3083 0.2534 0.2083 0.1712 0.1407 0.1741 0.1301 0.0972 0.0727 0.0543 0.0994 0.0676 0.0460 0.0313 0.0213 TABLE 6.5 FACTORS FOR CALCULATING THE PRESENT VALUE OF AN ANNUITY OF $1 Discount Rate No. of Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 0.980 1.942 2.884 3.808 4.713 0.9615 1.8861 2.7751 3.6299 4.4518 0.9434 1.8334 2.6730 3.4651 4.2124 0.9259 1.7833 2.5771 3.3121 3.9927 0.9091 1.7355 2.4869 3.1699 3.7908 0.8929 1.6901 2.4018 3.0373 3.6048 0.8772 1.6467 2.3216 2.9137 3.4331 0.8621 1.6052 2.2459 2.7982 3.2743 0.8475 1.5656 2.1743 2.6901 3.1272 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 5.601 6.472 7.325 8.162 8.983 5.2421 4.9173 6.0021 5.5824 6.7327 6.2098 7.4353 6.8017 8.11097.3601 4.6229 5.2064 5.7466 6.2469 6.7101 4.3553 4.8684 5.3349 5.7590 6.1446 4.1114 4.5638 4.9676 5.3282 5.6502 3.8887 4.2883 4.6389 4.9464 5.2161 3.6847 4.0386 4.3436 4.6065 4.8332 3.4976 3.8115 4.0776 4.3030 4.4941 9.787 10.575 11.348 12.106 12.849 8.7605 9.3851 9.9856 10.5631 11.1184 7.8869 8.3838 8.8527 9.2950 9.7122 7.1390 6.4951 7.53616.8137 7.9038 7.1034 8.2442 7.3667 5.9377 6.1944 6.4235 6.6282 5.4527 5.6603 5.8424 6.0021 5.0286 4.6560 5.1971 4.7932 5.34234.9095 5.4675 5.0081 5.5755 5.0916 4.3271 4.4392 4.5327 4.6106 4.6755 13.578 14.292 14.992 15.678 16.351 11.6523 10.10598.8514 7.8237 12.1657 10.4773 9.1216 8.0216 12.6593 10.8276 9.37198.2014 13.1339 11.1581 9.6036 8.3649 13.5903 11.4699 9.8181 8.5136 6.9740 7.1196 7.2497 .3658 7.4694 6.2651 6.3729 6.4674 6.5504 6.6231 5.6685 5.7487 5.8178 5.8775 5.9288 5.1624 5.2223 5.2732 5.3162 5.3527 4.7296 4.7746 4.8122 4.8435 4.8696 7 5.3837 5.4099 5.4321 5.4509 5.4669 4.8913 4.9094 4.9245 4.9371 4.9476 17.011 17.658 18.292 18.914 19.523 22.396 24.999 27.355 29.490 31.424 14.0292 11.7641 14.4511 12.0416 14.8568 12.3034 15.2470 12.5504 15.6221 12.7834 17.2920 13.7648 18.6646 14.4982 19.7928 15.0463 20.7200 15.4558 21.4822 15.7619 10.0168 10.2007 10.3711 10.5288 10.6748 11.2578 11.6546 11.9246 12.1084 12.2335 8.6487 7.5620 6.6870 5.9731 6.7429 6.0113 8.8832 7.7184 6.79216.0442 8.9847 7.78436.8351 6.0726 9.0770 7.8431 6.8729 6.0971 9.4269 8.0552 7.0027 6.1772 9.64428.1755 7.0700 6.2153 9.7791 8.2438 7.1050 6.2335 9.8628 8.2825 7.1232 6.2421 9.9148 8.3045 7.1327 6.2463 5.5168 4.9789 5.5386 4.9915 5.5482 5.55234.9986 5.5541 4.9995 Required information [The following information applies to the questions displayed below.) The following capital expenditure projects have been proposed for management's consideration at Scott Inc. for the upcoming budget year: Use Table 6-4 and Table 6-5. (Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.) Project Year(s) $ ( Initial investment Amount of net cash return $ (59,000) 13,400 13,400 13,400 13,400 13,400 13, 400 $ 1,221 1.02 29,000 29,000 29,000 18,000 $(136,000) 46,000 46,000 46,000 46,000 46,000 $(136,000) 13,600 27,200 40,800 54,400 68,000 $ (272,000) 90,000 90,000 45,500 45,500 45,500 45,500 $ 2,155 6-10 Per year NPV (18% discount rate) Present value ratio c-3. $686,000 is available for investment? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Project A 7 Project B Project C Project D ? Project E